Bank Reconciliation

The Bank Reconciliation function (Utilities > Bank Reconciliation) has been designed for accounting staff that need to manage their bank accounts. This facility is used to match transactions in the General Ledger Bank account to transactions that appear on the company’s bank statement.

Bank Reconciliation can be run in one of three ways:

-

A manual system for when working from a hard copy bank statement. In manual mode the system displays unreconciled GL transactions from the selected GL bank account, and you manually flag which of these are ‘reconciled’ – these will be the items that appear on the paper bank statement. The ones that are not flagged are the unreconciled GL transactions and the total of these should represent the difference between the balance of the GL bank account and the closing balance that appears on the bank statement.

-

An electronic system using a CSV format file supplied by the bank. In CSV mode, the system displays the unreconciled GL transactions from the selected GL bank account, but the bank statement transactions are imported into Exo Business from a CSV format text file provided by the bank. The process is then to match unreconciled GL transactions to the imported bank items. A GL transaction that is matched is flagged by the system as being reconciled. The objective is to match all the imported bank items to a GL transaction. The GL transactions that remain (unreconciled GL transactions) should represent the difference between the balance of the GL bank account and the closing balance that as per the Bank.

-

An electronic system using Bank Feeds. In Bank Feeds mode, the system displays the unreconciled GL transactions from the selected GL bank account, but the bank statement transactions are imported from the Bank Feeds module. Transactions that have already been matched by Bank Feeds are highlighted so that they can be reconciled straight away. Any unmatched transactions can be reconciled against the imported bank transactions manually.

Note: Before bank statement files can be imported into the Bank Reconciliation program from a CSV file, the bank format needs to be set up. This setup is performed in Setup > Bank Formats, and defines how MYOB Exo Business should interpret CSV bank statement files that are to be imported into Bank Rec. This only needs to be set up if the CSV method of Bank Reconciliation is to be used.

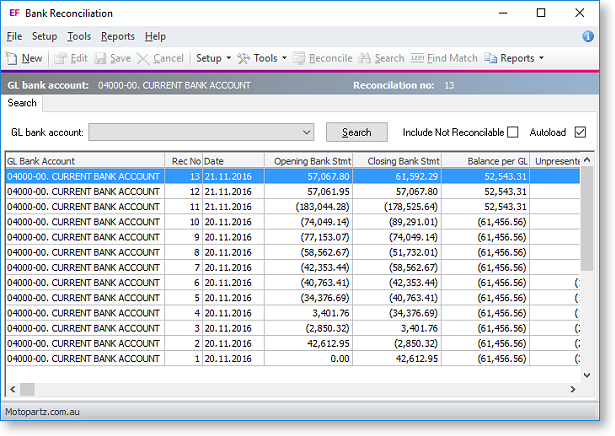

When choosing Bank Reconciliation from the menu, a window opens with the list of all previous bank reconciliations:

-

To list the reconciliations for a specific bank account, select the account from the GL bank account drop down list, and click Search.

-

To Include unreconcilable accounts in the list, check the Include Not Reconcilable checkbox.

-

To automatically list the previous bank reconciliations whenever the Bank Rec function is selected, select the Autoload check box. Alternatively, click on Search every time to list previous bank reconciliations.

Note: The list of previous bank reconciliations is displayed in an Exogrid, meaning that columns can be moved around, rows sorted by clicking on the appropriate column header and select the columns to view by right-clicking on the yellow column header and selecting Visible Columns.

Note: The details on the grid (statement balance, GL balance, unreconciled payments and deposits) are all taken from the database table BANK_REC_LOG.