KiwiSaver Groups

KiwiSaver is part of a government initiative designed to increase the level of savings by New Zealand households and support New Zealanders in retirement. The KiwiSaver Groups window controls which rate of contribution should apply, on both the employee's behalf, and (optionally) the employer's behalf.

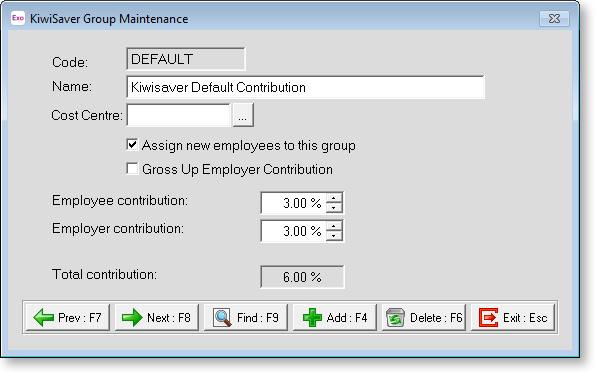

To set up KiwiSaver groups for your Payroll company, select KiwiSaver Groups from the Maintenance menu. Press F9 or click Find for a list of all KiwiSaver Groups. Press F4 or click Add to add a new group:

Cost Centre If the cost centre field is visible, Exo Payroll will cost the Employer contribution to its own specific cost centre. Enter a cost centre code here to cost to that specific cost centre, or leave the field blank, in order to cost to the employee's default cost centre.

Assign new employees to this group Selecting this option makes new employees KiwiSaver members by default. The KiwiSaver Act 2006 allows employers to have a chosen KiwiSaver scheme for their employees who do not select their own scheme. If the default scheme is not suitable, you can add to the list of groups, defining a new set of rates, and then you may select your new entry as being the default group.

Gross-up Employer Contribution Employer contributions are liable for Employer Superannuation Contribution Tax (ESCT). If employers are "locked in" to an agreement with an employee for a set percentage of employer contributions, in order to meet the terms of that agreement, the amount of employer contributions may need to be grossed-up to ensure that the employee receives their full entitlement. Ticking this option means that the employer contribution is grossed-up to offset ESCT. The section on KiwiSaver Troubleshooting contains more detail on grossing-up employer contributions.

Employee contribution Employees can contribute at either 3%, 4%, 6%, 8% or 10% of gross salary or wages. The contribution comes out of the employee's pay, after PAYE, and will appear on the KiwiSaver and IR348 reports as a form of deduction.

Employer contribution From 1 April 2013, employer contributions of 3% are required. Employers can still contribute voluntarily at a higher rate of employees' salaries. All employer contributions are liable for Employer Superannuation Contribution Tax (ESCT).

Total contribution This value is automatically calculated by the system, and is derived from the sum of the Employee's contribution and the Employer's contribution.