Contract Configuration: To Create Entities for a Consulting Contract

In this activity, you will learn how to create labor items and a case class for an empty contract template that will be used for a consulting contract.

Story

Suppose that after purchasing the juicers, the Healthy Drink Alley customer needs a consulting contract to teach employees about the proper use of juicers and related equipment. This service is provided by the SweetLife Fruits & Jams company's consultants of different qualifications: senior consultants, whose services cost $120 per hour, and other regular consultants, whose services cost $100 per hour.

According to the terms of the contract, in April 2025, the customer obtains 20 hours of consulting from the senior consultant William Perkins, and 4 hours from the consultant David Chubb for the total amount of $2,800. The billing of the contract will be performed on demand and on a per-activity basis.

Acting as a sales manager, you will create a contract for which prices depend on the skills and position of the consulting specialist, who can be a regular or a senior consultant.

Process Overview

In this activity on the Non-Stock Items (IN202000) form, you will create labor items with employee rates for a regular and a senior consultants, and then on the Case Classes (CR206000) form, you will create a case class.

Configuration Overview

In the U100 dataset, the following tasks have been performed for the purposes of this activity:

- On the Enable/Disable Features (CS100000) form, the Contract Management feature has been enabled.

- On the Customers (AR303000) form, the HDALLEY (Healthy Drink Alley) customer has been created.

- On the Chart of Accounts (GL202500) form, the 79000 (Contract Expenses) expense account and the 40300 (Sales - Consulting Services) sales accounts have been created.

System Preparation

To prepare to perform the instructions of this activity, launch the MYOB Acumatica website with the U100 dataset preloaded, and sign in as the sales manager David Chubb using the chubb username and the 123 password.

Step 1: Creating Labor Items with Employee Rates

On the Non-Stock Items (IN202000) form, perform the following instructions:

- To create a non-stock item for the consulting services that are performed by a

regular specialist, do the following:

- Add a new record.

- Specify the following settings in the Summary area:

- Inventory ID: CTCONSREG

- Description: Consulting services by regular consultant

- On the General tab, specify the following

settings:

- Type: Labor

- Posting Class: NONSTOCK

- Tax Category: EXEMPT

- Require Receipt: Cleared

- Require Shipment: Cleared

- Base Unit: HOUR

- Sales Unit: HOUR

- Purchase Unit: HOUR

- On the Price/Cost tab, specify 100 in the Default Price box.

- On the GL Accounts tab, specify the following

settings:

- Expense Account: 79000

(Contract Expenses)

This account accumulates the expenses that company spends to provide contract preparation.

- Sales Account: 40300 (Sales -

Consulting Services)

This account accumulates the revenue earned when employees provide consulting services.

- Expense Account: 79000

(Contract Expenses)

- On the form toolbar, click Save to save the non-stock item.

- To create a non-stock item for the consulting services that are performed by a

senior consultant, do the following:

- Add a new record.

- Specify the following settings in the Summary area:

- Inventory ID: CTCONSSEN

- Description: Consulting services by senior consultant

- On the General tab, specify the following

settings:

- Type: Labor

- Posting Class: NONSTOCK

- Tax Category: EXEMPT

- Require Receipt: Cleared

- Require Shipment: Cleared

- Base Unit: HOUR

- Sales Unit: HOUR

- Purchase Unit: HOUR

- On the Price/Cost tab, specify 120 in the Default Price box.

- On the GL Accounts tab, specify the following

settings:

- Expense Account: 79000 (Contract Expenses)

- Sales Account: 40300 (Sales - Consulting Services)

- On the form toolbar, click Save to save the non-stock item.

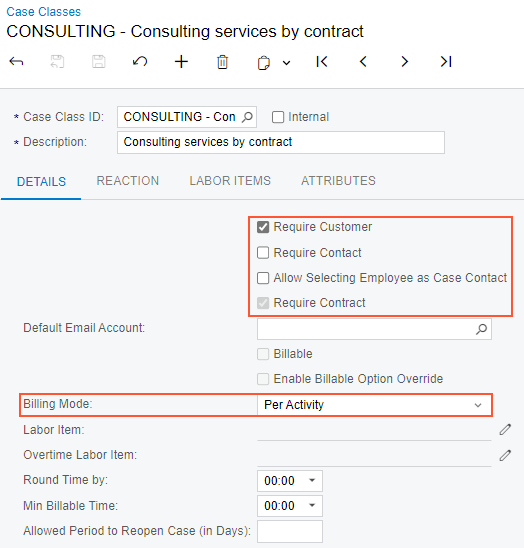

Step 2: Creating a Case Class of Per Activity Billing Mode

To create a case class for consulting services, do the following:

- On the Case Classes (CR206000) form, add a new record.

- In the Summary area, specify CONSULTING in the Case Class ID box and Consulting services by contract in the Description box.

- On the Details tab, specify the following settings (see

the screenshot below):

- Require Customer: Selected

- Require Contract: Selected

- Billing Mode: Per Activity

The Per Activity billing mode indicates that the cases of the class will be billed on a per-activity basis. For example, you can use this option for large cases that cannot be closed by the end of the billing period so that you can bill activities associated with an ongoing case. For each activity associated with a case of the class, you can specify whether it is billable or not.

Figure 1. Case class for the consulting contract

- Click Save to save the created case class.

In this activity you have created the labor items and the case class with per-activity billing settings. These entities you will use later to create an empty contract template for the consulting contract.