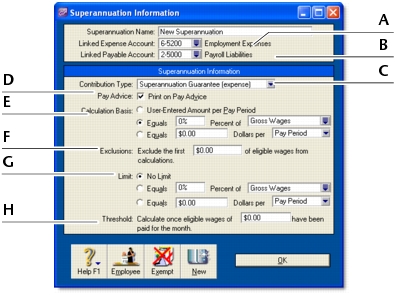

Paying your employees > Creating payroll categories > Superannuation Information window

|

Linked Expense Account is the account to which you charge employer expense superannuation payroll categories (Employer Additional, Productivity Superannuation, Redundancy Superannuation or Superannuation Guarantee). The Default Employer Expense Account you specified when setting up payroll appears as the default.

We recommend you create an expense account called Superannuation Expense and select it as the linked expense account.

|

|||||||

|

Linked Payable Account is the liability account to which the superannuation amounts accrue. The Default Tax/Deductions Payable Account you specified when setting up payroll appears as the default.

We recommend you create a liability account called Superannuation Liability and select it as the linked payable account.

|

|||||||

|

The Contribution Type may be Employee Additional, Employer Additional, Productivity, Redundancy, Salary Sacrifice, Spouse or Superannuation Guarantee. Select the appropriate type from the list.

|

|||||||

|

If you want the superannuation amount accrued to appear on employees’ pay advice, select the Print on Pay Advice option.

|

|||||||

|

Calculation Basis can be:

|

|||||||

|

In the Exclusions field type the amount by which the eligible wage is reduced before the superannuation is calculated. For example, an employee with a gross wage of $1000 per month and an exclusion of $100 will have the superannuation calculated only on $900.

|

|||||||

|

Superannuation limits can be used to place a ceiling on the superannuation calculation. For example, for an Employee Additional superannuation deduction of $30 per pay period and a limit of 2% of gross wages, a pay with gross wages of $1000 yields superannuation of only $20 (i.e. 2%). Limit can be one of the following three choices:

|

|||||||

|

If this superannuation calculation is only payable if wages exceed a specified amount per month (such as for superannuation guarantee contributions), enter this amount in the Threshold field. For example, if the superannuation guarantee contribution is 9% of the employee’s gross wages and the threshold is $450 per month, then superannuation is not payable until the employee’s gross wage exceeds $450 per month. When determining whether the gross wages on a pay exceeds the threshold per month, other pays issued that month are included. (See Troubleshooting superannuation calculations.)

|

|||||||