Retainage with a Cap: Process Activity

This activity will walk you through the process of performing progress billing for a project with contract cap retainage.

Story

Suppose that the ToadGreen Building Group company is a general contractor that is building a hotel for The Equity Group Investors. The project manager has created a fixed-price project; for this project, the customer will be billed once a month based on the progress of the performed work. Also, in the project, the project manager has defined the original project budget, which was also agreed upon with the customer. According to the contract, the customer retains 5% from each invoice, which guarantees to the customer that the ToadGreen company will meet its obligations in building the hotel.

Because the ToadGreen company, as a general contractor, needs to have enough resources for performing daily operations, the contract also includes a 50% retainage cap, which specifies the maximum retainage amount that can be held for the project.

Acting as the project manager, you need to make sure that the pro forma invoices prepared for the customer include the correct retainage amounts, and that the retainage is no longer held after the cap has been reached.

Configuration Overview

In the U100 dataset, the following tasks have been performed to support this activity:

- On the Enable/Disable Features (CS100000) form, the Construction, Payment Application by Line, and Retainage Support features have been enabled.

- On the Customers (AR303000) form, the EQUGRP customer has been created; the Pay by Line and Apply Retainage check boxes are selected on the General tab for this customer. On the GL Accounts tab, 18000 is specified in the Retainage Receivable Account box.

- On the Billing Rules (PM207000) form, the PROGRRET billing rule has been created.

- On the Projects

(PM301000) form, the HOTELCP project has been created with multiple

project tasks and their budgets. For each task, the PROGRRET billing rule

is specified. On the Summary tab of the form, the

contract cap retainage settings have been configured for the project.

For the project, three billing iterations have been performed. The pro forma invoices and the corresponding AR invoices have been prepared and released on the Pro Forma Invoices (PM307000) and Invoices and Memos (AR301000) forms, respectively; in each invoice, the retainage amount has been calculated.

Process Overview

You will review the billing details of a previously prepared pro forma invoice by using the Projects (PM301000) and Pro Forma Invoices (PM307000) forms. You will then perform billing while the cap has not been reached by using the same forms, and review the retainage that the system will calculate for the invoice. After that, you will perform billing when the cap has been reached so that retainage is not calculated for this invoices.

System Preparation

To prepare to perform the instructions of this activity, launch the MYOB Acumatica website, and sign in to a company with the U100 dataset preloaded. You should sign in as a construction project manager by using the ewatson username and the 123 password.

Step 1: Reviewing the Retainage Details of the Project

Review the details of the project as follows:

- Open the Projects (PM301000) form.

- In the Project ID box, select HOTELCP. In the Retainage section of the Summary tab, review the retainage details for the project. The Total Retained Amount is 958,392.99, while the calculated cap amount is 992,886.42. The contract completion percentage shown in the Completed (%) box is 48.26, which means that the 50% cap has not been reached and that additional retainage could still be withheld from the next invoice.

- On the Invoices tab, click the Pro Forma

Reference Nbr. link for the pro forma invoice with the

0003 in the Application Nbr. box.

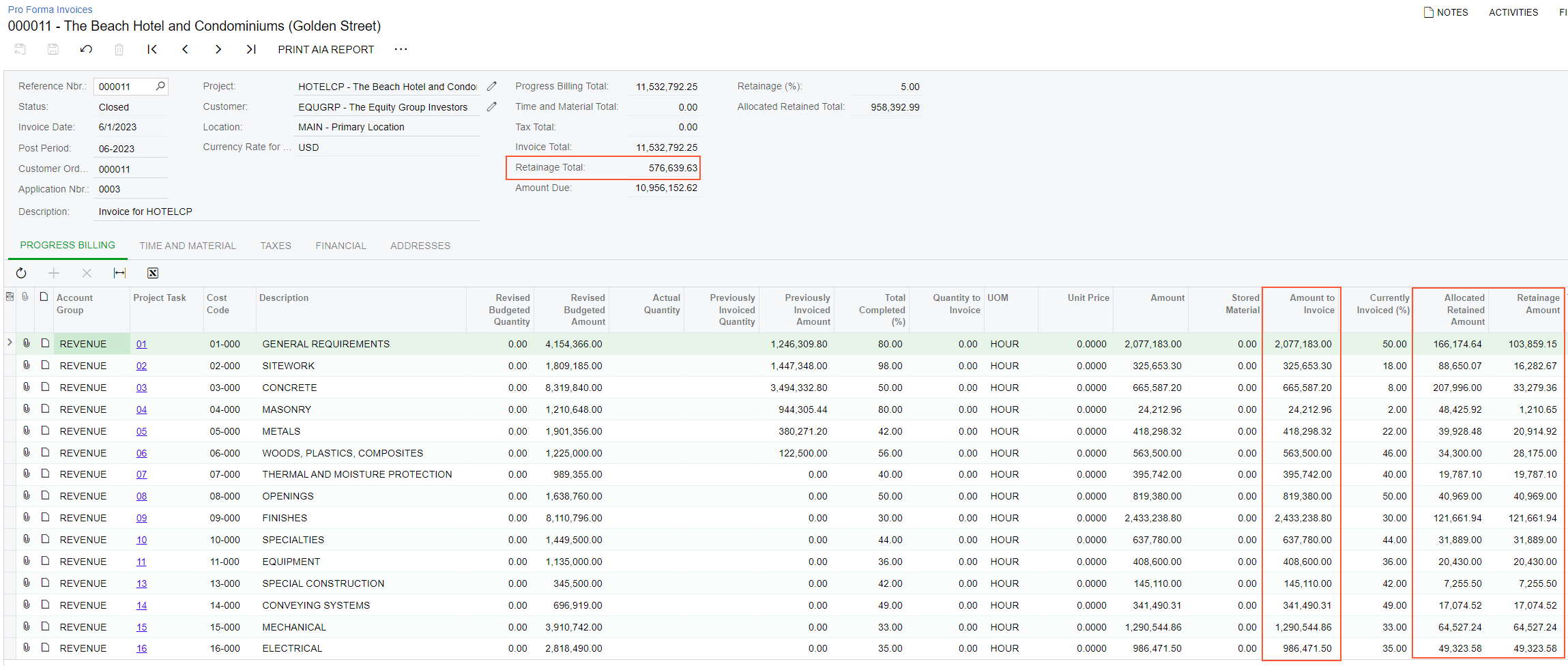

On the Pro Forma Invoices (PM307000) form, which opens with the selected pro forma invoice, review the retainage amounts on the Progress Billing tab. In each line, the retainage amount is calculated as the retainage percentage applied to the amount to invoice; for example, for the line with the 01-000 cost code, Retainage Amount is 103,859.15 (2,077,183.00 * 0.05).

The Retainage Total in the Summary area of the invoice (see the following screenshot) is the sum of the Retainage Amount column values for this pro forma invoice. The total project retainage (held for all three invoices prepared for the project by this moment) is shown in the Allocated Retained Total box in the Summary area; this amount is the sum of the Allocated Retained Amount column values.

Figure 1. The pro forma invoice with the retainage calculated

Step 2: Billing a Project Based on Progress

Bill a project by doing the following:

- Return to the HOTELCP project on the Projects (PM301000)

form, and on the Revenue Budget tab, in the

Completed (%) box, change the amounts as follows:

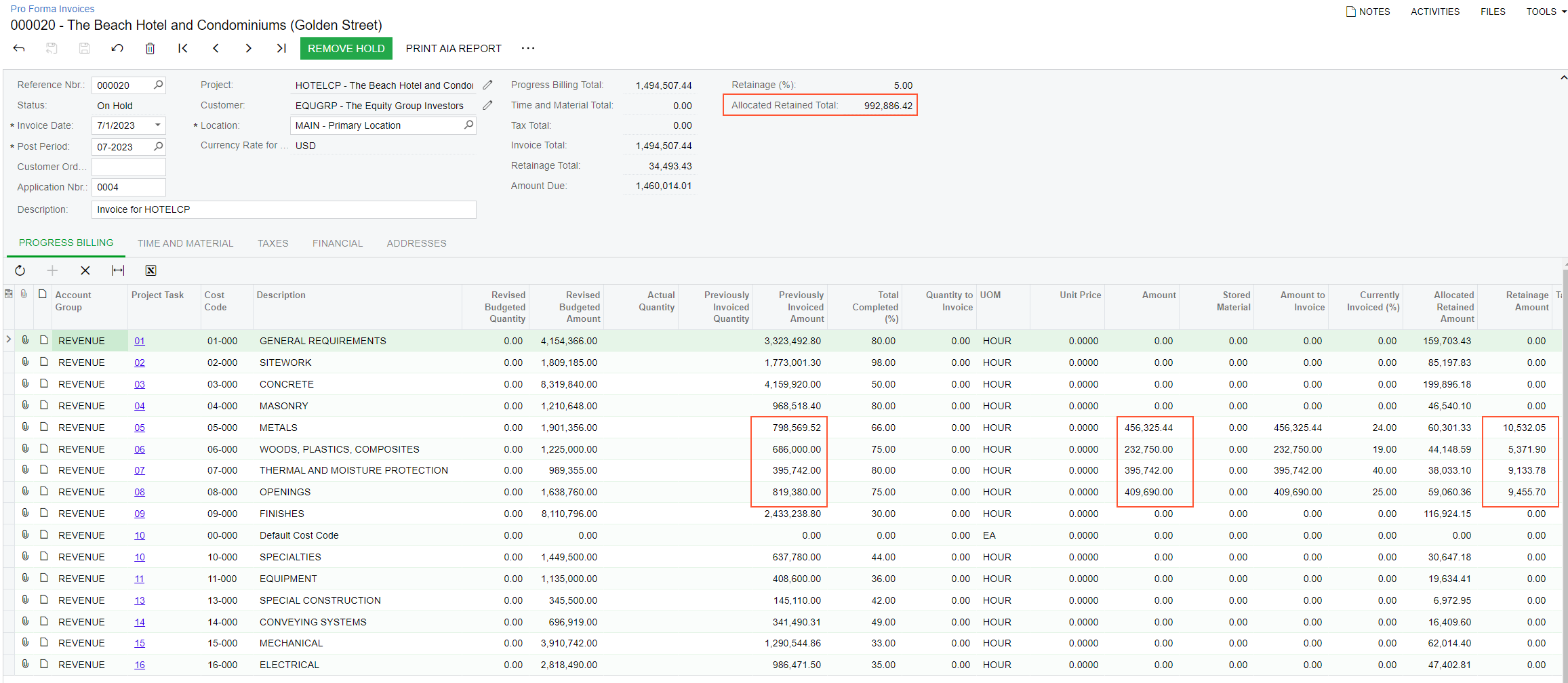

- In the line with the 05-000 cost code, change Completed (%) to 66. The system calculates the Pending Invoice Amount in the line to be 456,325.44.

- In the line with the 06-000 cost code, change Completed (%) to 75. The system calculates the Pending Invoice Amount in the line to be 232,750.00.

- In the line with the 07-000 cost code, change Completed (%) to 80. The system calculates the Pending Invoice Amount in the line to be 395,742.00.

- In the line with the 08-000 cost code, change Completed (%) to 75. The system calculates the Pending Invoice Amount in the line to be 409,690.00.

- In the Summary area, make sure the Pending Invoice Amount Total equals 1,494,507.44, and on the form toolbar, click Save.

- On the form toolbar, click Run Billing to generate a new

pro forma invoice for the project. The system opens the prepared document on the

Pro Forma Invoices

(PM307000) form, as shown in the screenshot below.

Notice that the Allocated Retained Total equals 992,886.42: This is the maximum retainage amount that can be held for the project. To avoid exceeding the retainage cap, for this invoice, the system has calculated the rest of the retainage that can be held and has reallocated it proportionally between the invoice lines.

Figure 2. The pro forma invoice with retainage

- On the form toolbar, click Remove Hold, and then click Release.

- On the Financial tab, click the AR Ref.

Nbr. link to open the created AR invoice on the Invoices and Memos (AR301000)

form.

On the Details tab, notice that the calculated retainage percent is the same for all lines with non-zero retainage amount and is less than 5% percent defined in the project.

- On the form toolbar, click Remove Hold, and then click Release.

The cap has been reached, so no more retainage will be calculated for the project. For the remaining invoices prepared for the project, the system will not calculate retainage amounts.