Appointment Billing Correction: General Information

In MYOB Acumatica, if you need to correct information in an already-released invoice that originated from an appointment, you reverse the invoice, correct the appointment, and generate a new invoice. The correction of the appointment can involve adding or deleting detail lines, editing items in the detail lines, or editing the prices.

Learning Objectives

In this chapter, you will learn how to reverse an invoice originating from an appointment, make corrections in the appointment, and generate another invoice for it.

Applicable Scenarios

You correct an appointment and prepare a new invoice for a customer in the following cases:

- When corrections to an invoice may be needed

- When corrections to an appointment may be needed

Workflow of Appointment Billing Correction

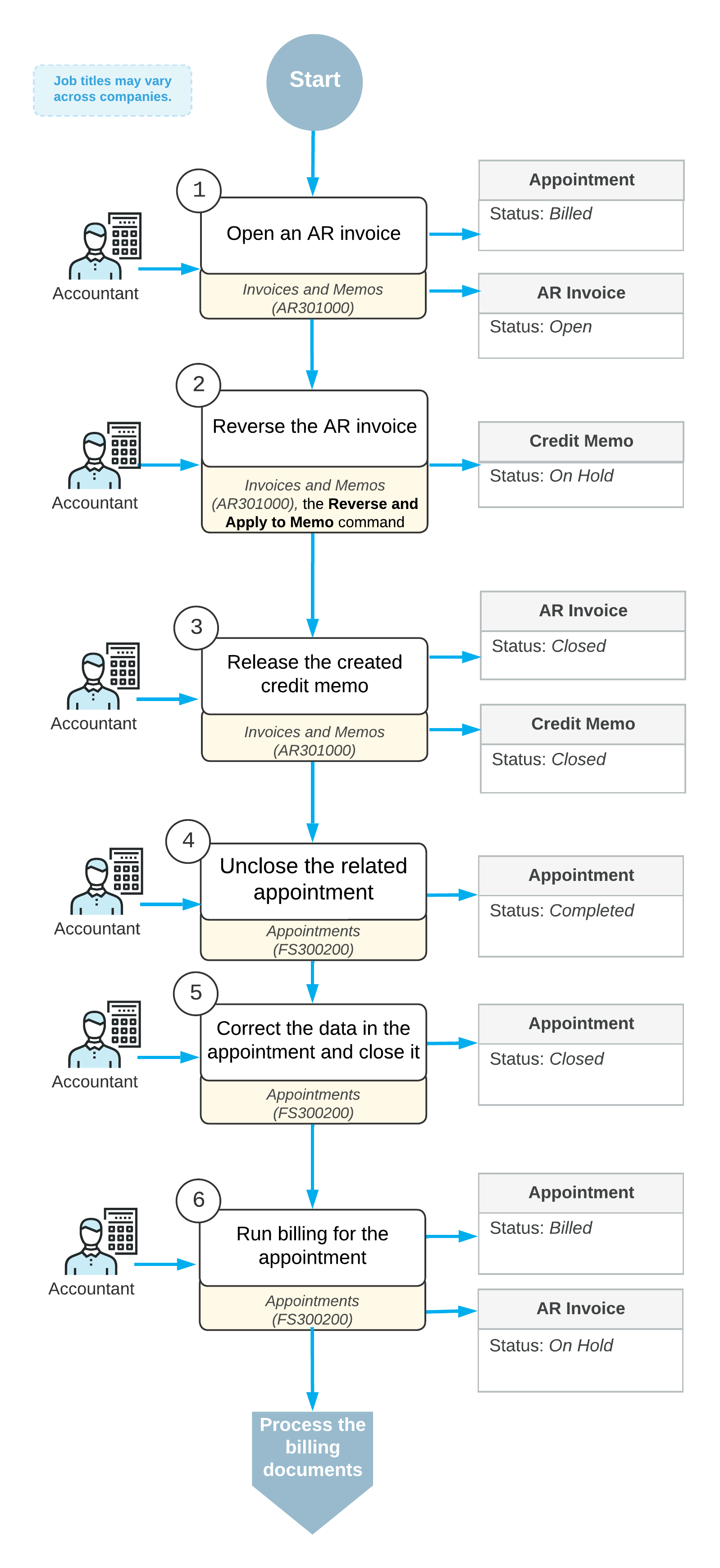

In the diagram below, you can see the general workflow of correcting an invoice that has been generated and released for an appointment. This diagram focuses on the process when the billing document is an accounts receivable invoice.

Correction of an Accounts Receivable Invoice Originating from an Appointment

To correct an appointment billing, if an accounts receivable invoice was used for the billing and it has the Open status (that is, it has been released), an accountant must first reverse this invoice. On the Billing Documents tab of the Appointments (FS300200) form, the accountant finds and clicks the reference number of the invoice. The system opens the invoice on the Invoices and Memos (AR301000) form in a pop-up window.

On the More menu (under Corrections) of the Invoices and Memos form, the accountant clicks Reverse and Apply to Memo. The system creates a document of the Credit Memo type and opens it on the current form. The accountant releases the credit memo, which causes the credit memo and the original invoice to be assigned the Closed status, and closes the form. On the Billing Documents tab of the Appointments form, the system adds a row with the AR Credit Memo document with its reference number.

On the Appointments form, on the More menu (under Corrections), the accountant clicks Unclose to unclose the appointment. The accountant then makes the needed corrections to the appointment. After that, they can process the appointment billing once again.

Correction of a Sales Invoice Originating from an Appointment

If there is an open sales invoice that has to be corrected and this invoice originates from an appointment, the accountant must first reverse the invoice, unclose the related appointment, and make the needed corrections to the appointment. Then they can generate the new invoice with the corrected information. The accountant finds the reference number of the invoice on the Billing Documents tab of the Appointments (FS300200) form. On this tab, the accountant clicks the reference number of the sales invoice. The system opens the invoice on the Invoices (SO303000) form in a pop-up window.

In the invoice, on the Invoices form, an accountant clicks Reverse Service Invoice on the More menu (under Corrections). The system creates a new document of the Credit Memo type and opens it on the current form. The accountant releases the credit memo and closes the Invoices form. The credit memo is assigned the Closed status, and the original invoice is assigned the Canceled status. The system adds a row with the SO Credit Memo document and its reference number on the Billing Documents tab of the Appointments form.

On the Appointments form, the accountant clicks Unclose on the More menu (under Corrections) and makes the needed corrections. After that, they can process the appointment billing once again.