Payroll (NZ): KiwiSaver Changes

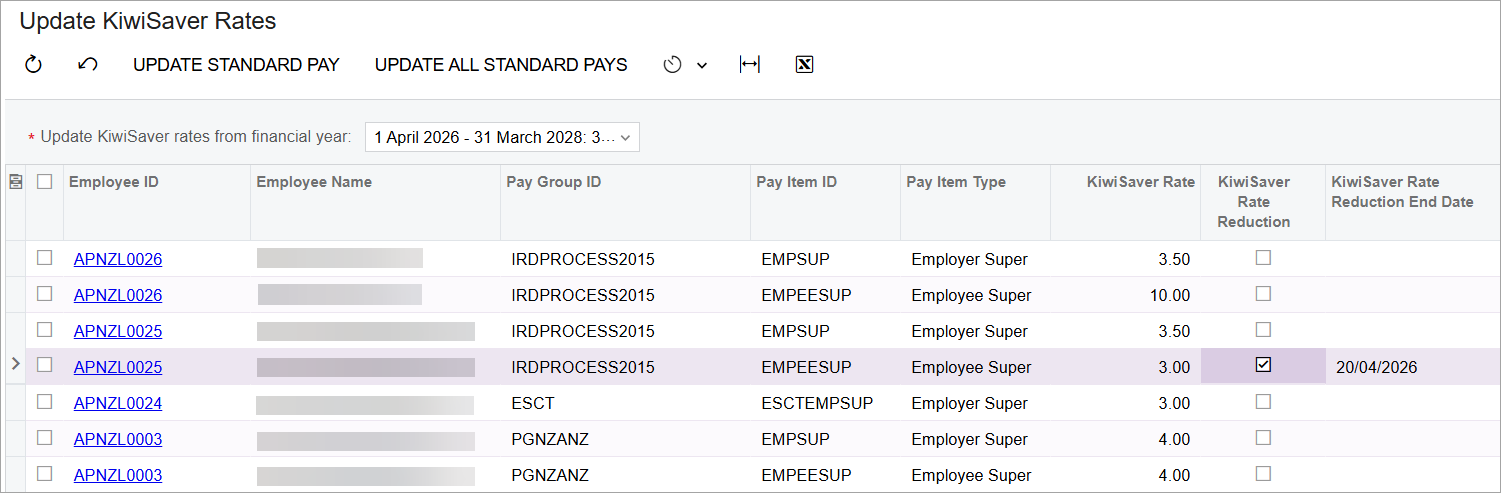

From 1 April 2026, the minimum KiwiSaver contribution is increasing to 3.5%, then to 4% in 2028, with potential further increases in the future. To make it easy to manage these changes, we've added a new Update KiwiSaver Rate form (MPPP2321), and a new option for KiwiSaver rate reductions on the KiwiSaver pay items on the employee Pay Details form.

Updating Minimum KiwiSaver Contributions in Bulk

The new Update KiwiSaver Rate form has two actions: Update Standard Pay, which applies to the selected employees, and Update All Standard Pays, which applies to all employees. These actions update employee and employer KiwiSaver rates to the minimum for the selected financial year (i.e. 3.5% for 2026-2027).

Managing Temporary Rate Reductions

From 1 February 2026, employees will be able to apply for temporary exemptions from the new minimum contributions, allowing them to stay at 3% for three to twelve months. These exemptions can be applied for any number of times.

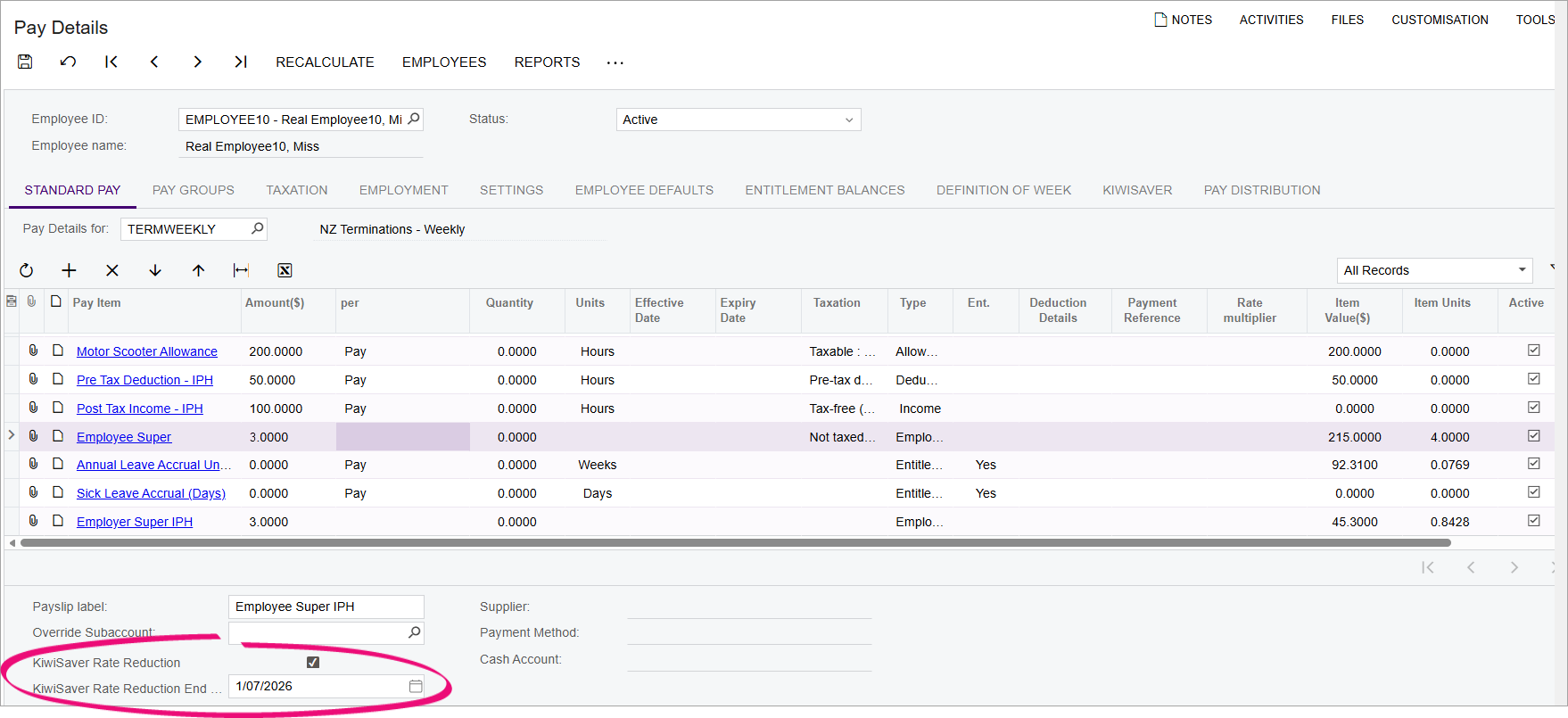

To manage exemptions, we've added two new fields to the KiwiSaver pay items on the Pay Details form. The KiwiSaver Rate Reduction checkbox indicates that the employee has a temporary rate exemption, and the KiwiSaver Rate Reduction End Date field indicates when the exemption finishes, at which point the employee's rate will be automatically raised to the minimum. Your company can also choose to match its employer contributions to the employee's reduced rate.