Progress Billing: To Bill a Project for Unrecognized Revenue

This activity will walk you through the process of billing a project for unrecognized revenue and then recognizing this revenue in the project budget.

Story

Suppose that the Thai Food Restaurant customer has ordered 16 hours of training of the company's employees on operating a juicer. Two training sessions of eight hours each have been planned and budgeted.

According to the business requirements of the SweetLife company, the revenue for the project should be recognized when AR invoices are issued to the customer. The SweetLife project accountant has created a project to handle the tracking and billing of the provided services and has defined a billing rule so that the unrecognized revenue is temporarily stored in a separate project budget line.

Acting as the project accountant, you need to update the progress of the project and prepare a pro forma invoice for the customer for the first stage of the project so that the customer can review and agree upon the amounts. Later, when the customer agrees to the terms of the provided pro forma invoice and a part of the training (four hours of the first training session) has been conducted, you need to recognize the revenue and record the actual values in the project budget.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the Project Accounting feature has been enabled.

- On the Account Groups (PM201000) form, the UNRECREV account group of the Income type has been created.

- On the Chart of Accounts (GL202500) form, the 21050 – Project unrecognized revenue account has been created and associated with the UNRECREV account group.

- On the Billing Rules (PM207000) form, the UNRECREV billing rule has been created. In the billing rule, Use Sales Account From is set to Project.

- On the Allocation Rules (PM207500) form, the REVREC allocation rule with the Allocate Budget allocation method has been configured.

- On the Customers (AR303000) form, the TOMYUM customer has been defined.

- On the Projects (PM301000) form, the TOMYUM1U project has been created for this customer, and two project tasks (PHASE1 and PHASE2) have been added. The UNRECREV billing rule and the REVREC allocation rule have been assigned to both project tasks. Also, on the Summary tab, the Create Pro Forma Invoice on Billing check box has been selected, indicating that a pro forma invoice is created when the project is billed. On the Defaults tab, the Default Sales Account is set to 21050 – Project unrecognized revenue.

Process Overview

You will update the progress of the project on the Projects (PM301000) form and run the project billing. You will review the created pro forma invoice and release it on the Pro Forma Invoices (PM307000) form. On the Invoices and Memos (AR301000) form, you will review the prepared accounts receivable invoice and release the invoice. Then on the Projects (PM301000) form, you will review how the unrecognized revenue has been recorded in the project budget. Finally, you will run the allocation rule and review how the revenue is recognized in the project budget.

System Preparation

To sign in to the system and prepare to perform the instructions of the activity, do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded; you should sign in as Pam Brawner by using the brawner username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/30/2025. If a different date is displayed, click the Business Date menu button and select 1/30/2025 on the calendar. For simplicity, in this activity, you will create and process all documents in the system on this business date.

Step 1: Billing for Unrecognized Revenue

To update the progress of project completion and bill the project, do the following:

- On the Projects (PM301000) form, open the TOMYUM1U project.

- On the Revenue Budget tab, in the revenue budget line with the PHASE1 project task, specify 400 as the Pending Invoice Amount.

- Save your changes to the project

- On the form toolbar, click

Run

Billing. The system creates a pro forma

invoice and opens it on the Pro Forma Invoices (PM307000) form.

Review the detail lines of the invoice on the Progress

Billing tab, and notice the following:

- Amount to Invoice in the only line is equal to Pending Invoice Amount for the corresponding revenue budget line of the TOMYUM1U project on the Revenue Budget tab of the Projects form.

- In the Sales Account column of this line, 21050 is specified. This is the account for recording unrecognized project revenue that the system has copied from the settings of the project task.

- On the form toolbar, click Remove Hold to assign the pro forma invoice the Open status, and then click Release to release the pro forma invoice. The system creates the accounts receivable invoice based on the pro forma invoice and assigns the Closed status to the pro forma invoice.

- On the Projects (PM301000) form, again open the

TOMYUM1U project. On the Revenue Budget tab,

notice the following:

- Pending Invoice Amount in the line with the PHASE1 task and REVENUE account group has become zero. Draft Invoice Amount and Actual Amount are zero as well. That is, the pending amount has been billed, but has not yet been recorded to this revenue budget line.

- A new line with the PHASE1 task and UNRECREV account group has appeared in the project revenue budget. This line temporarily stores the unrecognized revenue. The Draft Invoice Amount column shows the amount that has been billed ($400).

- On the Invoices tab, click the link in the AR Reference Nbr. column of the only line to open the accounts receivable invoice that was created on the Invoices and Memos (AR301000) form.

- On the form toolbar of the Invoices and Memos form, click Remove Hold to assign the invoice the Balanced status, and then click Release to release the accounts receivable invoice.

- On the Projects form, open the TOMYUM1U project, and on the Balances tab, review the amounts in the budget lines that have been updated as a result of the billing. Actual Amount for the UNRECREV account group is now $400.

Step 2: Recording Revenue to the Project Budget

To recognize the revenue, while you are still reviewing the TOMYUM1U project on the Projects (PM301000) form, do the following:

- On the Tasks tab, in the line with the PHASE1 project task, specify 50 in the Completed % column.

- Save your changes to the project.

- On the More menu, click Run Allocation.

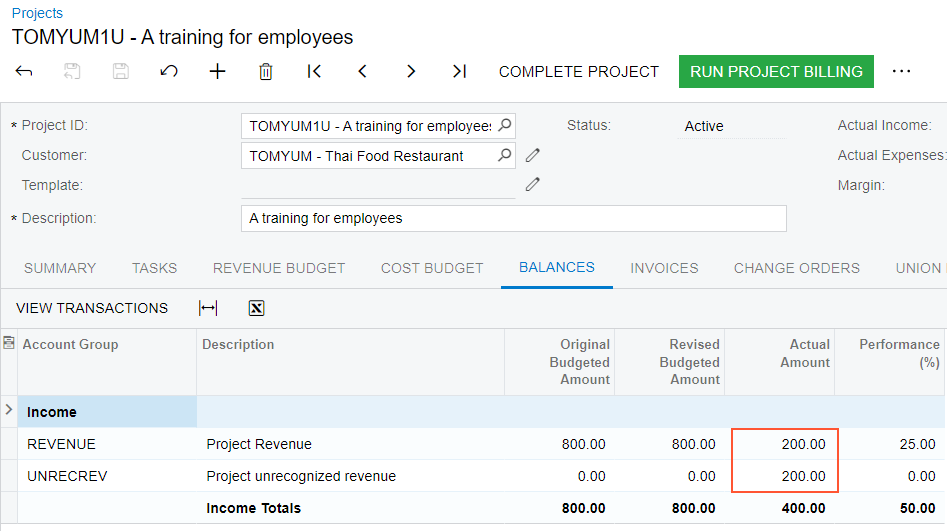

- On the Balances tab, review the project budget and notice

that an actual amount of 200.00 is now shown for the line with the

REVENUE account group (see the following screenshot). The recognized

part of the revenue has been recorded to the project budget.

Figure 1. Partially recognized revenue in the project budget

- On the Project Transaction Details (PM401000) form, in the Selection area, select TOMYUM1U in the Project box, and make sure the Account Group and Project Task boxes are empty.

- In the table, review the first project transaction line (which has AR

specified in the Module column). Notice the values in the

following columns:

- Orig. Doc. Type: Invoice is specified because the transaction has been created on release of the AR invoice.

- Debit Account Group: The transaction has debited the UNRECREV accrual account group.

- Debit Account: The transaction has debited the accrual account.

- Amount: The amount of the transaction is –400.00 because the transaction debits the account of the liability type.

- Review the second project transaction line (which has PM specified in the

Module column). Notice the values in the following

columns:

- Orig. Doc. Type: Allocation is specified because this transaction has been created by the allocation procedure.

- Debit Account Group: The allocation transaction has debited the UNRECREV accrual account group.

- Debit Account: The allocation transaction has debited the accrual account to clear the part of the unrecognized revenue.

- Credit Account Group: The allocation transaction has credited the REVENUE account group, which is the debit account group of the original transaction.

- Credit Account: The allocation transaction has credited the sales account to record the recognized part of the revenue to the project budget.

- Amount: The amount of the allocation transaction is 200.00. This is the recognized part of the revenue.

You have finished billing the project and recording the revenue to project budget.