Item Costs and Valuation Methods: To Sell Items with the FIFO Method

The following activity demonstrates how to completely process a sale of stock item that is assigned the FIFO valuation method.

Story

SweetLife Fruits & Jams is a midsize company that purchases fruit, jams, and spices from large fruit vendors and then sells these goods to wholesale customers such as restaurants and cafes. Clementines are among these goods. The CLEMENTINES stock item represents one pound of fresh clementines and has been assigned the FIFO valuation method in MYOB Acumatica.

Previously SweetLife bought clementines as follows:

- On January 5, 2025, 40 pounds for $4.50 each

- On January 15, 2025, 80 pounds for $4.25 each

Suppose that you are Regina Wiley, a sales manager at SweetLife. The FourStar Coffee & Sweets Shop customer ordered 50 pounds of clementines. You need to process the sale and review the cost of the items issued from the warehouse.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000)

form, the following features have been enabled:

- Inventory and Order Management, which provides the standard functionality of inventory and order management

- Inventory, which gives you the ability to maintain stock items by using forms related to the inventory functionality and to create and process sales and purchase documents that include stock items

- On the Customers (AR303000) form, the COFFEESHOP (FourStar Coffee & Sweets Shop) customer has been created.

- On the Stock Items (IN202500) form, the CLEMENTINES stock item has been created and the FIFO valuation method has been assigned to it.

- On the Receipts (IN301000) form, the following receipts

have been created:

- The 000099 receipt dated 1/5/2025 with 40 pounds of the CLEMENTINES item and a cost of $4.50 each

- The 0000100 receipt dated 1/15/2025 with 80 pounds of the CLEMENTINES item and a cost of $4.25 each

Process Overview

In this activity, you will do the following:

- On the Inventory Transactions by Account (IN403000) form, review the costs of the purchased fruit.

- On the Sales Orders (SO301000) form, create a sales order.

- On the same form, quick-process the sales order.

- On the Inventory Transactions by Account form, review how the stock item has been issued and how its cost has been calculated.

System Preparation

Before you start performing the steps of this activity, do the following:

- Launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as a sales manager by using the wiley username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/30/2025. If a different date is displayed, click the Business Date menu button and select 1/30/2025 on the calendar. For simplicity, in this activity, you will create and process all documents in the system on this business date.

Step 1: Reviewing the Costs of the Purchased Item

To review the costs of the CLEMENTINES item at the WHOLESALE warehouse, do the following:

- Open the Inventory Transactions by Account (IN403000) form.

- In the Selection area, specify the following settings:

- Inventory Account: 12100 - Inventory Asset

- Inventory ID: CLEMENTINES

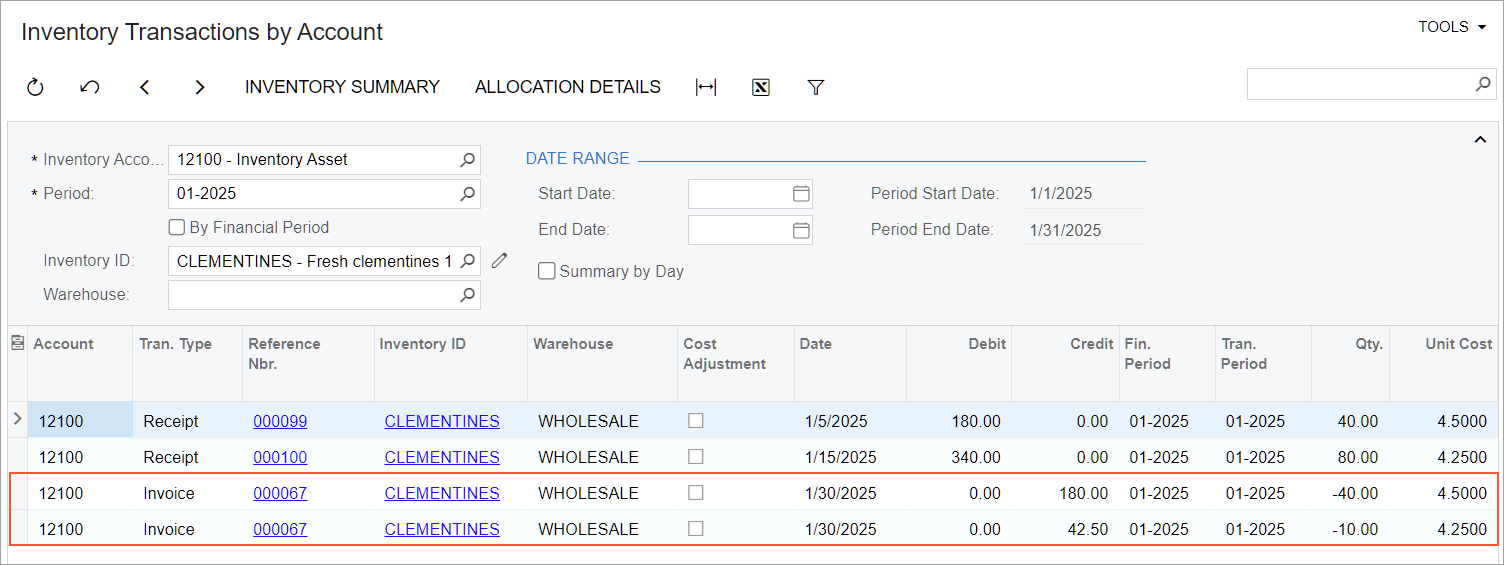

- Review the items that were received at two different costs (see the following

screenshot).

Figure 1. The stock items received in the wholesale warehouse

Step 2: Creating a Sales Order

To create the sales order for the FourStar Coffee & Sweets Shop, do the following:

- On the Sales Orders (SO301000) form, add a new record.

- In the Summary area, specify the following settings:

- Order Type: SO

- Customer: COFFEESHOP

- Date: 1/30/2025

- Description: Sale of 50 pounds of clementines

- On the table toolbar of the Details tab, click Add Row.

- Specify the following settings in this row:

- Branch: HEADOFFICE

- Inventory ID: CLEMENTINES

- Warehouse: WHOLESALE

- Quantity: 50

- On the form toolbar, click Save.

Step 3: Quick-Processing the Sales Order

To process the sales order, do the following:

- While you are still viewing the Sale of 50 pounds of clementines order on the Sales Orders (SO301000) form, click Quick Process on the form toolbar.

- In the Process Order dialog box, which opens, do the

following:

- In the Warehouse ID box, make sure that WHOLESALE is selected.

- In the Shipment Date section, make sure that Today is selected.

- In the Shipping section, make sure that the

following check boxes are selected:

- Create Shipment

- Confirm Shipment

- Update IN

- In the Invoicing section, do the following:

- Make sure that the Prepare Invoice check box is selected.

- Select the Release Invoice check box.

- Click OK. The Processing Results dialog box opens. Wait for the system to create the documents.

- Close the dialog box. Notice that the sales order now has the Completed status.

Step 4: Reviewing the Item's Costs

To review how the system has calculated the costs for the issued CLEMENTINES item, do the following:

- Open the Inventory Transactions by Account (IN403000) form.

- In the Selection area, specify the following settings:

- Inventory Account: 12100 - Inventory Asset

- Inventory ID: CLEMENTINES

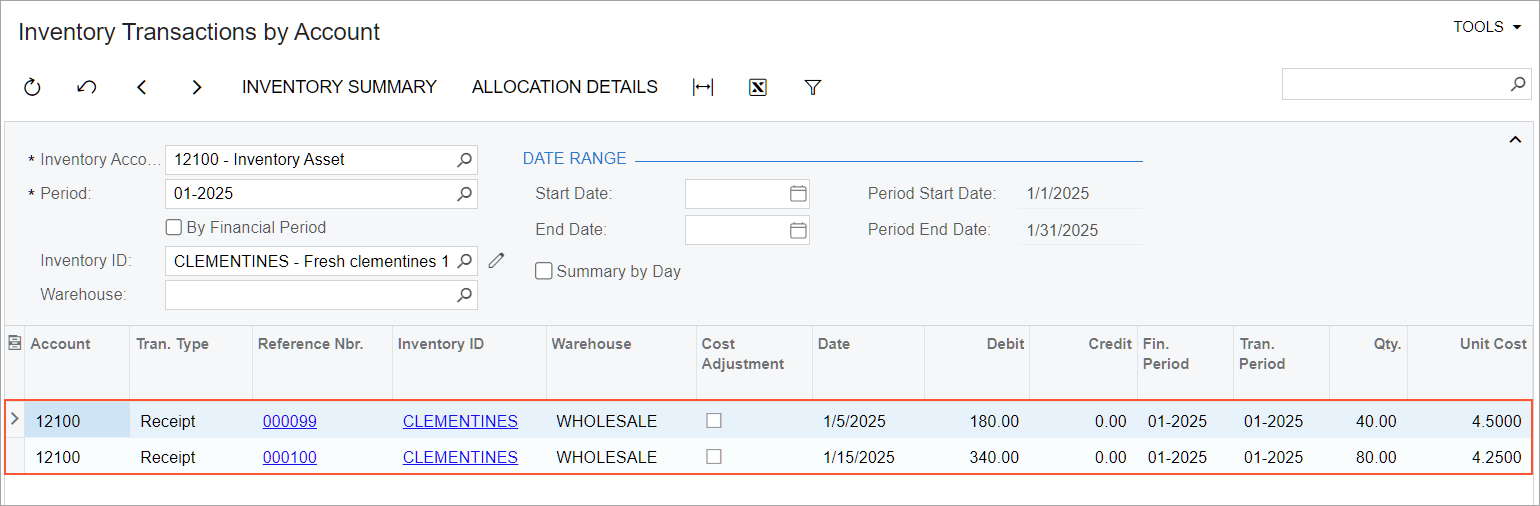

- Review the costs in the table (see the following screenshot). Notice that the 50

pounds of the item were issued as follows:

- For the 40 pounds that were received earlier, at the unit cost of $4.50

- For the 10 pounds that were received later, at the unit cost of $4.25

Figure 2. The item costs on the Inventory Transactions by Account form