Termination Holiday Pay Wizard

The Termination Holiday Pay Wizard provides a breakdown of the information that it has gathered in order to arrive at the final termination amount.

This amounts to:

Holiday pay outstanding from previous holiday pay years/anniversaries.

+

Holiday pay accruals for the current year.

-

Holiday pay paid in advance off the current year accrual.

All of these things need to be taken into consideration for termination pays.

NOTE: Employees are terminated using the Terminate/Reinstate option from the File menu. The Termination Holiday Pay Wizard gives you the option of terminating the employee after it is complete.

Click the Termination Wizard button on the Holiday Pay tab of the Leave Management screen to begin. A confirmation message appears - click Yes to proceed.

The starting point for the calculation of termination pay is the find the number of days of holiday pay outstanding. In other words, days that the employee was entitled to on their last holiday anniversary but have not yet taken to date.

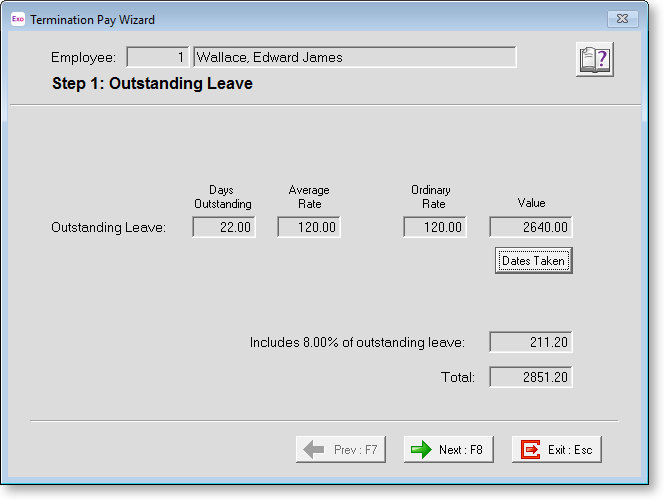

Step 1: Outstanding Leave

Outstanding Leave The Value for outstanding days of holiday pay is calculated as the Days Outstanding multiplied by the higher of two rates:

- Average Rate - this rate is calculated as the gross paid for the last twelve months divided by the days paid for the last twelve months.

- Ordinary Rate - this rate is either taken from the Standard Pay or calculated as an average of the last four week's earnings, depending on the employee's Ordinary Daily/Hourly Rate setting on the Holiday Pay tab of the Employee Maintenance window.

Exo Payroll selects the higher of the two rates - this is shown in bold (if neither is bold, it is because the two rates are the same).

Dates Taken This button lets you specify the calendar days that the termination pay covers. Note that if the coverage of days includes a statutory holiday, the employee should receive the statutory on top of, not in lieu of, their holiday pay.

Last Year Short Paid Amount Pre April 2004 this was a self calculating field based upon the rate an employee was paid for holiday pay and what should have been paid come the end of the holiday pay year. Post April 2004 this field will not accumulate dollars, as holiday pay will always be valued at the average daily rate for the last 12 months. If there is an amount in this field, it should be paid the employee upon termination.

Includes 8.00% of outstanding leave Section 26 of the Holidays Act states that the gross earnings, for the purposes of section 25(2) includes any payments under section 24(2). Therefore the gross earnings to which the entitlement percentage applies, includes gross earnings from Steps 1 and 2. Here we see the percentage amount of the 1st calculation that will be added to the percentage amount of the 2nd calculation in order to form a total percentage amount.

Once these details are completed, click Next or press F8 to proceed to the next screen.

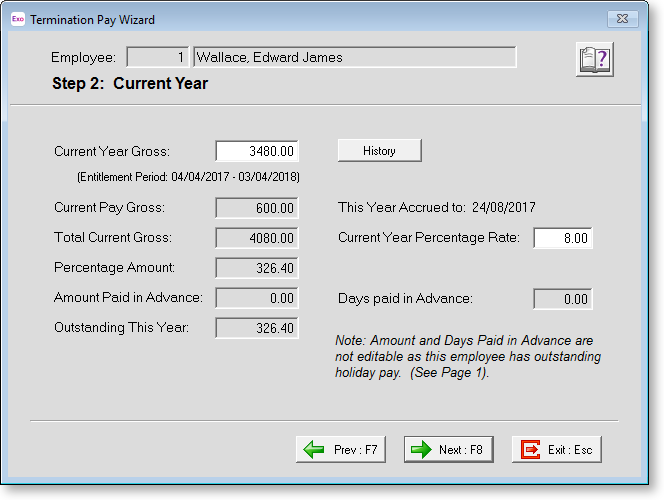

Step 2: Current Year

The value of the current holiday pay year accrual depends on how much the employee has earned, and the percentage rate to be applied (usually 8 or 10%).

NOTE: The Current Pay Gross is derived from the sum of your Current Pay wages/allowance/leave, exclusive of the termination pay itself. Any adjustment to the Current Pay Gross is done from the Current Pay screen as it is in a normal pay run.

The Outstanding This Year is a calculated field, its derivation is different for the two main methods of holiday pay allocation:

-

Percentage/days (or "Normal") - the proportion of year worked in calendar days against 365.

The "year worked" starts from the date of the last entitlement rollover and ends on the open Current Pay date. If the Current Pay is closed the projected end date of the next Current Pay is used.

-

Permanent Part-time / Pro-Rata - the proportion of year worked in working days (days paid) against 260.

The "year worked" starts from the date of the last entitlement rollover and ends on the open Current Pay date. If the Current Pay is closed the projected end date of the next Current Pay is used.

Click Next or press F8 continue.

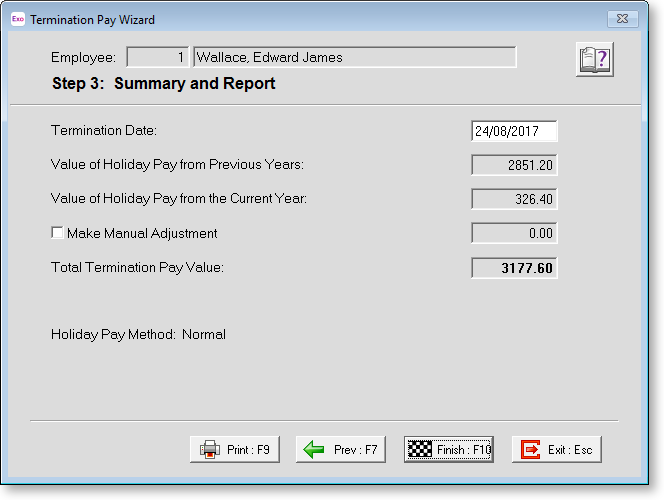

Step 3: Summary and Report

This screen consolidates and displays the components of termination pay.

Termination Date Enter the date the employee's employment ceases.

NOTE: The termination date is included for your reference; the date you enter does not affect any of the wizard’s calculations.

Value of Holiday Pay from Previous Years This is a calculated field, and is identical to the Total field from Step 1.

Value of Holiday Pay from the Current Year This is a calculated field, and is identical to the Outstanding This Year field from Step 2.

Make Manual Adjustment This option lets you override the termination pay value, if desired. However, if you suspect that the value is incorrect it is better to trace the source of the problem, whether it be from the current year percentage calculation, or the previous years' daily rate calculation, and correct the problem at its source.

For example, if you wanted to increase the termination value by $100, enter a manual adjustment of 100.00. If you want to decrease the termination value by $100, enter a manual adjustment of -100.00.

Total Termination Pay Value This is a calculated field, showing the result of all previous year and current year components and adjustments.

Holiday Pay Method Indicating the method of valuing holiday pay for the current employee, as defined on the Holiday Pay tab of the Employee Maintenance screen.

The Print button allows you to print/preview the Termination Pay Summary report – a breakdown of how the Total Termination Pay Value was arrived at.

Click Finish or press F10 to return to the Holiday Pay screen. You are asked if you want to terminate the employee following this update.

-

Clicking Yes runs this final pay and terminates the employee automatically after the pay is updated.

-

Clicking No displays a message asking if you want to change the entitlement date to one year ahead. In this situation you are simply paying out all of the employee's outstanding leave, and starting a new anniversary as of the termination date. You might do this if you were rehiring employees under a new company name. If you don't want to reset the entitlement date, you will simply be paying out all outstanding leave without terminating the employee.

After the Termination Wizard completes, the label TERMINATED appears at the top of the Current Pay window.

NOTE: The employee can still be terminated manually using the Terminate/Reinstate option from the File menu.