AR Invoices with Retainage: To Perform Time and Material Billing with Retainage

This activity will walk you through the process of performing time and material billing with retainage.

Story

Suppose that the ToadGreen Building Group company is building a hotel for The Equity Group Investors. A ToadGreen project accountant bills the customer for some extra time spent on the project that initially was not budgeted for the project; as was initially agreed with the customer, 5% retainage is held on these invoices.

Acting as the project manager, you need to create a new project task, enter a project transaction that represents the extra work, and create an invoice for that work with the retained amount.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the following features

have been enabled:

- Retainage Support

- Payment Application by Line

- Construction

- On the Customers (AR303000) form, the EQUGRP customer has been created; the Pay by Line and Apply Retainage check boxes are selected on the General tab for this customer.

- On the Account Groups (PM201000) form, the MATERIAL, LABOR, and SUBCON account groups have been created.

- On the Non-Stock Items (IN202000) form, the LABOR item has been created.

- On the Billing Rules (PM207000) form, the TM billing rule has been created. The rule has three steps for billing of transactions that are posted to MATERIAL, LABOR, or SUBCON account groups. The calculation formula is the following: The amount of expense multiplied by 1.25 equals the billed amount for the transaction.

- On the Projects (PM301000) form, the HOTEL project has been created with multiple project tasks and their budgets. On the Summary tab of the form, the Standard option is selected in the Retainage Mode box, and 5.00 is specified in the Retainage (%) box of the Retainage section.

Process Overview

You will create a project task and assign the time and material billing rule to it on the Projects (PM301000) form. You will then process a project transaction on the Project Transactions (PM304000) form to record the extra work, and run project billing on the Projects form. Then you will release the generated pro forma invoice on the Pro Forma Invoices (PM307000) form. Finally, you will release the related AR invoice with retainage on the Invoices and Memos (AR301000) form

System Preparation

To prepare to perform the instructions of this activity, do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. You should sign in as a project manager by using the ewatson username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to today’s date. For simplicity, in this activity, you will create and process all documents in the system on this business date.

Step 1: Adding a Task with a Time and Material Billing Rule

Add a task to the project by doing the following:

- On the Projects (PM301000) form, open the HOTEL project. On the Summary tab, notice the date in the Next Billing Date box. You will need to process the transaction with a date before this date.

- On the table toolbar of the Tasks tab, click

Add Row, and add a new project task with the

following settings:

- Task ID: 20

- Type: Cost and Revenue Task

- Description: Ad-hoc miscellaneous expenses

- Billing Rule: TM

- Status: Active

- Click Save to save your changes to the project.

Step 2: Creating and Releasing a Project Transaction

Enter and process the project transaction by doing the following:

- On the Project Transactions (PM304000) form, add a new record.

- On the form toolbar, click Add New Record to create a new project transaction, and in the Summary area, make sure PM is selected as the Module.

- In the Description box, type Miscellaneous expenses.

- On the Details tab, click Add Row,

and specify the following transaction details:

- Project: HOTEL

- Project Task: 20

- Cost Code: 00-000

- Account Group: LABOR

- Inventory ID: LABOR

- UOM: HOUR

- Quantity: 1

- Billable: Selected

- Billable Quantity: 1

- Unit Rate: 45

- Amount: 45.00 (calculated automatically)

- Date: 4/28/2025Tip:If the next billing date differs from 5/1/2025, in this column, you should instead specify the date that is three days before the next billing date.

- Save the transaction.

- On the form toolbar, click Release to release the project transaction.

Step 3: Running Project Billing

Perform billing for the entered project transaction as follows:

- On the Projects (PM301000) form, open the HOTEL project.

- On the form toolbar, click Run Billing.

The system opens the Pro Forma Invoices (PM307000) form with the pro forma invoice that was created. Review the only line on the Time and Material tab that has been created based on the project transaction that you have processed. The billed amount in the line is 56.25 (which is calculated by using the billing rule formula, 45 * 1.25, which is calculated by using the billing rule formula). The retainage amount is calculated as the retainage percentage applied to the amount to invoice of the line and equals 2.81.

- On the form toolbar, click Remove Hold to assign the pro forma invoice the Open status, and then click Release to release the pro forma invoice.

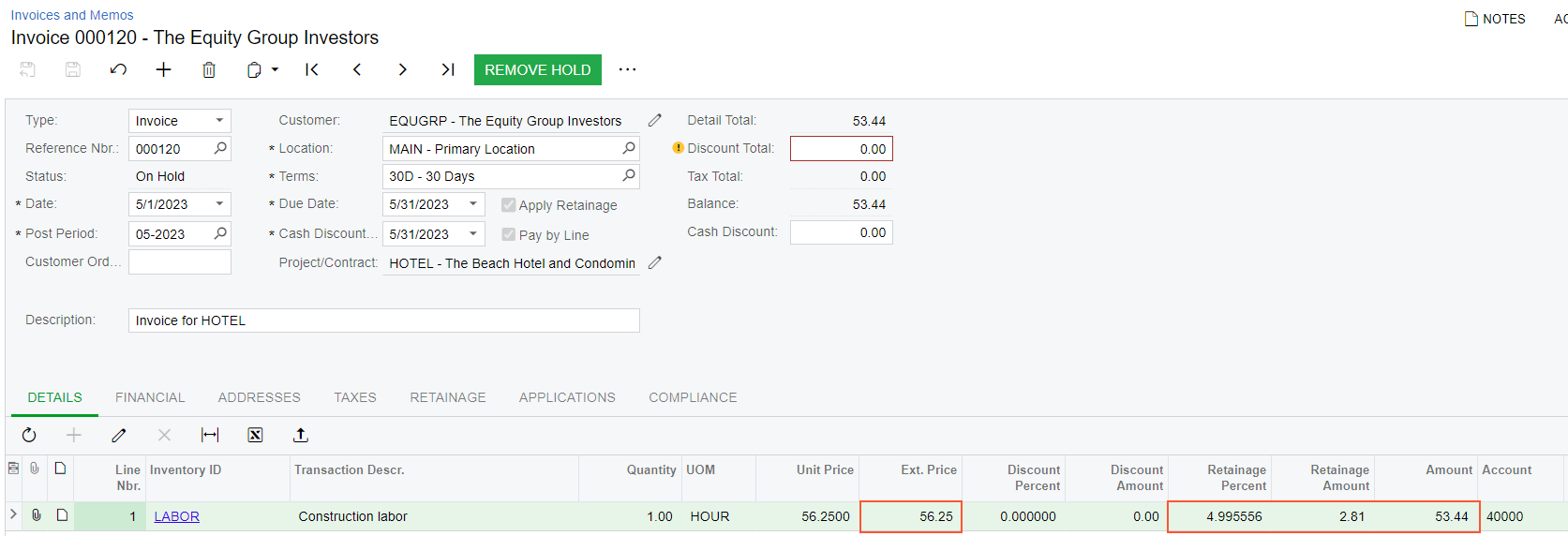

- On the Financial tab, click the AR Ref.

Nbr.

link

to open the generated AR invoice on the Invoices and Memos (AR301000)

form. In the invoice, which opens, make sure that the invoice has the line with

an Ext. Price value equal to the sum of the

Amount to Invoice value from the pro forma invoice

line (56.25) and a Retainage Amount of

2.81.

Figure 1. AR invoice with retainage

Attention:The retainage percent in the AR invoice line is calculated asRetainage Amount / Ext. Priceand thus may differ from the retainage percent of the pro forma line because of rounding differences. - On the form toolbar, click Remove Hold, and then click Release to release the invoice.

You have billed a project for time and material and included the retainage amount in the invoice.