Pro Forma Invoices: Deferred Revenue in Projects

Depending on the revenue recognition method that is established in a company, you may need to account for revenue after the corresponding part of work on a project has actually been completed.

To do this, you need to set up the project and its billing to temporarily allocate the revenue to the liability account and clear this account as soon as the related portion of the revenue should be recognized. This topics explains how you can configure deferred revenue in projects.

Setting Up a Project for Deferred Processing of Revenue

To configure the deferred processing of a project's revenue, you should do the following on the Projects (PM301000) form:

- Define the project to use the pro forma invoice workflow—that is, select the Create Pro Forma Invoice on Billing check box on the Summary tab.

- In the revenue budget of the project on the Revenue Budget tab, define the project budget lines to use the account group of the Income type.

- In the Default Sales Account box on the Defaults tab, specify a sales account of the liability type. This sales account must be linked to an account group of the Liability type.

- Assign a progress billing rule to the project tasks on the Tasks tab of the Projects form. In the billing rule step, specify Project in the Use Sales Account From box.

Billing a Project with Deferred Revenue

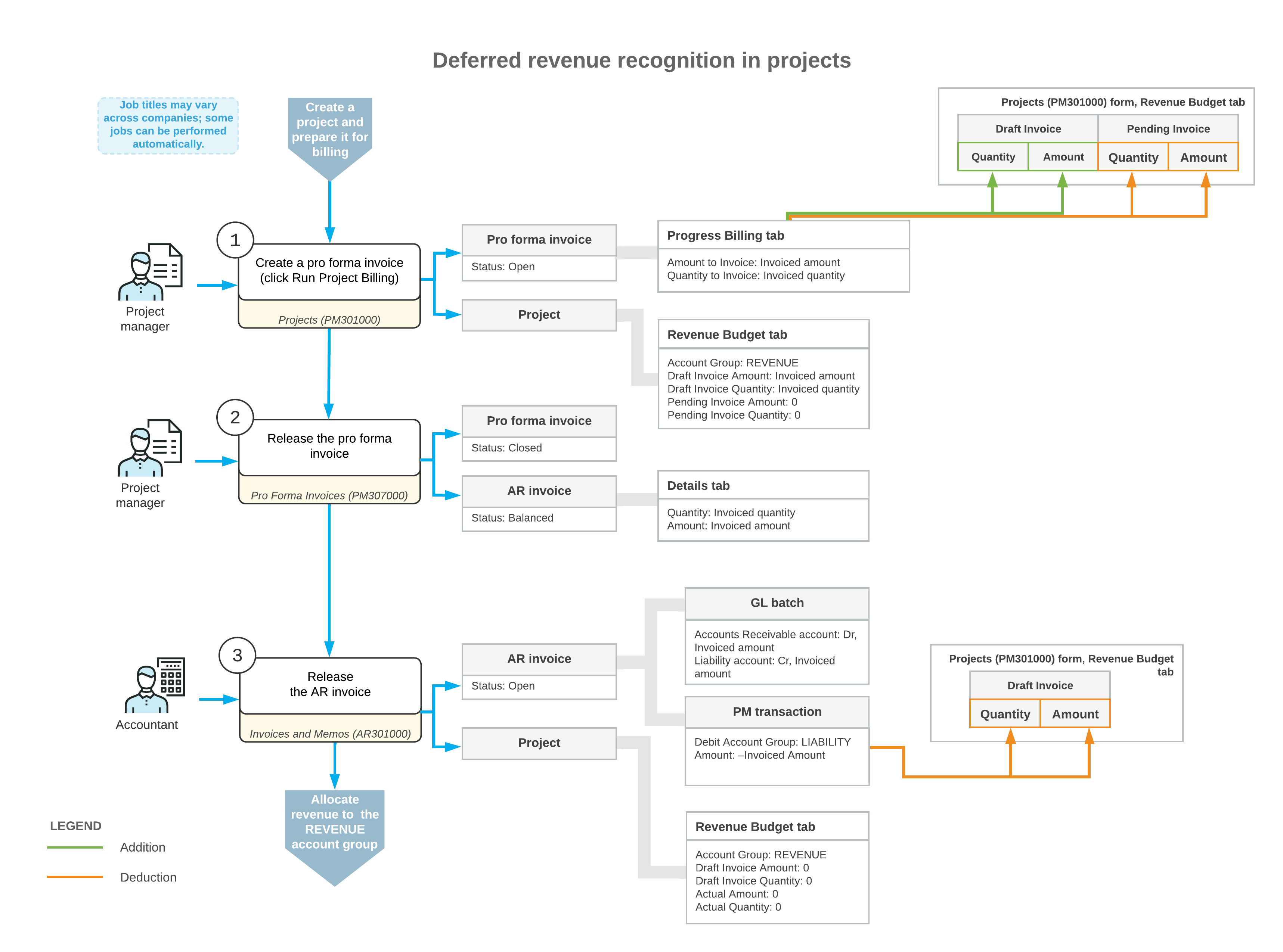

When a pro forma invoice is created for a project that you have configured for deferred processing of revenue, the system updates the revenue budget lines on the Revenue Budget tab of the Projects (PM301000) form as follows:

- The Pending Invoice Amount and Pending Invoice Quantity are set to zero.

- The Draft Invoice Amount and Draft Invoice Quantity are increased by the amount to invoice and quantity to invoice, respectively, of the corresponding pro forma invoice lines.

When you release the pro forma invoice on the Pro Forma Invoices (PM307000) form, the system creates a corresponding accounts receivable invoice with all information copied from the pro forma invoice.

To release the accounts receivable invoice, you click Release on the form toolbar of the Invoices and Memos (AR301000). On release of the accounts receivable invoice, the system generates a general ledger transaction and the corresponding project transaction. The general ledger transaction credits the liability account in the invoiced amount to record the unrecognized revenues.

On release of the project transaction, the system updates the revenue budget lines on the Revenue Budget tab of the Projects form as follows:

- The Draft Invoice Amount and Draft Invoice Quantity of the corresponding revenue budget line are set to zero, to indicate that the customer has been billed.

- The Actual Quantity and Actual Amount of the corresponding revenue budget line are still set to zero because the revenue has been accumulated to the liability account.

The deferred revenue is recognized as earned revenue after the corresponding part of the project work is completed. To perform revenue recognition, you need to configure and run an allocation rule to allocate the earned revenue from the liability account group to the income account group. Then the system will update the Actual Quantity and Actual Amount of the corresponding revenue budget line with the recognized revenue amount and quantity.

Workflow of Billing a Project with Deferred Revenue

The following diagram illustrates the workflow of processing a pro forma invoice and an AR invoice with deferred revenue recognition.