KiwiSaver Setup

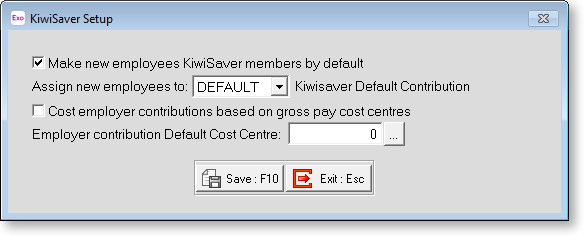

Click the KiwiSaver Setup button on Page 1 of the Payroll Setup window to set up KiwiSaver details for the company.

The KiwiSaver Act 2006 establishes KiwiSaver, a government-sponsored, work-based savings scheme. KiwiSaver was implemented 1 July 2007. The purpose of KiwiSaver is to encourage a long-term savings habit and asset accumulation by individuals who are not in a position to enjoy standards of living in retirement similar to those in pre-retirement. KiwiSaver is aimed at increasing individuals' wellbeing and financial independence, particularly in retirement, and to provide retirement benefits.

Make new employees KiwiSaver members by default Selecting this option means that any new employees will be automatically enrolled in KiwiSaver. MYOB recommends that this option is enabled. If a specific employee notifies the intention to opt out, you can alter their KiwiSaver status on the KiwiSaver tab of their Standard Pay.

NOTE: Casual employees are not opted in by default, in line with KiwiSaver legislation; you will need to manually opt in any new casual employees.

Assign new employees to The KiwiSaver Act allows employers to have a chosen KiwiSaver scheme for their employees who do not select their own scheme. If the default scheme is not suitable, you can create new groups in the KiwiSaver Groups maintenance window.

Cost employer contributions based on gross pay cost centre The Employer's KiwiSaver contribution will appear as an additional expense on the Costing and General Ledger reports. Selecting this option will result in the extra expense being proportionally costed using the same proportions as the gross expenditure. If this option is not selected, the extra expense is shown against its own specific Cost Centre and/or General Ledger code.

For example, if this option is enabled:

In the Current Pay:

|

Transaction Type |

Amount |

Cost Centre |

|

Wages |

$400 |

1 Wages |

|

Leave |

$100 |

2 Leave |

|

Employee KiwiSaver |

$20 |

|

|

Employer KiwiSaver |

$20 |

cost to gross pay cost centre |

In the Costing Analysis Report:

|

Transaction Type |

Amount |

Cost Centre |

|

Wages |

$400 |

1 Wages |

|

Leave |

$100 |

2 Leave |

|

Employer KiwiSaver |

$16 |

1 Wages |

|

Employer KiwiSaver |

$4 |

2 Leave |

- Transaction Type Amount Cost Centre

- Wages $400 1 Wages

- Leave $100 2 Leave

- Employer KiwiSaver $ 16 1 Wages

- Employer KiwiSaver $ 4 2 Leave

Here the Employer's KiwiSaver contribution is costed to the Cost Centres of the pay. No Cost Centre field will be visible for the specific KiwiSaver transaction in the Pay. The Employer's KiwiSaver contribution will appear against the General Ledger codes that relate to each type of Gross Expenditure, in the General Ledger reports.

When this option is disabled:

In the Current Pay:

|

Transaction Type |

Amount |

Cost Centre |

|

Wages |

$400 |

1 Wages |

|

Leave |

$100 |

2 Leave |

|

Employee KiwiSaver |

$20 |

|

|

Employer KiwiSaver |

$20 |

3 KiwiSaver |

In the Costing Analysis Report:

|

Transaction Type |

Amount |

Cost Centre |

|

Wages |

$400 |

1 Wages |

|

Leave |

$100 |

2 Leave |

|

Employer KiwiSaver |

$20 |

3 KiwiSaver |

Now the Employer's KiwiSaver contribution is costed to its own Cost Centre, as defined at either the company level (this window), or the group level (KiwiSaver Groups Maintenance window), or the transaction level (KiwiSaver window, Standard Pay). The Employer's KiwiSaver contribution can then appear against its own General Ledger code in the General Ledger reports.

Employer contribution Default Cost Centre This option will only be available when employer contributions are not being costed to gross pay cost centres, i.e. this option is not available if the Cost employer contributions based on gross pay cost centre option is ticked. Here you can specify a global default Cost Centre against which all Employer KiwiSaver contributions will appear in the Costing and General Ledger reports.