GL Consolidation: To Import Consolidation Data from a Subsidiary

The following activity will walk you through the process of importing the balances of GL accounts from a subsidiary to the parent company.

Story

Suppose that the management of SweetLife Fruits & Jams needs the data from its subsidiary to be imported in the system so that consolidation data should be available in all financial reports. Acting as a SweetLife accountant, you need to import the consolidation data from SweetLife AZ to SweetLife Fruits & Jams, post the consolidation batches, and make sure that the balances have been updated.

Configuration Overview

In the parent company with the U100 dataset, on the Enable/Disable Features (CS100000) form, the General Ledger Consolidation feature has been enabled.

Process Overview

In this activity, you will import the consolidation data to the parent company on the Import Consolidation Data (GL509000) form. You will then review and post the generated batches on the Journal Transactions (GL301000) form. Finally, you will review the account balances of the AZENTITY company for 11-2024 and 12-2024 on the Account Summary (GL401000) form.

System Preparation

Before you begin performing the steps of this activity, do the following:

- Launch the MYOB Acumatica website, and sign in to the parent company with the U100 dataset preloaded. You should sign in as an accountant Nenad Pasic by using the pasic username and the 123 password.

- On the Company and Branch Selection menu on the top pane of the MYOB Acumatica screen, make sure that the SweetLife Head Office and Wholesale Center branch is selected. If it is not selected, click the Company and Branch Selection menu button to view the list of branches that you have access to, and then click SweetLife Head Office and Wholesale Center.

- Make sure you the parent company has been prepared, as described in GL Consolidation Configuration: To Configure the Parent Company.

- Make sure the AZ_Subsidiary company (the consolidation unit) has been created and configured as described in GL Consolidation Configuration: To Configure a Consolidation Unit. It has also been prepared for consolidation as described in GL Consolidation: To Prepare the Consolidation Unit.

Step 1: Importing the Consolidation Data

To import the consolidation data from the consolidation unit to the parent company, do the following:

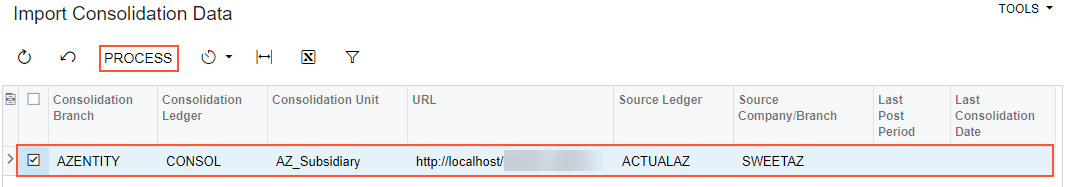

- Open the Import Consolidation Data (GL509000) form.

The consolidation rule that you set up earlier is displayed in the table.

- In the table, select the unlabeled check box for the only row, and click

Process on the form toolbar, as shown in the

following screenshot. The system opens the Processing

dialog box.

Figure 1. Import of consolidation data

- Close the Processing dialog box.Tip:You can schedule this process by using the Automation Schedules (SM205020) form.

Step 2: Reviewing and Posting the Consolidation Batches

To review and post the consolidation batches generated by the system, do the following:

- Open the Journal Transactions (GL3010PL) list of records.

- In the table, find a batch with the following settings:

- Module: GL

- Status: Balanced

- Ledger: CONSOL

- Transaction Date: 11/30/2024

This is the consolidation batch for 11-2024, which was generated as a result of the import process.

- Click the link in the Batch Number column to open the

batch on the Journal Transactions (GL301000) form.

The batch has a description indicating that this is a consolidation batch and AZENTITY specified in the Branch column for each entry.

- In the table, review the amount in the Debit Amount column for 10000 - Cash Account. This amount consolidates the amounts of all cash accounts in the AZ_Subsidiary company.

- On the form toolbar, click Release to release the consolidation batch.

- Return to the Journal Transactions (GL3010PL) list of records, and find a batch

with the following setting:

- Module: GL

- Status: Balanced

- Ledger: CONSOL

- Transaction Date: 12/31/2024

This is the consolidation batch for 12-2024, which was generated as a result of the import process.

- Click the link in the Batch Number column to open the batch on the Journal Transactions form.

- In the table, review the entries and the amount in the Debit Amount column for 10000 - Cash Account.

- On the form toolbar, click Release to release the batch.

Step 3: Reviewing the Account Balances of the AZENTITY Company

To review the account balances of the AZENTITY company, do the following:

- Open the Account Summary (GL401000) form.

- In the Selection area, specify the following settings:

- Company/Branch: AZENTITY - AZ Subsidiary

- Ledger: CONSOL

- Period: 11-2024

- In the table, review the balances shown for the 11-2024 period.

- In the Period box, select 12-2024.

- In the table, review the balances shown for the 12-2024 period. Tip:This data can be used for preparing ARM reports and is available in all GL reports and inquiries.