Expenses with Corporate Cards: General Information

By using MYOB Advanced, you can track payments to vendors, which your company made by using a corporate credit card. For this purpose, you create a cash account that represents the corporate credit card in the system and link the cash account to an accrued liability account.

Learning Objectives

In this chapter, you will learn how to do the following:

- Configure a cash account, a payment method, and a vendor for a corporate credit card

- Process a bill paid with the credit card

- Pay the credit card bill

- Reconcile the balance of the corporate credit card in the system

Applicable Scenarios

You process expenses paid by a corporate credit card if you want to track payments to vendors.

Configuration of Corporate Credit Cards

For each corporate credit card, on the Chart of Accounts (GL202500) form, you have you define one accrued liability account in the chart of accounts. The accrued liability account must be in the same currency as the corporate credit card.

- The Clearing Account check box is cleared.

- The Restrict Visibility with Branch check box is cleared.

- The Use for Corporate Cards check box is selected.

- Only one payment method can be associated with the cash account.

- Optionally, the Requires Reconciliation check box is selected; if it is, a numbering sequence must be specified in the Reconciliation Numbering Sequence box. The predefined CARECON numbering sequence can be selected.

Although the cash account that is used for a corporate card must have only one associated payment method, this payment method can be selected for multiple cash accounts. If a payment method is selected for a cash account that is used for a corporate card, in the Summary area of the Payment Methods (CA204000) form, the Use in AP check box is selected. Also, on the Settings for Use in AP tab of the form, this payment method should have the following settings:

- Not Required (Additional Processing section): Selected

- Require Unique Payment Ref. (Payment Settings section): Cleared

On the Vendors (AP303000) form, you create a vendor that represents the bank that issued the corporate credit card. For this vendor, you specify the accrued liability account as the Expense Account.

Payment of Expenses Paid with Corporate Cards

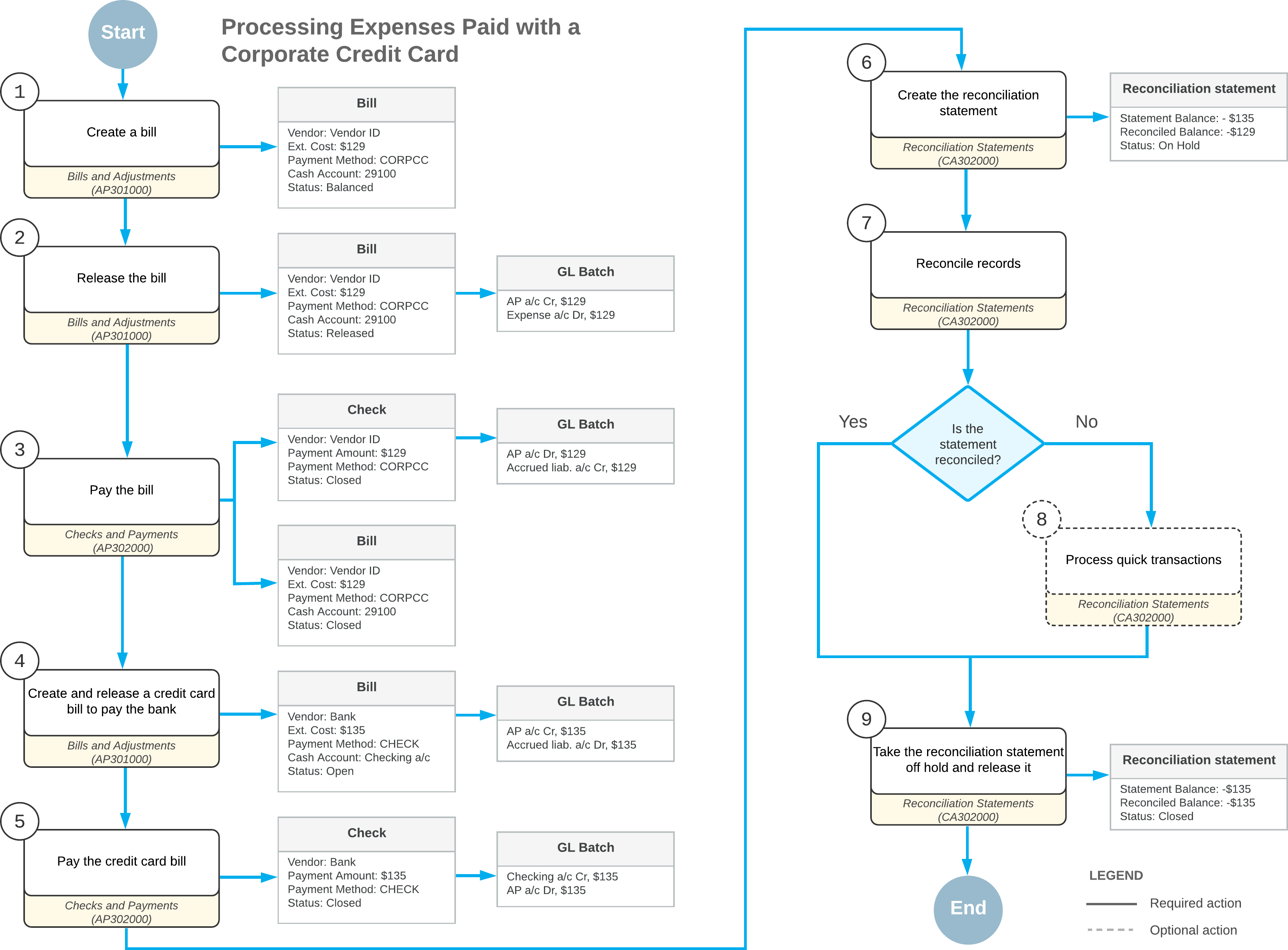

To process a payment by using a corporate credit card for a bill, on the Bills and Adjustments (AP301000) form, you process a bill, and then enter a payment for this bill on the Checks and Payments (AP302000) form, specifying the credit card cash account for the payment.

At the end of the financial period, you receive a statement for the corporate credit card from the bank. On the Bills and Adjustments form, you create an AP bill in the amount of the statement and specify the accrued liability account as the expense account of the bill.

You pay the credit card bill by processing an AP payment for the credit card bill from the cash account your company uses to pay for the credit card, such as a checking account.

You can reconcile the balance of the credit card (that is, the balance of the accrued liability cash account) with the credit card statement in the same way as you reconcile balanced for regular cash accounts. For more details on bank account reconciliation, see Bank Reconciliation: General Information.

Workflow of the Processing of Expenses Paid with a Corporate Credit Card

For processing of expenses paid with a corporate credit card, the typical process involves the actions and generated documents shown in the following diagram.