AR Invoices with Retainage: To Perform Progress Billing with Retainage

This activity will walk you through the process of performing progress billing with retainage.

Story

Suppose that the ToadGreen Building Group company is building a hotel for the Equity Group Investors. A ToadGreen project manager bills the customer for the progress of the work being performed. According to the contract signed with the customer, the customer retains 5% of the amount of each progress billing line in an invoice. After a defined part of the work is done, the ToadGreen project accountant prepares an AR invoice for the customer to request the release of 20% of the retained amount.

Acting as the project manager, you need to prepare a pro forma invoice for the project. Then acting as the project accountant, you need to enter and process all the needed financial documents in the system.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the following features

have been enabled:

- Retainage Support

- Payment Application by Line

- Construction

- On the Customers (AR303000) form, the EQUGRP customer has been created; the Pay by Line and Apply Retainage check boxes are selected on the Financial tab for this customer. On the GL Accounts tab, 18000 is specified in the Retainage Receivable Account box.

- On the Projects (PM301000) form, the HOTEL project has been created with multiple project tasks and their budgets. The PROGRRET billing rule is assigned to all project tasks. On the Summary tab of the form, the Standard option is selected in the Retainage Mode box and 5.00 is specified in the Retainage (%) box of the Retainage section.

Process Overview

You will specify the pending invoice amounts on the Projects (PM301000) form and run the project billing. On the Pro Forma Invoices (PM307000) form, you will release the generated pro forma invoice. Also, you will release the related AR invoice on the Invoices and Memos (AR301000) form.

You will then prepare the retainage invoice by using the Release AR Retainage (AR510000) form, and release it on the Invoices and Memos form. On the Payments and Applications (AR302000) form, you will create a payment that includes lines of both the original invoice and the retainage invoice and release the payment and the payment application.

System Preparation

To prepare to perform the instructions of this activity, do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. You should sign in as a construction project manager by using the ewatson username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 4/1/2025. If a different date is displayed, click the Business Date menu button, and select 4/1/2025 on the calendar. For simplicity, in this activity, you will create and process all documents in the system on this business date.

Step 1: Creating and Releasing the AR Invoice with Retainage

To perform progress billing with retainage, do the following:

- On the Projects (PM301000) form, open the HOTEL project.

- On the Revenue Budget tab, in the first line (for the 01 project task) of the table, in the Pending Invoice Amount column, enter 100000.

- In the second line (for the 02 project task), in the Pending Invoice Amount column, specify 10000.

- In the Summary

area, make sure that the Pending Invoice Amount

Total is 110,000.00, and click Run

Billing on the form toolbar to bill the project by

progress.

The system opens the Pro Forma Invoices (PM307000) form with a prepared pro forma invoice. On the Progress Billing tab, in the first and second lines, the Amount box shows the Pending Invoice Amount from the respective revenue budget line (100,000 and 10,000), and the calculated retainage amount (5,000 and 500) is shown in the Retainage Amount column. Other lines of the pro forma invoice have zero amount and quantity.

- In the Summary area, in the Customer Order Nbr. box, type INVHOTEL0401. This is the original reference number of the pro forma invoice assigned by the customer.

- On the form toolbar, click Remove Hold to assign the pro forma invoice the Open status, and then click Release to release the document.

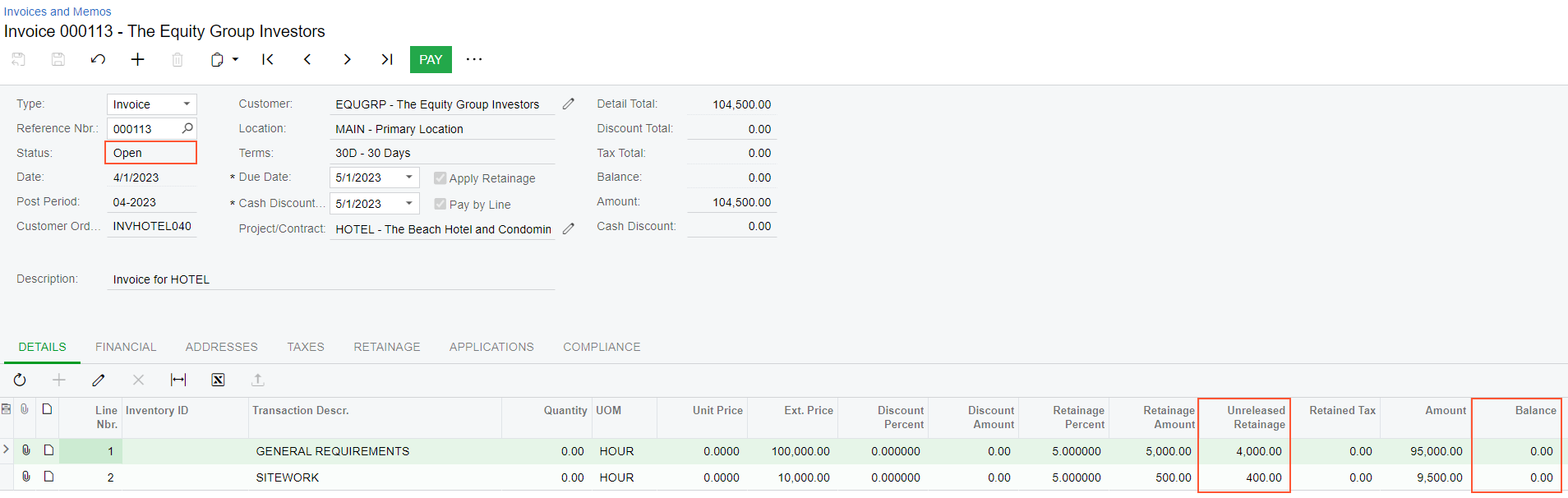

- On the Financial tab, click the AR Ref.

Nbr.

link to open

the created AR invoice on the Invoices and Memos (AR301000)

form. The invoice total

balance

is 104,500. The amount of the first line is 95,000 (which is the

line amount, 100,000, minus the retainage amount, 5,000). For the

second line, the amount is 9,500 (10,000 – 500).

Other lines of

the AR invoice have zero amount and quantity. Also, notice

that the system has copied the customer order number from the pro forma invoice

to the accounts receivable invoice and specified it in the Customer

Order Nbr. box.Tip:The Pay by Line check box is selected in the Summary area, indicating that the balances of this invoice are tracked at the line level. The default value of this setting is copied from the customer record.

- On the form toolbar, click Remove Hold to assign the accounts receivable invoice the Balanced status.

- On the form toolbar, click Release to release the invoice.

- Sign out from the system.

You have billed the project by progress and prepared the pro forma invoice and the AR invoice.

Step 2: Releasing Retainage of the AR Invoice

To release the retainage, do the following:

- Sign in as a project accountant by using the bsanchez username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, click the Business Date menu button, and select 4/1/2025 on the calendar.

- On the Invoices and Memos (AR301000) form, open the AR invoice to the EQUGRP customer in the amount of $104,500, which you have created earlier in this activity.

- On the More menu (under Processing), click Release Retainage. The system opens the Release AR Retainage (AR510000) form.

- In the Summary area, in the Retainage Percent box, specify 20, which is the percentage of the retainage to be released (1,000.00 and 100.00, respectively, shown in the Retainage to Release column of the table).

- Select the unlabeled check box in both lines in the table, and click

Process on the form toolbar.

The Processing dialog box opens. When the process is complete, the system creates a retainage AR invoice. Close the dialog box.

- On the Invoices and Memos form, open the prepared retainage document. In the Summary area, notice that the Retainage Document check box is selected. The total retainage invoice amount is 1,100.00 (which is the retainage amount that you have released).

- On the form toolbar, click Remove Hold and then click Release to release the retainage document.

- On the Financial tab, click the link in the

Batch Nbr. box to open the generated batch of general

ledger transactions.

The system opens the Journal Transactions (GL301000) form with the GL transaction created for the retainage invoice. The non-project code is specified in all the transaction lines. Notice that the retainage amount has credited the 18000 – AR Retainage account and debited the 11000 – Accounts Receivable account. (The system has generated two separate credit entries for each of the processed retainage amounts.)

Step 3: Entering a Payment for the Invoices

Process the payment for the prepared invoices as follows:

- On the Invoices and Memos

form, open the original AR invoice to the EQUGRP customer in the amount

of $104,500.

On the Details tab, in the first and second invoice lines, notice that the Unreleased Retainage balances has been reduced by the amount of the released retainage. For the first line, the originally retained amount was 5,000.00, the amount of 1,000 has been released, and the remaining unreleased retainage balance is 4,000.00. For the second line, the remaining unreleased retainage balance is 400.00.

- On the form toolbar, click Pay.

The system opens the Payments and Applications (AR302000) form with the prepared payment, which has two lines. In each line, the system has populated the Amount Paid column with the amount from the Balance column of the invoice.

- On the table toolbar of the Documents to Apply tab, click

Add Row; add the first line of the retainage invoice

in the full amount of the open balance by performing the following

instructions:

- In the Reference Nbr. column, select the reference number of the retainage invoice.

- In the Line Nbr. column, select 1 (the first line).

- In the Amount Paid column, specify 1000.

- On the table toolbar of the Documents to Apply tab, click

Add Row; add the second line of the retainage invoice

in the full amount of the open balance by performing the following

instructions:

- In the Reference Nbr. column, select the reference number of the retainage invoice.

- In the Line Nbr. column, select 2 (the first line).

- In the Amount Paid column, specify 100.

- In the Summary area, in the Payment Amount box, enter 105,600.

- On the form toolbar, click Remove Hold, and then click Release to release the payment along with the payment applications to the invoice lines.

- On the Application History tab, click the

Reference Nbr. link in any of the original invoice

lines to open the original invoice on the Invoices and Memos form. The

open AR balance of the invoice (in the Balance box) is

now zero, as shown in the following screenshot, but the invoice retains the

Open status because the invoice lines still have unreleased retainage

amounts.

Figure 1. The original invoice with the unreleased retainage amount

You have prepared the invoice with retainage for the project, released a part of the retainage, and paid for the original and retainage documents.