Overhead in the Project Budget: Process Activity

In this activity, you will learn how to estimate the project overhead calculated based on the project costs.

Story

Suppose that the West BBQ Restaurant customer ordered 40 hours of new-employee training on operating juicers from the SweetLife Fruits & Jams company. The parties agreed that the project should be billed in the amount of $2,000 when the services were provided.

SweetLife's project manager created a project to account for the provided services. Then suppose that starting from 1/27/2025, a consultant of SweetLife provided three days of training (24 hours) and SweetLife's project accountant entered the corresponding project transaction.

Acting as the project accountant, while preparing monthly reports for the project manager, you need to estimate the project costs that have been already incurred considering the administrative overhead, which is 20% of labor costs.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- For the purposes of this activity, on the Enable/Disable Features (CS100000) form, the Project Accounting feature has been enabled to support the project accounting functionality.

- On the Projects (PM301000) form, the WESTBBQ8 project has been created an the TRAINING task has been created for the project.

- On the Account Groups (PM201000) form, the OVERHEAD account group has been created.

- On the Allocation Rules (PM207500) form, the OVERHEAD allocation rule has been created. This allocation rule is configured to process project transactions that represent labor expenses and post the overhead that is calculated as 20% of the transaction amount to the OVERHEAD account group. (For an example of allocation rule configuration, see Overhead in the Project Budget: Implementation Activity.)

- On the Project Transactions (PM304000) form, the PM00000023 batch of project transactions related to the project has been created and released.

Process Overview

In this activity, you will first specify the allocation rule for the project task on the Projects (PM301000) form. On the same form, you will then perform allocation for the project.

System Preparation

To sign in to the system and prepare to perform the instructions of the activity, do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded; you should sign in as project accountant by using the brawner username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/30/2025. If a different date is displayed, click the Business Date menu button and select 1/30/2025 on the calendar. For simplicity, in this activity, you will create and process all documents in the system on this business date.

Step: Capturing Project Overhead

To configure the project for allocation and capture the project overhead, do the following:

- On the Projects (PM301000) form, open the WESTBBQ8 project.

- On the Tasks tab, in the line with the TRAINING task, select the OVERHEAD allocation rule in the Allocation Rule column.

- Save your changes to the project.

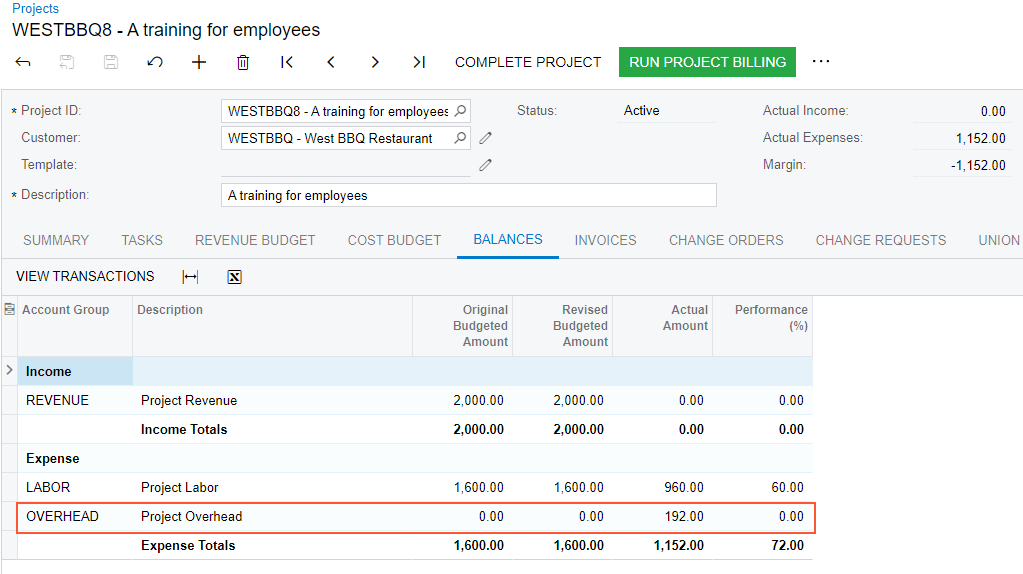

On the Balances tab, notice that there is only one expense line with the LABOR account group, and the actual amount is $960.

- On the More menu, under Billing and Allocations, click

Run Allocation.

The system performs the allocation using the allocation rule you have specified for the project task.

When the allocation is completed, on the Balances tab, review the project balance again, as shown in the following screenshot. Notice that one more expense line with the OVERHEAD account group has appeared in the table. The actual amount of the line is $192, which is 20% of $960.

Figure 1. The captured overhead in the project expenses

- In the table, click the line with the OVERHEAD account group, and on the tab

toolbar, click View Transactions.

On the Project Transaction Details (PM401000) form, which opens, review the created allocation transaction in the amount of $192.00 that corresponds to the account group. The original document type of the transaction is Allocation and the debit account group is OVERHEAD.

You have estimated the project overhead.