Order Synchronization: Card Payments

In MYOB Acumatica Retail Connectors, users can import and, if necessary, process debit and credit card payments from external ecommerce systems through integration with payment gateways. The ability to use card-processing features, such as authorization, capture, voiding, and refunding card transactions, is available if the Integrated Card Processing feature is enabled on the Enable/Disable Features (CS100000) form. This topic explains how to configure a payment provider for processing of payments made in the BigCommerce store after they are imported to MYOB Acumatica.

Mapping of Card-Based Payment Methods

During the configuration of a connection to the BigCommerce store, one of the steps you perform is the mapping of payment methods configured in MYOB Acumatica with payment methods configured in the BigCommerce store. You define payment method mapping in the table on the Payments tab of the BigCommerce Stores (BC201000) form.

For the Authorize.Net store payment method, you specify the following:

- ERP Payment Method: The identifier of the payment method in MYOB Acumatica that was configured to use the same processing center as was used for setting up the payment provider in the online store.

- Cash Account: A cash account that was specified for the payment method on the Allowed Cash Accounts tab on the Payment Methods (CA204000) form.

- Proc. Center ID: The identifier of the processing center configured for the payment method on the Processing Centers tab of the Processing Centers (CA205000) form.

- Active: A check box that you select for a payment method to indicate that payments made in the ecommerce system that are based on should be imported to MYOB Acumatica.

- Release Payments and Refunds: A check box that you select to indicate that the payment should be immediately released after it is imported to MYOB Acumatica. If this check box is selected for a card-based payment method associated with a credit card processing center in MYOB Acumatica (that is, for the payment method for which a processing center is selected in the Proc. Center ID column), only payments that have been captured in the store will be automatically released on import. Payments that have been authorized but not captured in the store need to be processed after import and then released manually or by using the Release AR Documents (AR501000) form.

- Process Refunds: A check box that indicates (if selected) that refunds made to the payment method should be imported to MYOB Acumatica. This check box is selected and unavailable for card payment methods for which a processing center is specified, which indicates that all refunds made to such payment methods must be imported to MYOB Acumatica.

Mapping of the Authorize.Net Payment Method

Because the support of the Authorize.Net plug-in has been deprecated in MYOB Acumatica, you can no longer create new transactions with Authorize.Net. If you continue using Authorize.Net in the BigCommerce store, you can import the payments processed with this payment method only as non-card payments. You need to specify the following settings for the Authorize.Net store payment method on the Payments tab of the BigCommerce Stores (BC201000) form:

- ERP Payment Method: A Cash/Check payment method of MYOB Acumatica.

- Cash Account: A cash account that was specified for the payment method on the Allowed Cash Accounts tab on the Payment Methods (CA204000) form.

- Proc. Center ID: Cleared

- Active: A check box that you select for a payment method to indicate that payments made in the ecommerce system that are based on should be imported to MYOB Acumatica.

- Release Payments and Refunds: A check box that you select to indicate that the payment should be immediately released after it is imported to MYOB Acumatica.

- Process Refunds: A check box that indicates (if selected) that refunds made to the payment method should be imported to MYOB Acumatica.

In the BigCommerce store, on the page, on the Authorize.Net Settings tab, we recommend you to select Authorize & Capture in the Transaction Type box. This setting prevents the Open status from being assigned to a non-captured payment imported to MYOB Acumatica, which is an incorrect status for a payment with unfinished processing.

For step-by-step instructions on configuring and importing payments based on the Authorize.Net payment method, see Order Synchronization: To Configure and Import Authorize.Net Payments.

With these settings, credit card payments processed with Authorize.Net in the BigCommerce store will be imported to MYOB Acumatica as non-card payments. These payments can be captured, voided, or refunded only in the BigCommerce store. For more details on processing non-card payments for BigCommerce, see Order Synchronization: Non-Card Payments.

Refunds created for these payments will be imported as non-card refunds. For more details on processing non-card refunds for BigCommerce, see Importing Non-Card Refunds.

Import of Payments Based on Credit Cards

A customer who has signed in to the BigCommerce store can save credit card details during checkout. When this customer selects a payment method, enters the details of a new card, selects the Save this card for future transactions check box, and then places an order, the details of the credit card are saved in the processing center configured in the BigCommerce store.

When the payment is imported from BigCommerce to MYOB Acumatica (as part of the synchronization of the Sales Order entity or the Payment entity), on the Payments and Applications (AR302000) form, the system creates a document of the Prepayment type with the Pending Processing status. In the Summary area of the created document, the system inserts the following information:

- Payment Method: The payment method that has been mapped to the store payment method on the Payments tab of the BigCommerce Stores (BC201000) form

- Cash Account: The cash account selected for the mapped payment method

- Payment Ref.: The number of the related credit card transaction in the processing center

- Processing Status: The processing status of the credit card

transaction. Depending on the last successful operation with the transaction, the processing

status can be one of the following:

- Pre-Authorized: The payment has been authorized but the funds have not been captured. The last successful operation was Authorize Only.

- Captured: The funds have been captured. The last successful operation with the credit card transaction was either Authorize and Capture or Capture Authorized.

- Pre-Auth./Capture Pending Validation: The last successful operation with the credit card transaction is unknown. To get the correct processing status of the credit card transaction, you can use the Validate Card Payment action on the Payments and Applications form.

On the Card Processing tab on the Payments and Applications form, the system creates a row for the last successful operation with the credit card transaction. In the Proc. Center Response Reason box, Imported External Transaction indicates that the information about the credit card transaction operation has been imported from the external ecommerce system.

In the Tran. Type box, the transaction operation can have one of the following types:

- Authorize Only: The payment was authorized when the order was placed but has not yet been captured.

- Authorize and Capture: The payment was captured when the order was placed.

- Capture Authorized: The payment was authorized when the order was placed, and then the funds were captured in the control panel of the store.

- Unknown: The status of the operation with the credit card transaction is unknown.

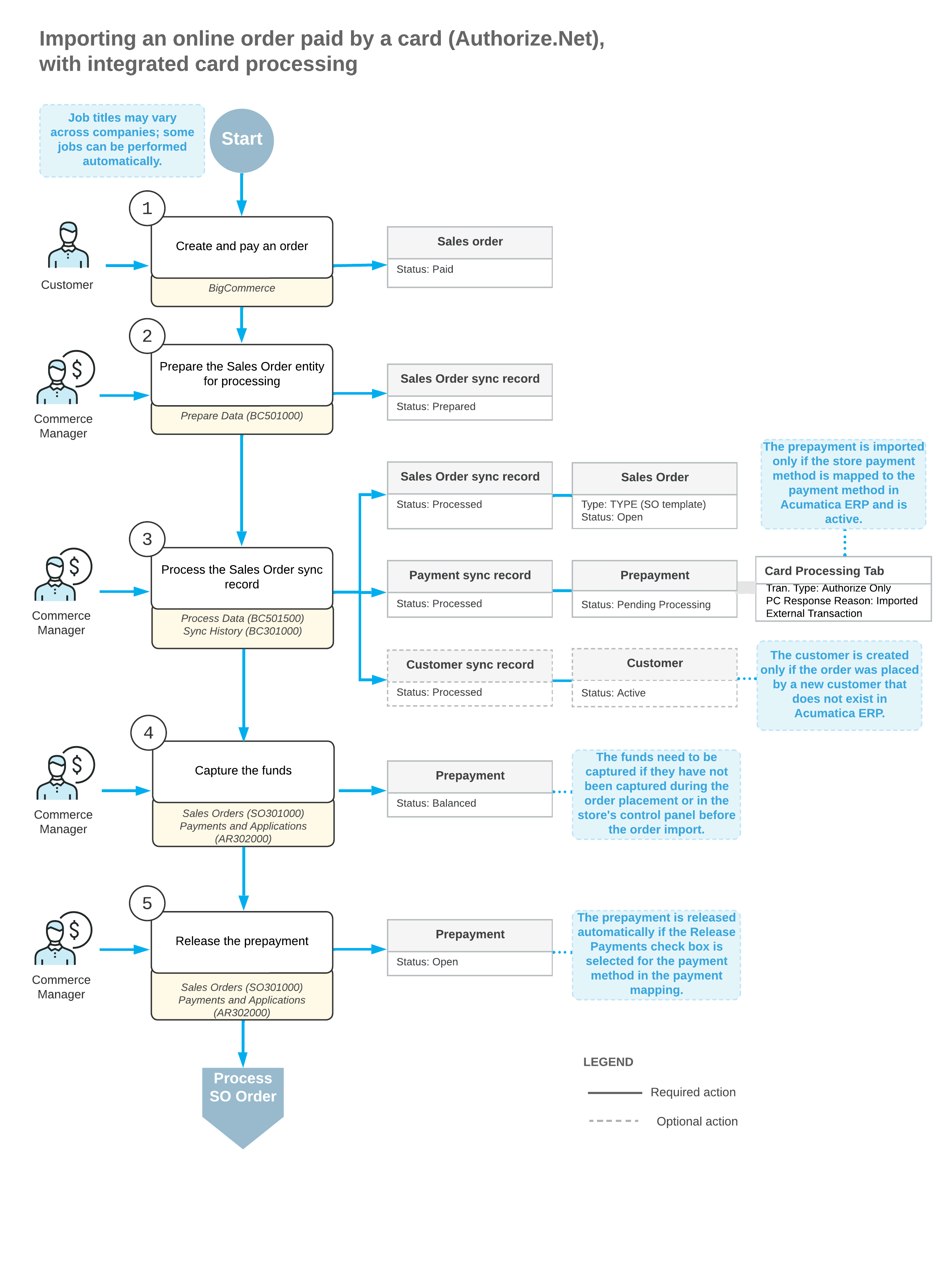

The following diagram illustrates the workflow of importing a sales order to MYOB Acumatica from a BigCommerce store where it was placed and paid by a card based on a payment method for which integrated card processing has been configured in MYOB Acumatica.

Deferred Processing of Imported Credit Card Payments

- If the customer used a previously saved credit card

- If the customer entered the details of a new card and selected the Save this card for future transactions check box during checkout

- If the last operation on the credit card transaction has the Unknown status

External credit card transactions that require validation are displayed on the Deferred Processing Required tab of the Validate Card Payments (AR513000) form and have the Load Payment Profile check box selected.

When the validation process is started, the system performs the following actions:

- On the Customer Payment Methods (AR303010) form, creates a customer payment method based on the payment profile from the processing center.

- Links the customer payment method to the credit card transaction.

- Links the customer payment method to the imported payment.

- Requests the status of the credit card transaction, and updates the processing status of the

transaction and the status of the prepayment, if necessary.

If the updated processing status of the transaction is Captured, the status of the prepayment changes to Balanced. If on the General tab of the Accounts Receivable Preferences (AR101000) form, the Enable Integrated CC Processing check box is selected, the system releases the prepayment.

Customizations may support forced validation of all imported credit card transactions. In this case, all credit card transactions imported from external systems will be displayed on the Deferred Processing Required tab of the Validate Card Payments form and will need to be validated.