Interbranch Account Mapping: Implementation Activity

Story

The Muffins & Cakes company registers transactions between its branches in the system. Its branches use separate accounting, so they require balancing. The company also registers transactions with the SweetLife head office and retail shop. The account mapping rules between the Muffins & Cakes head office branch (MHEAD in the system) and the Muffin & Cakes retail store branch (MRETAIL) have already been defined in MYOB Acumatica as well as mapping rules between the Muffins & Cakes head office branch and the SweetLife head office branch (HEADOFFICE). You will review these rules. You need to define account mapping rules for transactions between Muffins & Cakes head office branch and SweetLife retail shop (RETAIL).

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the following features have been enabled:

- Multicompany Support, which allows administrative users to create multiple companies within a tenant.

- Multibranch Support, which allows administrative users to create multiple branches for companies.

- Inter-Branch Transactions, which allows users to configure the automatic generation of balancing entries for transactions between different companies within one tenant, branches of different companies within one tenant, and branches that belong to one company and require balancing.

- On the Enable/Disable Features form, the Multiple Base Currencies feature has been disabled.

- On the Companies (CS101500) form, the SWEETLIFE and MUFFINS companies have been defined.

- On the Branches (CS102000) form, the HEADOFFICE and RETAIL branches of the SWEETLIFE company have been created; the MHEAD and MRETAIL branches of the MUFFINS company have been created.

- On the Chart of Accounts (GL202500) form, the list of accounts including 19000 - Due from Related Entity and 26000 - Due to Related Entity have been created.

- On the Inter-Branch Account Mapping (GL101010) form, the account mapping rules between the Muffins & Cakes head office branch (MHEAD) and the Muffins & Cakes retail store branch (MRETAIL) and between the Muffins & Cakes head office branch (MHEAD) and SweetLife Head Office and Wholesale Center HEADOFFICE have been defined.

Process Overview

In this activity, you will review the preconfigured account mapping on the Inter-Branch Account Mapping (GL101010) form. On the same form, you will configure the account mapping rules for transactions between two branches of separate companies.

System Preparation

Launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as a system administrator Kimberly Gibbs by using the gibbs username and the 123 password.

Step 1: Reviewing the Configuration of Mapping Rules Between Branches

To review the configuration of account mapping rules between the two branches of the Muffins Head Office & Wholesale Center company, do the following:

- Open the Inter-Branch Account Mapping (GL101010) form.

- In the Originating Branch box of the Summary area, select

MHEAD.

The originating branch is the branch to which the rules defined on the tabs apply.

- On the Transaction in Originating Branch tab, review the settings

that are used to generate balancing transactions in the originating branch.

In the first row on this tab, notice that the MRETAIL branch is selected as the destination branch. This mapping rule applies to all the accounts within the specified account range. The 19000 - Due from Related Entity account is specified as the offset account to which the system will post the balancing entry in the originating branch. The same settings apply to the HEADOFFICE branch in the second row of the tab.

- On the Transaction in Destination Branch tab, review the settings

that are used to generate balancing transactions in the destination branch.

In the rows on this tab, notice that 26000 - Due to Related Entity is specified as the offset account to which the system will post the balancing entry in the destination branches.

- In the Originating Branch box in the Summary area, select MRETAIL, and review the mapping rules for transactions originating from the MRETAIL branch.

Now that you have reviewed the settings of existing interbranch account mapping rules, you will create your own account mapping rules.

Step 2: Defining Interbranch Account Mapping for Intercompany Transactions

To configure the account mapping rules for transactions between the Muffins Head Office & Wholesale Center branch and the SweetLife Store branch, which are in separate companies, do the following:

- While you are still on the Inter-Branch Account Mapping (GL101010) form, select MHEAD in the Originating Branch box of the Summary area.

- On the Transaction in Originating Branch tab, click

Add Row on the table toolbar, and specify the following settings

in the new row:

- Destination Branch: RETAIL

- Account From: 00000

- Account To: 99999

- Offset Account: 19000 - Due from Related Entity

This mapping rule applies to all the accounts within the specified account range. The 19000 - Due from Related Entity account is specified as the offset account to which the system will post the balancing entry in the originating branch.

- On the Transaction in Destination Branch tab, click

Add Row on the table toolbar, and specify the following settings

in the new row:

- Destination Branch: RETAIL

- Account From: 00000

- Account To: 99999

- Offset Account: 26000 - Due to Related Entity

This mapping rule applies to all the accounts within the specified account range. The 26000 - Due to Related Entity account is specified as the offset account to which the system will post the balancing entry in the destination branch.

- On the form toolbar, click Save.

You have defined the account mapping rules to be used when MHEAD is the originating branch and RETAIL is the destination branch. Now you will specify the account mapping rules to be used when RETAIL is the originating branch and MHEAD is the destination branch.

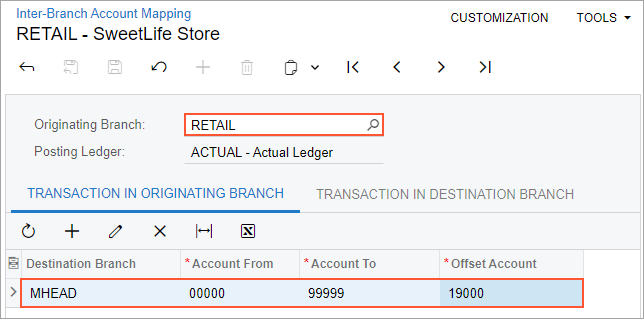

- In the Originating Branch box of the Summary area, select RETAIL.

- On the Transaction in Originating Branch tab, click

Add Row on the table toolbar, and specify the following settings

in the new row:

- Destination Branch: MHEAD

- Account From: 00000

- Account To: 99999

- Offset Account: 19000 - Due from Related Entity

- On the Transaction in Destination Branch tab, click

Add Row on the table toolbar, and specify the following settings

in the new row as shown in the screenshot below:

- Destination Branch: MHEAD

- Account From: 00000

- Account To: 99999

- Offset Account: 26000 - Due to Related Entity

- On the form toolbar, click

Save.

Now you have configured balancing rules that will be used for transactions between the Muffins Head Office & Wholesale Center branch and the SweetLife Store branch, as shown in the following screenshot.