Direct Write-Offs: To Process a Balance Write-Off

The following activity will walk you through the processing of a balance write-off.

Story

Suppose that in January 2025, SweetLife Fruits & Jams undercharged one of its customers, Morning Cafe, in the amount of $7 for onsite training courses. However, on January 30, the chief accountant of SweetLife decided to write off this small amount.

Acting as the chief accountant, you need to create a $7 debit memo, update to customer's settings to enable write-offs, and create a balance write off for the $7.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Customers (AR303000) form, the MORNINGCAF customer has been created.

Process Overview

In this activity, you will create a debit memo on the Invoices and Memos (AR301000) form. On the Customers (AR303000) form, you will update the settings of the customer. On the Write Off Balances and Credits (AR505000) form, you will process a balance write-off to write off the amount of the debit memo. Finally, on the Payments and Applications (AR302000) form, you will review the Balance WO document automatically generated by the system.

System Preparation

Before you begin processing a direct write-off, do the following:

- Launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as Anna Johnson by using the johnson username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/30/2025. If a different date is displayed, click the Business Date menu button and select 1/30/2025 on the calendar. For simplicity, in this activity, you will create and process all documents in the system on this business date.

- As a prerequisite activity, in the company to which you are signed in, be sure you have set up the write-off functionality, as described in Direct Write-Offs: Implementation Activity.

- On the Company and Branch Selection menu on the top pane of the MYOB Acumatica screen, select the SweetLife Head Office and Wholesale Center branch.

Step 1: Creating a Debit Memo

To create a debit memo, do the following:

- On the Invoices and Memos (AR301000) form, add a new record.

- In the Summary area, specify the following settings:

- Type: Debit Memo

- Date: 1/15/2025

- Post Period: 01-2025 (inserted automatically)

- Customer: MORNINGCAF

- Description: Undercharged amount for onsite training

- On the Details tab, click Add Row

on the table toolbar, and specify the following settings in the added row:

- Branch: HEADOFFICE

- Transaction Descr.: Undercharged amount for onsite training

- Ext. Price: 7

- On the form toolbar, click Save.

- On the form toolbar, click Remove Hold, and then click Release to release the debit memo.

Step 2: Updating the Customer's Settings

To update the customer's settings, do the following:

- On the Customers (AR303000) form, open the MORNINGCAF customer.

- On the Financial tab (Financial

Settings section), specify the following settings:

- Enable Write-Offs: Selected

- Write-Off Limit: 10

- On the form toolbar, click Save.

Step 3: Processing a Balance Write-Off

To create and release a balance write-off for the customer, do the following:

- Open the Write Off Balances and Credits (AR505000) form.

- In the Selection area, specify the following settings:

- Type: Balance WO

- Doc. Date: 1/30/2025

- Company/Branch: HEADOFFICE

- Post Period: 01-2025

- Customer: MORNINGCAF

- Reason Code: BALWOFF (inserted automatically)

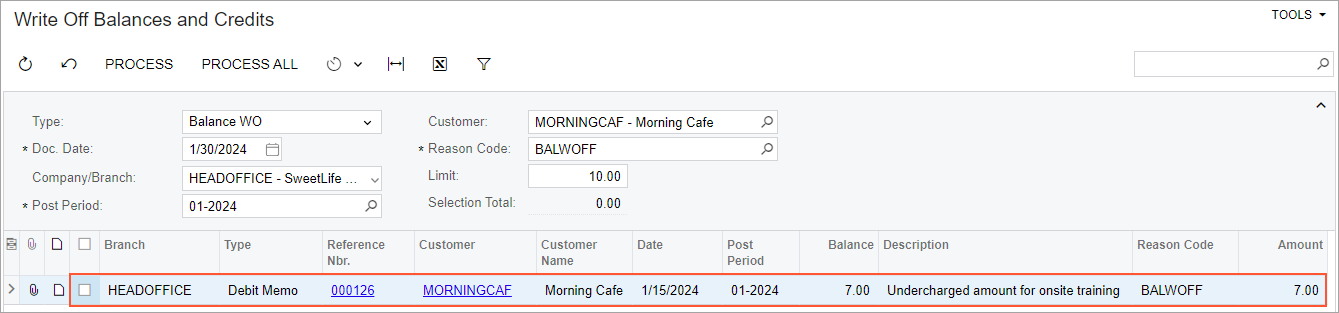

The debit memo that has the $7 balance appears in table (see the screenshot below), because the form shows the documents of this customer that have a balance no greater than the amount specified in the Limit box, which by default contains the Write-Off Limit amount specified for the customer.

Figure 1. Debit memo that can be written off

- In the table, select the unlabeled check box in the row of the debit memo.

The Selection Total box in the Summary area shows the total amount of the selected documents that will be written off during the process, which in this case is $7 for the debit memo.

- On the form toolbar, click Process to write off the customer balance and generate the write-off transaction to be posted to the specified date and period. The system generates and releases a Balance WO type of document for each document selected in the table.

Step 4: Reviewing the Balance WO Document

To review the generated Balance WO document, do the following:

- Open the Payments and Applications (AR302000) form.

- In the Type box, select Balance WO and open the

document that the system created and released in Step 3.

Notice that the system has inserted the amount, the document date, and the post period into the Balance WO document, based on the settings you have specified on the Write Off Balances and Credits (AR505000) form. The system has automatically released and closed the Balance WO document. The debit memo whose amount has been written off is displayed on the Application History tab. In the Amount Paid column, you can see the written-off amount.

- On the Financial tab, click the number of the batch that

has been generated on release of the Balance WO document; the system

displays the GL transaction on the Journal Transactions (GL301000)

form.

On release of the Balance WO document, the system decreases the customer's current balance by the written-off amount, closes the document that has been processed, and generates the batch to debit the account specified for the reason code and credit the AR account of the document.