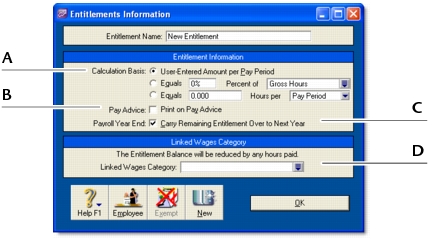

Paying your employees > Creating payroll categories > Entitlements Information window

|

Calculation Basis can be:

Type the required percentage for the entitlement in the first field and then select the wage category from the selection list, which shows all your hourly wage categories, in addition to Gross Hours and Federal Hours, which totals all the hourly wage categories you pay an employee.

For example, an annual leave entitlement may be for 20 days per year, being 160 hours per year based on a 40-hour week. Every hour worked accumulates 0.076923 hours of leave, or 7.6923%. If a worker is paid an hourly pay of 40 hours plus 2 hours overtime, and both are included in gross hours, the Gross Hours and Federal Hours options will calculate an entitlement on a weekly pay of 7.6923% of 42 hours, or 3.231 hours.

|

|||||||

|

If you want the entitlement amount to appear on the pay advice, select the Print on Pay Advice option.

|

|||||||

|

If you want to carry over any entitlement leave balance from the previous year, select the Carry Remaining Entitlement Over to Next Year option.

|

|||||||

|

Each entitlement category must have a Linked Wages Category. For example, the Holiday Leave Entitlement could be linked to the Holiday Pay wage category and the Sick Leave Entitlement could be linked to the Sick Leave wage category. If you create a new entitlement, you must link it to a wage category.

When employees uses their entitlement, for example, by taking a holiday, you allocate the hours taken against the linked wage category (in this example, the Holiday Pay wage category). The employee’s accrued leave balance is reduced by the hours taken.

Note that you can link multiple wage categories to an entitlement. This enables you to provide and track different types of the same entitlement. For example, you can link a Sick Pay With Certificate wage category and Sick Pay Without Certificate wage category to sick leave entitlement. When an employee takes either type of leave, your sick leave entitlement is reduced by the hours taken.

|

|||||||

The following examples may help you calculate the percentage rate for your hourly employees.

|

▪

|

An employee has an entitlement to 20 days holiday a year and works an 8-hour day.

|

|

▪

|

An employee has an entitlement to 20 days holiday a year and works a 7.6-hour day.

|

|

▪

|

An employee has 6 days sick leave a year and works an 8-hour day.

8 x 5 = 40 work hours per week 6 x 8 = 48 hours of sick leave 48 ÷ (40 x 52) = 2.31% |