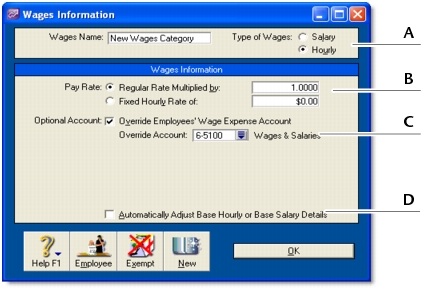

Paying your employees > Creating payroll categories > Wages Information window

|

Choose either Salary or Hourly to specify whether the calculation will be based upon the hours worked or a set amount per pay period.

Linked wage categories for entitlements (such as Holiday Pay) must be hourly for all employees (even those paid a salary) for the entitlements to be processed correctly. See Entitlements Information window for more information.

|

|

|

If you select Hourly as the type of wages, the Pay Rate fields appear. Select Regular Rate Multiplied by and enter, for example, 2 for double time or 1.5 for time and a half. This will multiply the employee’s Hourly Base Pay (entered in the Payroll Details tab view of their card) by this amount. Alternatively, you can enter a fixed hourly rate. This dollar amount per hour will be the same for each employee regardless of their hourly base pay.

|

|

|

If you want to override the employees’ wage expense account (entered in the Payroll Details tab view of their card) for this particular wage, select the Optional Account option and type or select the override account in the field that appears.

|

|

|

[Hourly wages only] If you want to use this wage category to pay leave entitlements (such as Sick Pay or Holiday Pay), select the Automatically Adjust Base Hourly or Base Salary Details option. When you record leave, base pay amounts will be adjusted for the amount of leave paid.

|

|