Bank Reconciliation: General Information

One way you can maintain internal control over the company's cash is by performing regular reconciliations of accounts. Generally, the goal of reconciliation is to find discrepancies between account balances tracked by different means (by your company in MYOB Advanced, and by a third-party financial institution using its software), identify any errors, and make the needed corrections or adjustments.

If you are reconciling your cash accounts, you need quick and accurate tools to ensure that the third-party records match the transactions—cash transactions, payments to vendors, quick checks, incoming payments from customers, and cash sales—recorded in your system. MYOB Advanced offers you capabilities that ease the processes of importing, tracking, and matching the transactions.

Learning Objectives

You will learn how to reconcile a cash account with a statement from a third-party financial institution.

Applicable Scenarios

If you are reconciling an account from a financial institution, you compare its statement to the transactions of the cash account as tracked in your system. Because financial institutions offer a variety of online banking services, you do not need to wait for a monthly statement; you can instead download a list of recent banking transactions in a suitable format as needed. Regular reconciliations can reduce the number of errors on accounts and make it easier to find overlooked transactions, such as missing sales invoices or checks that have been lost in transit.

If you are reconciling a cash account other than a bank account (for instance, a cash register account), you can upload a list of amounts that are confirmed with the cash register receipts or with point-of-sale (or similar) reports.

Steps of the Reconciliation Process

In general, you perform the following steps when you reconcile each cash account:

- Preparing for the reconciliation: During or after each financial period, on the Process Bank Transactions (CA306000) form, you clear transactions for the account as you receive information that the financial institution has processed them. For details, see Bank Reconciliation: Uploading and Processing of Bank Transactions.

- Verifying the beginning balance of the cash account: At the end of the financial

period, on the Reconciliation Statements (CA302000) form, you verify that

the beginning balance of the cash account in MYOB Advanced

matches the beginning balance on the bank statement (or on your record of the petty cash

account); if they do not match, you void the earlier statement and fix all errors. Also, you

can review unreconciled transactions from previous financial periods and see which of them have

been preliminarily cleared. Note: If a transaction has been matched to an entry on a bank statement on the Process Bank Transactions form, the Cleared check box is selected for the transaction on the Reconciliation Statements form. Also, a transaction is cleared if a user has selected the Cleared check box for it on the form where the transaction was entered.

- Creating the reconciliation statement: You create a new reconciliation statement for the cash account on the Reconciliation Statements form and enter the statement balance—for instance, the ending balance from the bank statement.

- Clearing the transactions: If you have used the Process Bank Transactions form

to clear bank transactions, on the Reconciliation Statements form, you click the

Reconcile Processed button on the table toolbar, and the system selects

the Reconciled check boxes in the table for all released documents that

were processed on the Process Bank Transactions form.

If you have been manually clearing transactions during the financial period for which you have created the reconciliation statement and are sure that the clearing is valid, you select the Reconciled check box for each cleared transaction.

If no transactions have been cleared, by using a bank statement or other paper documents confirming transactions, you compare the transactions to the lines of the bank statement by using transaction identifiers, dates, and amounts. For each confirmed transaction, you select the Reconciled check box.

Tip: You can perform reconciliation in as many sessions as you need. You can save the reconciliation statement at any time to continue to work with it later. - Adjusting the cash account balance: As you progress through the list on the Reconciliation Statements form, you can view the updated value of the difference between the reconciled balance of the cash account and the balance of the statement you have entered. You can create cash adjustments for transactions (such as bank interest or service charges) that have occurred but were not recorded to the account in MYOB Advanced. The reconciliation is finished when the difference between the reconciled balance of the cash account and the balance of the statement is zero. For details, see Adjustment of a Cash Account Balance.

- Confirming the reconciliation results: When you have finished comparing the cash account transactions to a bank statement on the Reconciliation Statements form and the difference between the reconciled balance of the cash account and the balance of the statement is zero, you save the reconciliation statement. You can now release the reconciliation statement, which confirms that the cash account balance is reconciled for the financial period. For details, see the Release of a Reconciliation Statement section of this topic.

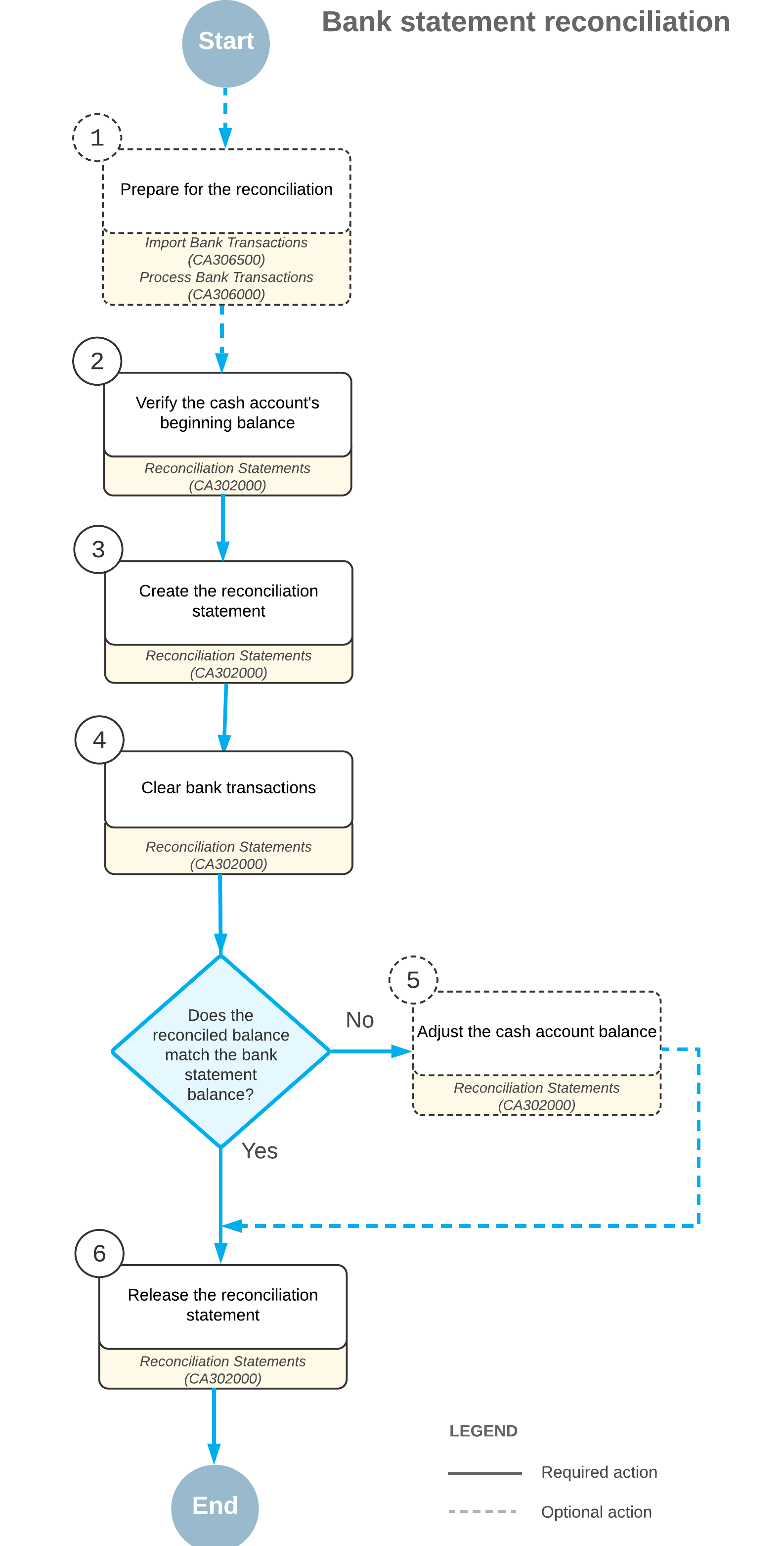

Process Diagram

The following diagram illustrates the process of bank statement reconciliation.

Creation of the First Reconciliation Statement

If you have never performed reconciliation for a particular account and then decide to start reconciling the account on a specific date (for example, when you are converting a cash account into a bank account), consider creating a first reconciliation statement that includes all the transactions that had been recorded to this account before this specific date and that were not recorded to another source.

When you know the balance of your first reconciliation statement, you create the reconciliation statement and mark the transactions as reconciled. When the reconciled balance and the statement balance are equal, you save and release the reconciliation statement.

When you are reconciling the account for the second time, if you detect transactions that should belong to the first statement, you void the first statement, add these transactions, and release the statement again.

Adjustment of a Cash Account Balance

If you are reconciling a bank account, you compare the cash account transactions to the bank account records (which are usually found in a bank statement). Theoretically, the balance of the bank account should reconcile with the balance of the associated cash account as shown in your system. However, a transaction may be recorded on your books sooner or later than the bank actually reflects that change in the corresponding account. Also, the bank may invoke service charges of amounts that are not known in advance.

If you do not use automatic processing of the bank transactions, you may encounter a transaction that is in a bank statement, but is not recorded to the system. In MYOB Advanced, you can create cash adjustments for these transactions that have occurred but were not recorded to the account by clicking Create Adjustment on the table toolbar of the Reconciliation Statements (CA302000) form.

Release of a Reconciliation Statement

You can release a balanced statement by clicking Release on the form toolbar of the Reconciliation Statement History (CA302010) or Reconciliation Statements (CA302000) form.

The released statement includes only documents for which the Reconciled check box is selected in the table on the Reconciliation Statements form. When you release the reconciliation statement, the system assigns a date and a reconciliation statement reference number to all transactions marked as reconciled; these transactions will not appear on any future reconciliation statement.

If transactions were not marked as reconciled but were marked as cleared, they will keep the Cleared status and will appear on subsequent statements until they are reconciled.