Holiday Pay

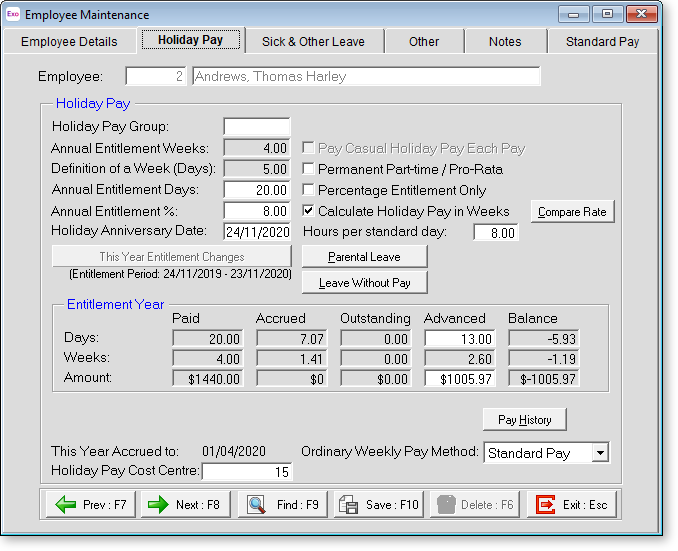

The Holiday Pay tab of the Employee Maintenance window contains the employee's Holiday Pay status, including their Annual Entitlement, Current Year Accrual and Outstanding Entitlements from previous holiday pay years. While it is not necessary to have loaded the data in this screen before you start paying your staff, it is recommended, as you will eventually come to a point where you will have to pay out someone's holiday pay and therefore will need to have their outstanding balance from previous years, and current accrual for this year, in the system.

Holiday Pay

Holiday Pay Group This is the group code containing the holiday pay rule that will be allocated to this employee, as defined in the holiday pay groups masterfile.

If Holiday Pay Groups are enabled on the Leave Management Setup window in the Payroll Setup, and you assign a holiday pay group code to the employee, the entitlement days and percentage will be drawn from the group rule.

If a group rule is not being employed you will have to assign the entitlement % and days manually.

Annual Entitlement Weeks This is normally set at 4.00. It represents the number of weeks' Holiday Pay the employee is entitled to.

Definition of a Week (Days/Hours) The employee's Agreed Definition of a Week, as set on the Days/Hours Paid section of the Standard Pay. This is used to convert the employee's weekly Holiday Pay balance and entitlement to hours or days.

Annual Entitlement Days For permanent full-timers enter the number of weeks converted to days that a person is entitled to for the year. This should be equal to their weekly entitlement multiplied by their Definition of a Week.

For permanent part-timers, set a person entitled to four weeks to 20 days. The payroll will pro-rata the actual days accruals for Permanent Part-timers to the number of days they have worked in the year, e.g. a person who works only two days per week would accrue only 8 days (of their average daily rate) if set to four weeks/20 days.

Even when you are unsure of how many days a person will in fact work in the year, this method will accrue the correct proportion of holidays per year for the actual days worked, providing you tell the system each pay period how many days you want to divide the holiday pay year by. (This is done using in the Days Paid button in the Current Pay.)

Annual Entitlement % This is normally set at 8%. This amount will also be used to calculate a person's holiday pay who is terminating before 12 months work and for the part of the current year worked for any person who is to be terminated before their next anniversary. In other words, incomplete years of holiday pay are paid out as x percentage of the current year's gross earnings.

Conversely, complete years of holiday are normally paid out at as x days at the employee's average daily rate for that year. Therefore there is a need to record both the weekly entitlement and entitlement days.

NOTE: If you are using Holiday Pay Groups and the employee has been allocated to one then the value behind this field will be drawn from the group rule.

Holiday Anniversary Date This field will have a date, which is the next Holiday Pay anniversary for this employee. (This is always a date in the future and "This Years" entitlement is always building up towards this date)

You will note that the Days entitlement are automatically being built up by the computer program. From the last anniversary date (a year prior to the date showing) towards the next anniversary date (the one showing) The actual date they have been accrued to is shown at the bottom right of screen which will, in normal circumstances, be the date of the next Pay. So that when you do the next pay the days accrued will include the pay you are working on and be accurate if you decided to terminate an employee.

NOTE: Before changing any of the below settings for an existing employee, take note of their existing entitlements; otherwise you may lose them.

Pay Casual holiday Pay each Pay This will automatically give a casual employee holiday pay each pay. This does not come off the hourly rate but will always be 8% added to the Gross.

Permanent Part Time / Pro Rata This allows the program to pro-rata the days accrued to the number of days worked, e.g. a person on two days a week would accrue eight days per year. This option is only available if Allow Permanent Part Time / Pro-Rata Holiday Pay is ticked on the Leave Management Setup window in the Payroll Setup.

Percentage Entitlement Only Under this method only dollar amounts will display - the system will not track daily rates, it will take a percentage of the current year's gross earnings for holiday pay valuation. This option is only available if Allow percentage based Holiday Pay method is ticked on the Leave Management Setup window in the Payroll Setup.

Calculate Holiday Pay in Weeks When this option is ticked, the employee's Holiday Pay entitlement and balance is calculated in weeks. The weekly values are converted to hours or days for requesting and paying leave based on the employee's Agreed Definition of a Week. This option is only available if Calculated Holiday Pay in Weeks is ticked on the Leave Management Setup window in the Payroll Setup.

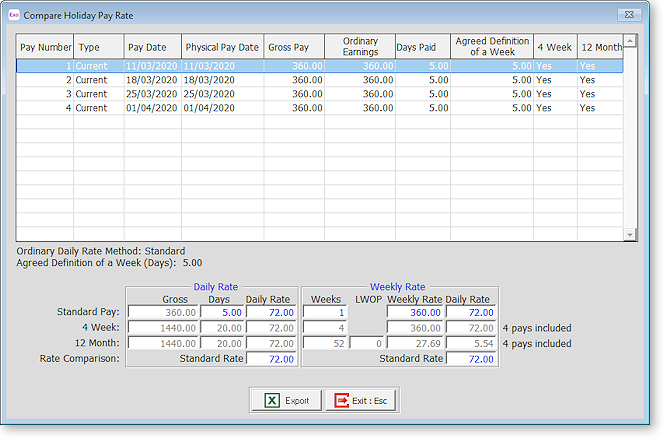

When the option is ticked, a Compare Rates button becomes available - clicking this button opens the Compare Holiday Pay Rate window, which displays the employee's Holiday Pay rate as calculated in days/hours and in weeks, showing any difference between the two rates that may need to be investigated.

Hours per Standard Day This field allows Exo Payroll to work out an hourly equivalent of the number of days of holidays paid out, for reports such as the Statistics Return.

It is also used for calculating the employee's Relevant Daily Rate, for leave types such as:

- Sick leave

- Bereavement Leave

- Public Holidays

- Alternative Leave Paid

- Family Violence Leave

- Shift Leave (where Shift Leave is being valued as Sick Leave in Leave Management Setup)

- Other Leave (where Shift Leave is being valued as Sick Leave in Leave Management Setup)

For companies who allocate the holiday pay accrual in days, the Relevant Daily Rate is calculated as follows:

- Gross Earnings liable for Relevant Daily Pay/Average Daily Pay / days paid for last 52 weeks / Hours per Standard Day = Relevant Hourly Rate

- Relevant Hourly Rate X Hours per Standard Day = Relevant Daily Rate

(For companies who allocate the holiday pay accrual in hours, the Relevant Daily Rate is calculated as follows:

- Gross Earnings liable for Relevant Daily Pay/Average Daily Pay / hours paid for last 52 weeks = Relevant Hourly Rate

- Relevant Hourly Rate X Hours per Standard Day = Relevant Daily Rate

NOTE: If the employee works different hours for each day of the week, you may choose to pay the employee at their hourly rate, and specify the number of hours to pay based on the number of hours that the employee is rostered for on that day of the week (refer to the Sick & Other Leave tab for details on setting the Relevant Rate method to Hourly Rate). In that case, you would leave the Hours per Standard Day at zero, indicating that the employee does not work standard hours for each day.

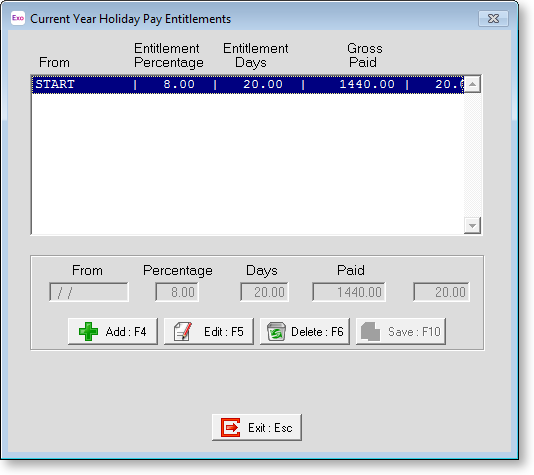

This Year Entitlement Changes If you have attached a Holiday Pay Group to the employee, the This Year Holiday Pay Entitlements button will become enabled. Clicking this button opens the following window:

This window contains the employee's holiday pay gross earnings for the current holiday pay year, and any rule changes which have occurred partway through the year.

To add a new rule, click the Add button, then set the following properties:

- From - enter the date from which the rule change applies.

- Percentage - enter the employee's annual percentage entitlement

- Days/Hours - enter the employee's annual entitlement in Days or Hours, depending on which method was chosen on the Leave Management Setup window.

Click Save. The Gross Paid value is calculated automatically based on pay history.

You can edit an existing rule by selecting it and clicking Edit.

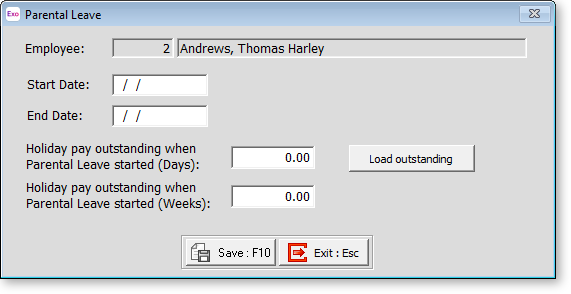

Parental Leave

Click the Parental Leave button to open a window where you can enter details of any Parental Leave taken by the employee.

Start Date Enter the date when the employee's Parental Leave started.

End Date Enter the date when the employee's Parental Leave ended, or leave this blank if the date isn't currently known.

NOTE: If the Paid Parental End Date is in the future, or if no End Date has been entered yet, the note “Currently on Parental Leave” appears on the Holiday Pay tab and on the side panel of the Current Pay window, under Leave Calculation Details. If the Paid Parental End Date is any date in the last 12 months, the note “Returned from Parental Leave on …” appears on the side panel of the Current Pay window, under Leave Calculation Details.

Holiday Pay outstanding when Parental Leave started The employee’s outstanding Holiday Pay amount in hours/days and in weeks, as at the entered Start Date. These values are editable and can be updated as necessary. Clicking the Load outstanding button updates these fields with the employee’s current amounts. Once dates have been entered and saved, these fields become read-only and the Load outstanding button is disabled.

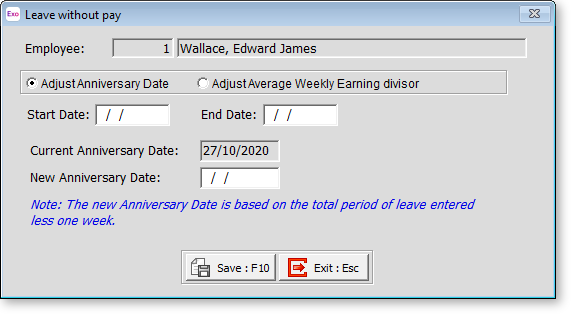

Leave Without Pay

Click the Leave Without Pay button to open a window where you can enter details of any Leave Without Pay (LWOP) taken by the employee.

NOTE: This button is only available for employees whose Holiday Pay is calculated in weeks.

Leave Without Pay of more than one continuous week affects an employee's Average Weekly Earnings (AWE) rate for Holiday Pay. In this case, you must either:

- move the employee's Holiday Pay anniversary date back one week for each whole or partial week of LWOP taken beyond the first (e.g. two weeks of LWOP means that the anniversary date should be moved back by one week), or

- reduce the AWE divisor by one for each whole or partial week of LWOP taken beyond the first (e.g. three weeks of LWOP means the divisor should be reduced by two weeks, so gross earnings are divided by 50 weeks instead of the usual 52 to calculate AWE).

Note: This does not apply to all kinds of unpaid leave, e.g. unpaid sick leave, unpaid parental leave, voluntary service and unpaid leave on ACC are exempt from this, so there is no need to adjust the employee's anniversary date or AWE divisor. See "Leave without pay" on the MBIE website for more information.

Adjust Anniversary Date / Adjust Average Weekly Earnings divisor Select which of the above methods you want to use to account for the employee's LWOP. The fields below change depending on which option you select.

Start Date / End Date Enter the start and end dates for the employee's LWOP.

Current Anniversary Date When adjusting the employee's anniversary date, this read-only field display the employee's current Holiday Pay anniversary date.

New Anniversary Date Enter the employee's new anniversary date. The default value for this field is calculated using the start and end dates you selected.

The AWE divisor will be adjusted by Enter the number of weeks to reduce the AWE divisor by. The default value for this field is calculated using the start and end dates you selected.

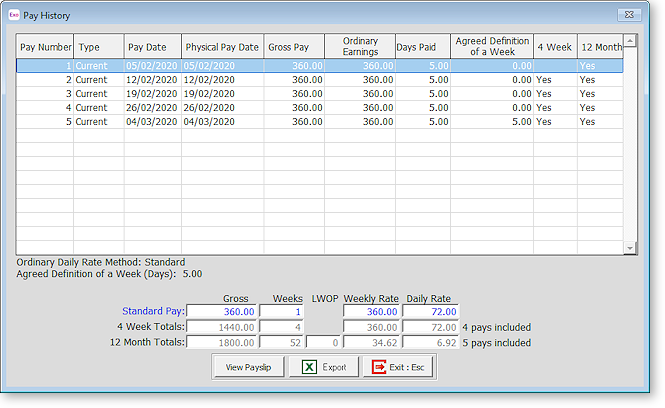

NOTE: The number of weeks entered here will appear in the LWOP column on the Pay History window.

Entitlement Year

The lower part of the window shows you the fields where the Holiday Pay liable earning records are kept. These figures are separate and different from the Tax Year figures. These records will also be influenced by what you decide goes into the Gross Pay for the Holiday Pay Year, e.g. when creating an allowance you decide whether this is to be added to the Gross for the Holiday Pay. You do not use this screen while actually paying Holiday pay: You use the Holiday Pay screen in the Current Pay, which gathers its information for here.

The Entitlement Year section holds the days/hours and amounts for the current holiday entitlement year - the end date of which is shown in the holiday pay screen as the Holiday Anniversary Date, and the start date of which is end the date less one year.

Days/Hours The number of days/hours that an employee has worked and been paid for, based on the Weeks amount and the employee's Agreed Definition of a Week.

Weeks The number of weeks that an employee has worked and been paid for.

Amount The total gross earnings liable for Holiday Pay, for the Holiday Pay year to date.

Accrued This field is automatically calculated. The calculation is as follows:

The number of calendar days between the employees last Holiday Entitlement date and the current or next pay period date, divided into 365 which gives us a fraction of the year worked, e.g. if there have been 183 days since the last anniversary then the fraction is 50%. This is then applied to the employees normal annual entitlement value to arrive at an accrual e.g. 20 x 0.50 = 10 Accrued Days.

Accrued Amount This field is automatically calculated by the Payroll. The calculation is as follows:

The Amount Paid for the Entitlement Year X the Annual Entitlement %, e.g. 2280 X 0.08 = $182.40 for an employee on the Percentage Only method.

Outstanding The number of days/hours/weeks of holiday pay owing and still outstanding from years prior to the last anniversary date. This value is calculated automatically as pays are run and as Holiday Pay years roll over.

Outstanding Amount The lump sum of Holiday Pay owing and still outstanding from years prior to the last anniversary date, for an employee who is on the Percentage Only Method. This value is calculated automatically as pays are run and as Holiday Pay years roll over.

Advanced The number of days/hours/weeks of Holiday Pay that have been paid in advance of the next Holiday Anniversary Date. This value is calculated automatically as pays are run and as holiday pay is paid out of the employee's current year's accrual of holidays.

Advanced Amount The lump sum of Holiday Pay that have been paid in advance of the next Holiday Anniversary Date, for an employee who is on the Percentage Only Method. This value is calculated automatically as pays are run and as Holiday Pay is paid out of the employee's current year's accrual of holidays.

Balance Calculated as Accrued + Outstanding - Advanced.

Balance Amount Calculated as Accrued Amount + Outstanding Amount – Advanced Amount, for an employee who is on the Percentage Only Method.

Last 12 Months

This section is used purely for calculating an average daily rate of holiday, by dividing the gross earnings liable for holiday pay (for the last 12 months), by the days/hours paid (for the last 12 months).

The last 12 months is defined as being from the pay period prior to the Current Pay, less one year.

Gross Pay The gross earnings liable for holiday pay will be divided by the days/hours paid to calculate the average daily rate of holiday pay, when paying outstanding or advanced days of holiday pay.

The gross earnings liable for holiday pay will also be used to calculate a value for termination pay. For example, if the Gross Paid for the current entitlement year = $30,000, the value of termination pay would be 6% of $30,000 or $1800, plus any outstanding days holiday pay x the daily rate for those days.

The average daily rate is calculated automatically, based on actual pay history. If no prior pay history exists, the system will ascertain that the employee's average daily rate is zero, then it will look up the employee's ordinary daily rate at the time of payment. The system will compare both figures and use the higher of the two – therefore the employee will be paid, but not at their average daily rate, as none exists without full pay history, taking into account extra pay and overtime earned during the previous year.

If you are new to Exo Payroll, you must use the Year to Date Loader to input historical information for the employee's holiday pay year to date. After initial setup, the Gross Pay value is calculated automatically as pays are run, and will be for the last 12 months in relation to the Current Pay Period End date.

Days/Hours Paid This value is calculated automatically as pays are run, and is the sum of the Days/Hours Paid for each pay for the last 12 months in relation to the Current Pay Period End date.

Pay History

The Pay History button opens a window showing the history of Days/Hours Paid for the current period of employment. The Type column shows whether the pay was a Current Pay or a One-Off Pay.

Clicking the View Payslip button generates a payslip report, showing the details of the selected pay. (You can also right-click on a pay and select View Payslip to generate a payslip for that pay.)

NOTE: You can click Copy to copy all data on the window to the clipboard, so that it can be pasted into an external application, such as a spreadsheet. If Microsoft Excel is installed, the Copy button is replaced by an Export button, which outputs the data to a Microsoft Excel file in the .XLSX format.

This Year Accrued To This property represents the end of the date span of the current year's holiday pay accrual. This date will be:

- Prior to the first pay run – the system date of your computer

- While the Current Pay matching the employee's pay frequency is open – the Current Pay period end date.

- While the Current Pay matching the employee's pay frequency is closed – the Current Pay period end date plus one pay period.

It is advisable to print reports that track changes in leave liability, such as the Holiday Pay report, while the Current Pay is still open. If you are using leave liability reports for scheduling purposes, e.g. in order to allocate labour for the next working week, it is advisable to print these reports when the Current Pay is closed.

Ordinary Weekly Pay Method Select where to obtain the daily/hourly rate for Ordinary Weekly Pay calculation:

- Standard Pay - the daily/hourly rate is taken from the employee's Standard Pay. If the Standard Pay is not defined, i.e. the Standard Pay gross is zero, the system will use the 4 Week Average.

- 4 Week Average - the daily/hourly rate is calculated using the last four weeks' earnings, regardless of what is in the Standard Pay. This is useful for casual employees who work irregular hours, or employees who have a basic pay but often have extra earnings to be included in the calculation for leave, such as regular overtime or commissions.

- Higher Rate - the employee's rate will be the higher of their Standard Pay or 4 Week Average rate. This option can be useful for cases like employees who occasionally work overtime, but mostly work to their Standard Pay, e.g. employees doing seasonal work.

Holiday Pay Cost Centre If you use a specific Cost Centre for each employees or departments Holiday Pay when paid, this can be entered here and will be the default when paying Holiday Pay.