Correction of a Bill for a Subcontract: Process Activity

This activity will walk you through the process of correcting an AP bill for a subcontract.

Story

Suppose that on March 1, 2025, the ToadGreen company hired a subcontractor, Harmon Installation, to build an entrance in the hotel that ToadGreen is building. According to the terms of the subcontract, $10,000 will be paid to the subcontractor for this work, and 10% of each payment will be withheld by the company until the related work is finished.

On March 25, 2025, ToadGreen received the first bill for the completed work from the subcontractor. A ToadGreen project accountant entered and released a bill in the amount of $7,000, which includes the $700 retainage amount.

Then suppose that the project accountant realized that the bill was entered incorrectly, and the billed amount must be $6,000 for the subcontract. Acting as this project accountant, you will correct the billed amount and quantity in the subcontract by processing the debit adjustment.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000), the Construction and Retainage Support features have been enabled.

- On the Vendors (AP303000) form, the HARMINT (Harmon Installation) vendor has been defined. On the Financial tab, the Apply Retainage check box is selected for this vendor.

- On the Non-Stock Items (IN202000) form, the LABOR non-stock item has been created.

- On the Projects (PM301000) form, the HOTEL project has been created with multiple project tasks.

- On the Subcontracts (SC301000) form, the subcontract for the HARMINT vendor in the amount of $10,000.00 has been entered.

- On the Bills and Adjustments (AP301000) form, the partial bill for the HARMINT vendor in the amount of $7,000.00 has been entered and released; the retainage amount $700 is calculated for the bill (which is shown in the Original Retainage box on the Retainage tab).

Process Overview

On the Bills and Adjustments (AP301000) form, you will create a debit adjustment and add the line of the subcontract to this adjustment. Then you will specify the correction amount and release the adjustment. Finally, you will review the billed amount and quantity in the subcontract to make sure that they have been updated.

System Preparation

Before you start correcting the bill, do the following:

- Launch the MYOB Acumatica website, and sign in as a construction project manager by using the ewatson username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, click the Business Date menu button, and select 3/25/2025 on the calendar.

Step 1: Creating a Debit Adjustment

You will first create the debit adjustment that will correct the AP bill for the subcontract. Do the following:

- On the Bills and Adjustments (AP301000) form, add a new record.

- In the Summary area, specify the following settings:

- Type: Debit Adj.

- Vendor: HARMINT

- Date: 3/25/2025

- Description: Adjusting overbilled contractor

- On the form toolbar, click Save.

Step 2: Adding the Subcontract Line to the Document

To add a line of the subcontract to be corrected, while you are still reviewing the debit adjustment on the Bills and Adjustments (AP301000) form, do the following:

- On the table toolbar of the Details tab, click Add Subcontract. The Add Subcontract dialog box opens.

- In the dialog box, find the line dated 3/1/2025 with the HOTEL project and $10,000 subcontract total. Notice that the Total Billed Amount for the subcontract is $7,000.

- Select the unlabeled check box in the line, and click Add & Close. The system adds the subcontract line to the debit adjustment and closes the dialog box. In the Subcontract Nbr. column of the line added to the document, notice that the system has inserted the reference number of the subcontract for which the adjustment is being created.

- In the line, change the Quantity to

8 and the Unit Cost to

125. The Ext. Cost in the line

is $1,000 (which is the amount by which the billed amount will be adjusted).

Tip:The retainage percent and retainage amount in the line are zero because the processed debit adjustment does not change the retained amounts.

- On the form toolbar, click Save.

Step 3: Releasing the Debit Adjustment and Reviewing the Result

To release the debit adjustment and see how this affects the subcontract, do the following:

- On the form toolbar, click Remove Hold. The system assigns the debit adjustment the Balanced status.

- On the form toolbar, click Release to release the debit adjustment.

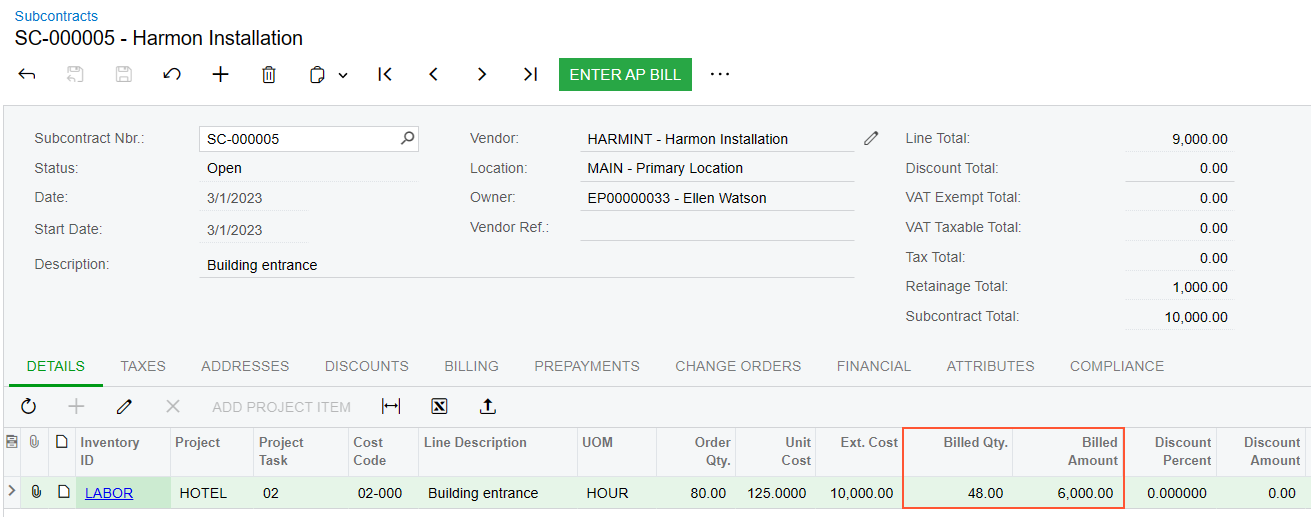

- On the Subcontracts (SC301000) form, open the subcontract for the HARMINT vendor, for which you have processed the debit adjustment.

- On the Details tab, review the billed amount and quantity

in the subcontract line, and make sure they have been adjusted for the

subcontract, as shown in the following screenshot.

Figure 1. The adjusted amount and quantity in the subcontract line

You have corrected the bill for the subcontract. You can now apply the debit adjustment to the AP bill to finish the correction process.