Holiday Pay Groups

Selecting Holiday Pay Groups from the Maintenance menu opens a window that allows you to set award-based rules and then place employees in their allows you to create groups of holiday pay types and then just place employees in their appropriate group. This grouping will enable automatic roll-overs into employee's next entitlement brackets and also to split accumulating holiday over the course of a holiday pay year.

You are now able to define groups of holiday pay that allow for different calculations. These groups are then attached to an employee at the individual employee level in screen two of the employee's masterfiles.

What this means is that you could have an employee starting at 8% and 20 days entitlement. After 60 months or 5 years service moving to 10% and 25 days entitlement, and finally moving to 12% and 30 days entitlement after 120 months or 10 years service.

These entitlements will automatically be given to the employee on the appropriate length of service anniversaries.

If you have a company anniversary you are also able to split the accumulation of holiday pay over a holiday pay year. What this means is that you are now able to have a company anniversary of say 25th December but an employee who starts in July. On the anniversary of the employee's 5th year of service they are now able to accumulate 20 days pro-rata from 25th December through to July and 25 days pro-rata from July through to December.

Holiday Pay Groups will only appear in the maintenance menu if the option to use them has been switched on in the Holiday & Sick Pay Setup area in Setup Payroll screen.

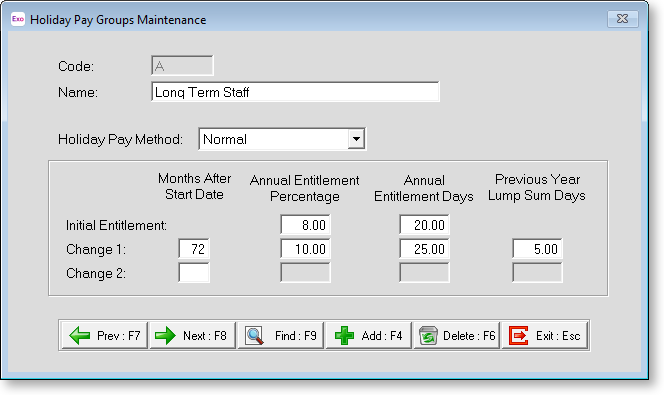

To set up holiday pay groups for your Payroll company, select Holiday Pay Groups from the Maintenance menu. Press F9 or click Find for a list of all Holiday Pay Groups. Press F4 or click Add to add a new group:

Code Enter the Group Code you want to use

Name Enter the name you want to label this Group code number

Holiday Pay Method Every Holiday Pay group must have a calculation method that it will use when calculating Holiday Pay. This method can be any one of the following.

- Normal - This is the default as most employees use this method. It uses a percentage entitlement & days to accrue holiday pay.

- Casual Holiday Pay Each Pay Period - This method will allow an employee to receive a definable % of their gross pay each pay period as a separate holiday pay amount.

- Permanent Part-Time / Pro-Rata - This method allows the employee to accrue a number of days or hours based on a pro-rata comparison against a full time employee. The more days or hours the employee works, the more days or hours they accrue.

- Percentage Entitlement Only - This method means the employee does not accrue any days or hours entitlements. All the employee will accrue is a value of holiday pay based upon the amount of money they have earned.

Once you have chosen a calculation method to use you are then able to define what the employee's initial entitlement is.

This is what the employee will start off on. e.g. If you are using the Normal holiday pay method this would normally be 8% and 20 days but if you wish this can be altered to define a starting holiday pay entitlement of say 10% and 25 days.

You are then able to define the next two brackets the holiday pay group will roll-over into.

Initial Entitlement Enter an employee's initial entitlement as a percentage, then enter an employees' initial entitlement in days (or hours if you are paying holiday pay by the hour)

Change 1 Enter the number of months after an employees' start date that the first change in their Holiday Pay will take place. e.g. 5 years = 60 months, then enter the new annual entitlement as a percentage and in days (or hours if you are paying holiday pay by the hour)

If the employee is to receive a lump sum of days at this time then type in how many days they are to receive when this first change is made.

Change 2 The system allows for up to two rule changes for Holiday Pay. Change 2 works in the same way as Change 1.