Construction Reports: To Prepare AIA Report for Released Retainage

This activity will walk you through the process of preparing AIA report for released retainage.

Story

Suppose that the ToadGreen Building Group company is in the middle of building a hotel for the Equity Group Investors. As has been agreed with the customer, the customer is being billed once a month based on the progress of the performed work. The ToadGreen construction project manager is tracking the progress of work as a fixed-price project, billing the customer by the percent of project completion. The project has been billed three times, in April, May and June, 2025. According to the contract signed with the customer, the customer retains 5% of the amount of each progress billing line in an invoice.

Also suppose that on 6/10/2025, after a certain part of work is done, the ToadGreen project manager need to prepare to request the release of 20% of the retained amount from customer. Acting as the project manager, you need to release a part of retainage and prepare an AIA report for the released part of retainage for the corresponding financial period.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- The following features have been enabled on the Enable/Disable Features

(CS100000) form:

- Construction

- Construction Project Management

- On the Projects (PM301000) form, the HOTELRT project has been created with project tasks and their budgets. In the billing rule assigned to project tasks (PROGRRET), the only progress billing step is configured on the Billing Rules (PM207000) form and the Create Zero Lines with Zero Amount and Quantity check box is selected.

- For the project, three billing iterations have been performed. The pro forma invoices and corresponding AR invoices has been prepared and released on the Pro Forma Invoices (PM307000) and Invoices and Memos (AR301000) forms, respectively.

Process Overview

You will release a part of retainage for the project by using the Release AR Retainage (AR510000) form; then you will release the prepared retainage invoice on the Invoices and Memos (AR301000) form. Then you will run project billing for the project and review the prepared pro forma invoice for the released retainage on the Pro Forma Invoices (PM307000) form. Finally, you will prepare AIA report for the released retainage amount.

System Preparation

To prepare to perform the instructions of this activity, do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. You should sign in as a construction project accountant by using the bsanchez username and the 123 password.

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 6/10/2025. If a different date is displayed, click the Business Date menu button, and select 6/10/2025 on the calendar. For simplicity, in this activity, you will create and process all documents in the system on this business date.

Step 1: Reviewing AIA Report

Review the amounts in AIA report before retainage release, as follows:

- On the Projects (PM301000) form, open the HOTELRT project.

- On the Invoices tab, click the line with the invoice dated 6/1/2025, and on the table toolbar, click AIA Report. On the Application and Certification for Payment page of the AIA report that opens on the AIA Report (PM644000) form, review the Retainage amount, which is $958,392.99, and the Current Payment Due amount, which is $10,956,152.62.

You will release a part of the retainage for this invoice.

Step 2: Releasing Retainage

To release a part of retainage held for the project, do the following:

- On the Invoices and Memos (AR301000) form, open the AR invoice for the HOTELRT project in the amount of 10,956,152.62 dated 6/1/2025. This is the invoice that has been prepared on release of the third pro forma invoice for the project.

- On the More menu, click Release Retainage. The system opens the Release AR Retainage (AR510000) form with the invoice reference number selected in the Summary area.

- In the Summary area, specify the following settings:

- Date: 6/10/2025

- Retainage Percent: 20

- Select the unlabeled check box for all the invoice lines.

- In the Selection area, make sure the calculated retainage amount to be released

is 115,327.92, and on the form toolbar, click

Process.

The Processing dialog box opens. When the process is complete, close the dialog box.

- On the Invoices and Memos form, find and open the prepared retainage invoice, which is assigned the On Hold status. In the Summary area, notice that the Retainage Document check box is selected, which means that the invoice has been prepared for the released retainage amount (which is 115,327.92).

- In the Summary area, make sure 6/10/2025 is specified as the Date.

- On the form toolbar, click Remove Hold, and click Release to release the invoice. The retainage invoice is assigned the Open status.

Step 3: Creating Zero Pro Forma Invoice

To create a pro forma invoice for the retainage invoice, do the following:

- On the Projects (PM301000) form, open the HOTELRT project. In the Summary area, make sure Pending Invoice Amount Total is 0.

- In the Next Billing Date box on the Summary tab, make sure 7/1/2025 is specified.

- On the form toolbar, click Run Billing. The system creates a zero pro forma invoice and opens it on the Pro Forma Invoices (PM307000) form. On the Progress Billing tab, notice that the system has created lines with zero amount for each project task.

Step 4: Preparing AIA Report

To prepare AIA report, do the following:

- While you are still viewing the prepared pro forma invoice on the Pro Forma Invoices (PM307000) form, on the form toolbar, click Remove Hold, and then click Release to release the invoice.

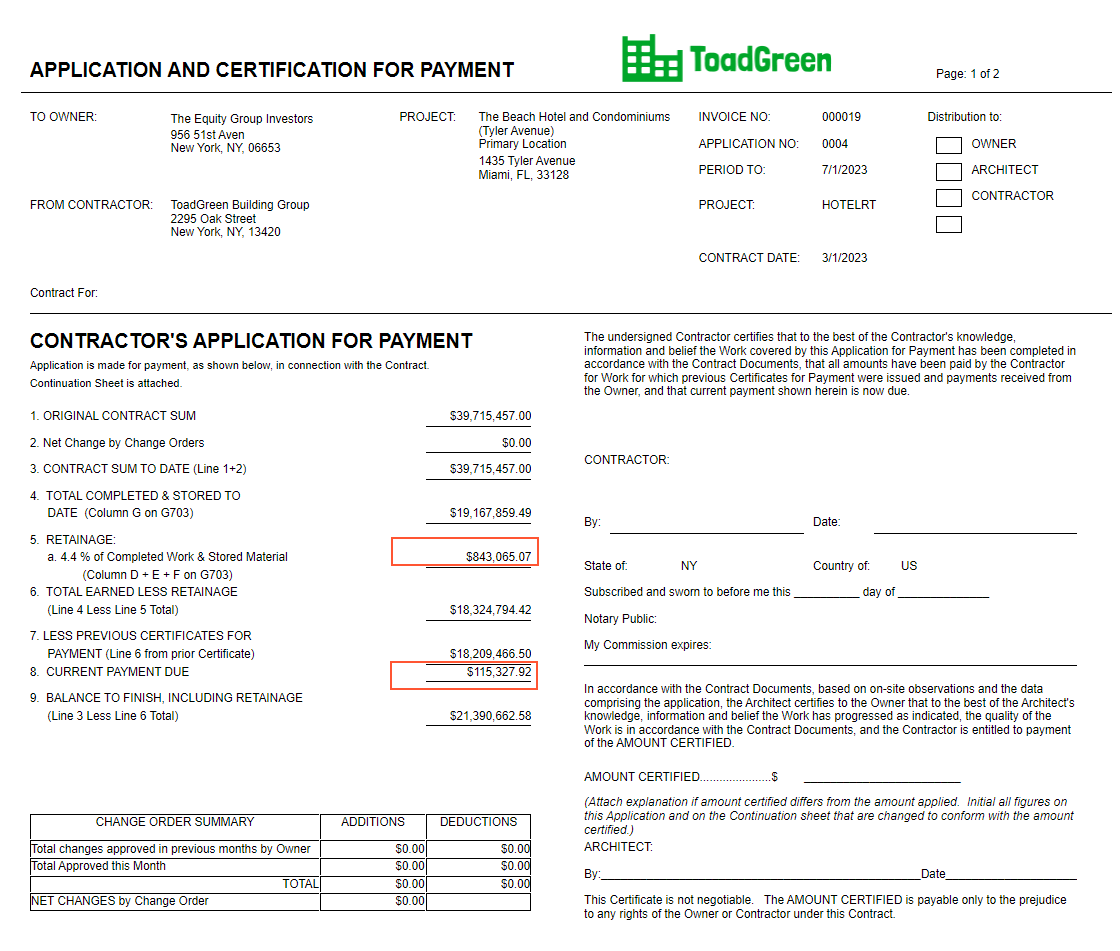

- On the form toolbar, click Print AIA Report. The system

opens the AIA report on the AIA Report (PM644000) form. On

the Application and Certification for Payment page of the report (see the

screenshot below), review the updated amounts:

- The Retainage amount has been decreased by the amount of the released retainage and is now $843,065.07 ($958,392.99 - $115,327.92). This amount is calculated as the sum of the held retainage amounts on the AIA continuation sheet.

- The Current Payment Due amount is $115,327.92 (the amount of retainage that has been released).

Figure 1. AIA report with released retainage

You have prepared AIA report with the released retainage amount.