Creating a Debtor Invoice

Transactions > Debtors Invoice

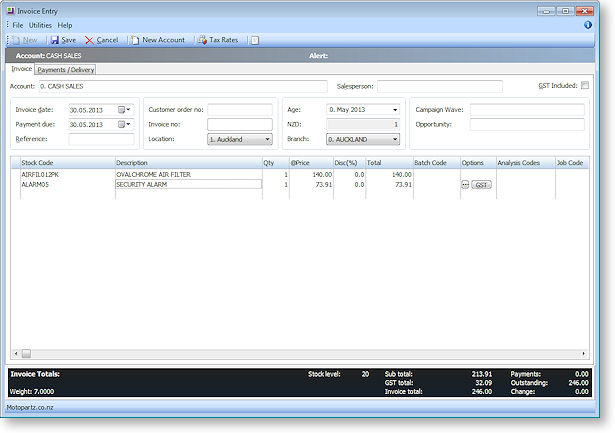

You can create a Debtor Invoice either directly from the Invoice Entry window or as part of the Sales Order supply process. The Debtor Invoice Entry window allows stock to be sold and invoice to be created directly, without the need for a sales order.

-

Click New to create a new Debtor Invoice.

-

Enter the debtor account number in the Account field, or type ‘?’ and tab to search for the required account.

-

Enter the basic details of the invoice:

Field

Description

Salesperson

Select the staff member you want to record as having made the sale.

GST Included

Tick to make the invoice GST inclusive. You can override this at an invoice line level by clicking on the options ellipsis icon for the invoice line and changing the tax rate.

If you have EXO Business Config, you can disable this option, both at invoice and invoice line level, so that all debtor invoices follow the GST inclusive rule that has been set for your company.

Invoice Date

The invoice date. Must be within the period specified by the Age field.

Payment Due

The date payment of this invoice will be due, calculated using the credit terms entered for the debtor.

Note: You can change this field's label by configuring the Debtor invoice due date field caption Company-level profile setting in EXO Business Config, if you require specific wording more appropriate for your customers.

Reference

An additional reference number you can record for the invoice, such as the name of the customer's project or cost centre.

Note: You can change this field's label by configuring the Debtor invoice reference caption Company-level profile setting in EXO Business Config, if you require specific wording more appropriate for your customers.

Customer order no.

The customer order number.

Invoice no.

The invoice number will be automatically generated when you save the invoice. Note that a profile setting in the Configuration Assistant can be set to allow you to enter your own invoice number.

Location

Select from list of active locations in this field.

Age

If the Post to Past Periods User-level profile setting is enabled, you can select the period that the invoice will be generated in; if it is disabled, this field is read-only and always shows the current period.

(currency)

If you operate in multiple currencies, this is the currency specified for the Debtor account, e.g. AUD, NZD. If you don't operate in multiple currencies, this field displays as "N/A" and cannot be edited.

For Debtor accounts that are in a foreign currency, you can enter "?" into this field and press tab to open a search window showing the exchange rates that were used in the first transaction on or before the Invoice Date entered for this invoice. This can be useful when entering invoices for prior periods, as it shows what the historical exchange rates were in the prior period.

Branch

Select the branch of the transaction. Branches are cost centres in MYOB EXO Business.

Campaign Wave

If the EXO Business CRM module is installed, invoices can be associated with a campaign wave to track sales against a marketing campaign.

Opportunity

This field is available if the EXO Business CRM module is installed. If the invoice was generated from an Opportunity, the Opportunity will be entered here automatically; otherwise, one can be manually entered (enter ? and press tab to search for an Opportunity).

-

Enter the details of stock items being sold in the invoice:

Field

Description

Stock Code

The Stock item code. Type '?' in this field and press tab to select stock item from a list.

Note: If the Enable GL code entry into the stock code field on a debtors invoice profile setting is enabled, you can enter a GL Code into this field by entering "@" and then the code (or enter "@" and press the enter key to search for a GL code).

Description

The Description of the stock item, display only.

Qty

The quantity of the stock item you are selling.

@Price

The price of the stock item. Double-click on this field to view the Price Formulation window, which lists any price policies which apply to this stock item or debtor which have affected the price displayed in this field.

Disc (%)

The discount percentage on this line. Enter the percentage number of the discount. The discount amount is now removed from the invoice line total

Note: If you have EXO Business Config, you can specify whether or not you want to allow line discounts in a Debtor invoice.

Total

The total amount for the invoice line.

Options

The ellipsis button here displays the Invoice Line Periscope, which summarises transaction information for the line, and allows you to override tax and discount information for the line.

-

To check the quantity in stock of the highlighted stock item, in each of your locations, right-click anywhere in the window and choose Stock Level. For each location this lists physical stock on hand, free stock, not for sale, committed, and on back order.

-

To check how the tax has been calculated on an invoice line, press Tax Rates to display a summary of the tax rates used, which will also show the difference between automatically calculated rates and overridden rates.

-

To add more descriptive comments to the invoice, click the Narrative button.

-

At any time when you're creating an invoice, you can create a one-off stock item. A one-off stock item is used for one-off sales, where you don't intend to keep the stock item in inventory, or even sell that stock item again.

Tip: The invoice window can also be used to create invoices at a Point of Sale. The EXO Business POS module provides an Enhanced Point of sale system with features and functions tailored for a more advanced retail environment.

Note: If there are restrictions attached to a debtor or alerts defined, the system displays warning messages, e.g. “Do not accept cheque”, or “This account on STOP CREDIT”

-

Click Save.

-

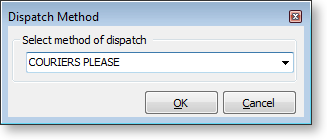

If your company ships goods, the Dispatch Method window is displayed. Select the method for shipping the goods and click OK.

This is controlled by the User-level profile setting Prompt for dispatch information for debtor invoices & sales orders, which must be enabled to display this window.

-

You are prompted to print the invoice. Choose the required invoice template you want to use for this debtor and click Yes.

Note: You can batch print multiple invoices from the Invoice Batch Printing window.

Receive a Payment on a New Invoice

You can receive debtor payments in various ways:

-

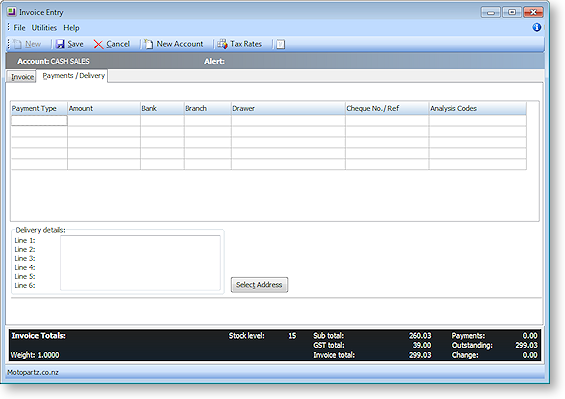

in the Payments/Delivery tab of the Debtor Invoice Entry window,

-

in the Debtor Receipts window, and

-

in the Debtor Batch Receipt window.

The Payments/Delivery tab is the easiest and quickest method of receiving payment at the point of sale. However, if you want to enter comprehensive payment information, or give discounts on the sale, we recommend you receive payments using the Debtor Receipts window.

Note: If the Payments/Delivery tab does not appear in the Debtor Invoice window for a new invoice, then if the profile 'Allow Debtor Payments Entry' in the Configuration Assistant needs to be enabled.

-

Select the Payments/Delivery tab.

-

Enter the payment type in the Payment Type field either by typing the name of the payment type, or by typing '?' in the field and selecting from the list that is displayed. You can use multiple lines to pay with multiple payment types.

-

Press the spacebar in the Amount field to display the total invoice amount.

-

Enter the remaining payment details.

-

Click Save to save and print the invoice.

Enter Delivery Details for an Invoice

Note: If the Payments/Delivery tab does not appear in the Debtor Invoice window for a new invoice, then if the profile 'Allow Debtor Payments Entry' in the Configuration Assistant needs to be enabled.

-

The delivery address for an account is displayed in the Delivery details of the frame. If the account has multiple delivery addresses, click on the Select Address button. The Extra Delivery Addresses window is displayed, where you can add extra delivery addresses.

-

Select the required delivery address and Save.