Tax Reports

The main Tax Return functions under Tax Reports on the Reports menu are used to generate the tax return (specific to the country), and are complimented with Tax By Rate Type and Tax Rate Exceptions reports. You can also use the Tax Rate Exception Report menu item to highlight invoices where the tax rate is not relevant to the transaction type.

Tax Returns

The following Tax Return reports are available:

- New Zealand GST Return

- BAS Tax Return

- Singapore GST Return

- VAT Return

- Taxable Payments Annual Report

Each report is accompanied by an Edit Return option, which lets you select and edit previous returns.

Note: Video-based Help is available for the BAS return and NZ GST return on the Exo Business Education Centre.

Tax by Rate Type Report

Reports > Tax Reports > Tax Report by Rate Type

The Tax by Rate Type report can be used to create "manual" tax returns, or to allow auditing of data. Two reports exist: a tax rate report for payment transactions and a tax rate report for invoice transactions.

Note: The Clarity report for payment transactions is TAXByRateType_Payment.CLR, and invoice transactions is TAXByRateType.CLR.

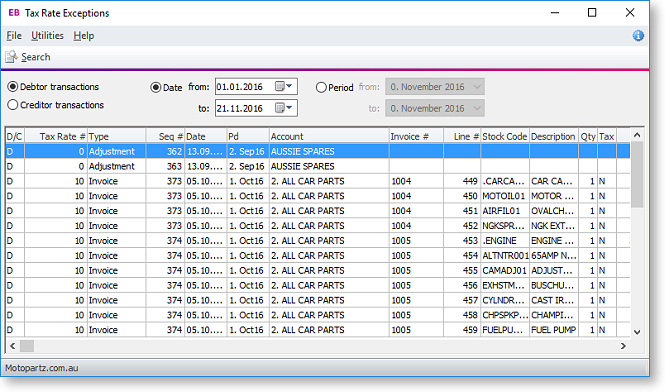

Tax Rate Exceptions

A Tax Rate Exceptions report can be run to help identify incorrect coding, or invalid codes. This report is available from the NZ GST Return and BAS Return windows by selecting Utilities > Tax Rate Exceptions. (You can also add the report to the main Exo Business menu for direct access.)

This report can help identify tax rates set up or used on the incorrect ledger if changes are made to the tax rate settings.