Payments with Write-Offs: To Create a Payment with a Credit Write-Off

In this activity, you will learn how to create a payment, apply it to multiple invoices, and create a credit write-off.

Story

Suppose that on January 30, 2025, the SweetLife Fruits & Jams company received a check for $80.70 from one of its customers, Morning Cafe.

Acting as a SweetLife accountant, you need to create the payment in the system and apply it to two outstanding invoices of this customer, which have a total amount of $80. As you are processing the payment, you need to create a credit write-off for the remaining payment balance of $0.70 and apply it to one of the invoices.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Reason Codes (CS211000) form, a reason code for credit write-offs has been created.

- On the Customers (AR303000) form, the MORNINGCAF customer has been created. For the customer, the Enable Write-Offs check box has been selected on the Financial tab of the Customers form.

- On the Invoices and Memos (AR301000) form, the $46 and $34 invoices that will be paid in the activity have been created for the customer.

Process Overview

To process the customer payment, you create a payment document on the Payments and Applications (AR302000) form, and then apply the payment to two of the customer's invoices. While applying one of the invoices to the payment, you enter a credit write-off in the row for this invoice on the Documents to Apply tab. You then release the payment and its applications and review the GL transaction generated by the system on the Journal Transactions (GL301000) form.

System Preparation

To prepare the system for the processing of the customer payment, do the following:

- Launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. To

sign in as an accountant, use the following credentials:

- Username: johnson

- Password: 123

- In the info area, in the upper-right corner of the top pane of the MYOB Acumatica screen, make sure that the business date in your system is set to 1/30/2025. If a different date is displayed, click the Business Date menu button and select 1/30/2025. For simplicity, in this exercise, you will create and process all documents in the system on this business date.

- On the Company and Branch Selection menu, also on the top pane of the MYOB Acumatica screen, make sure that the SweetLife Head Office and Wholesale Center branch is selected. If it is not selected, click the Company and Branch Selection menu to view the list of branches that you have access to, and then click SweetLife Head Office and Wholesale Center.

Step 1: Entering a Payment

To enter a payment, do the following:

- On the Payments and Applications (AR302000) form, add a new record.

- In the Summary area, specify the following settings:

- Type: Payment

- Customer: MORNINGCAF

- Application Date: 1/30/2025 (inserted by default)

- Application Period: 01-2025 (inserted by default)

- Payment Amount: 80.70

- Description: Check payment received on 1/30/2025

Step 2: Applying the Payment to Multiple Invoices and Creating a Credit Write-Off

To apply the payment to two of the customer's invoices and create a credit write-off, do the following:

- While you are still on the Payments and Applications (AR302000) form viewing the payment you have created, in the table on the Documents to Apply tab, review the customer's invoices, which the system has loaded automatically.

- Click the Included check box for the two rows in the table, which correspond to a $46 invoice and a $34 invoice. Notice that the Applied to Documents box in the Summary area now displays 80.00 and the Available Balance box displays 0.70.

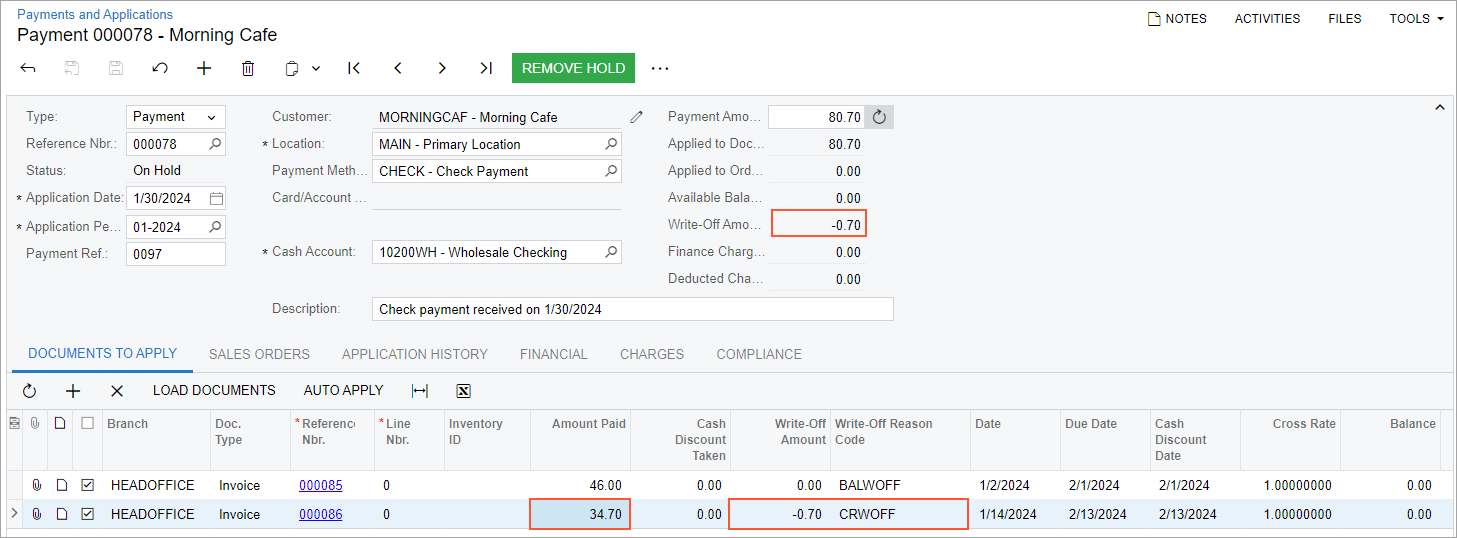

- On the Documents to Apply tab, in the row of the $34

invoice, specify the following settings (also shown in the screenshot below):

- Write-Off Amount: -0.70

- Write-Off Reason Code: CRWOFF

- Amount Paid: 34.70

- On the form toolbar, click Save to save your changes. The

saved payment is illustrated in the following screenshot.

Figure 1. A payment with a credit write-off

- Review the Summary area of the form. The Applied to Documents box now displays 80.70, the Write-Off Amount box displays -0.70, and the Available Balance box displays 0.00.

Step 3: Releasing the Payment and Its Applications

To release the payment and its applications to the invoices, do the following:

- While you are still on the Payments and Applications (AR302000) form viewing the payment you have created, click Remove Hold on the form toolbar to give the payment the Balanced status.

- On the form toolbar, click Release to release the payment

and its applications.

Notice that the payment now has the Closed status.

- On the Application History tab, review the rows that the

system has added, and click the link in the Batch Number

column in any row.

The system opens the Journal Transactions (GL301000) form with the GL transaction generated after the release of the payment and its applications.