Relevant Daily Pay Valuation

An area of the Holidays Act that has caused a lot of confusion is the relevant daily pay.

The requirement of a Relevant Daily Pay is to pay an employee the amount they would have received had they worked on the day on which they had sick leave, bereavement, alternative leave, or a public holiday.

For many employees this is not an easy thing to calculate, as they may work highly variable hours. In addition, the relevant daily pay must also factor in commission payments and productivity or incentive based payments and any overtime that the employee would have received had they worked on the day.

For employees with no definable Relevant Daily Pay, an averaging calculation must be used. For Holiday Pay, a 4-week average is used; for all other leave types, the Average Daily Pay (basically a 52-week average) is used.

The 4-week average calculation takes the gross earnings the employee has received in the past four weeks and divides it by the number of physical days worked over the four week period.

The Average Daily Pay is defined as:

The employee's gross earnings for the 52 calendar weeks before the end of the pay period immediately before the calculation is made,

Divided by:

The number of whole or part days during which the employee earned those gross earnings, including any day on which the employee was on a paid holiday or paid leave; but excluding any other day on which the employee did not actually work.

To use an averaging calculation to value an employee's leave:

-

For Holiday Pay, select "4 Week Average" for the Ordinary Daily/Hourly Rate property on the Holiday Pay tab of the Employee Maintenance screen.

-

For all other leave types, select "Average Daily Pay" for the Relevant Hourly Rate Method property on the Sick & Other Leave tab of the Employee Maintenance screen.

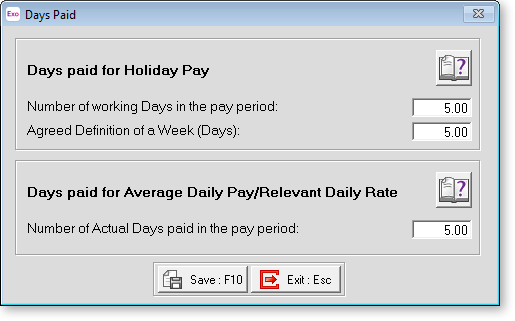

To assist with the calculation, Exo Payroll includes a new field in the current pay that records the physical days worked in a pay period.

This field is called Days Paid for Relevant Daily Rate if you are working in days, or Hours Paid for Relevant Daily Rate if you are working in hours. It only appears for employees that are set to the "Average Daily Pay" Relevant Hourly Rate Method in the Sick & Other Leave tab.

Days paid for Relevant Daily Rate This field should represent the number of physical days that the employee has worked on in the pay period.

Any portion of a day worked should be counted as 1 day.

For example, if an employee has worked 5 full days and 1 half day you would enter 6.

When paying sick leave, bereavement leave, alternative leave or public holidays the rate is broken down to an hourly amount by dividing the average day amount by the hours per standard day value.

Even if your employees are working highly variable hours you would still define an "hours per standard day" value.

If you are unsure of what value to use enter 8 (this value is defined in the employee maintenance holiday pay screen).

When paying a full day of sick leave, bereavement leave, alternative leave or public holiday you would enter the hours per standard day amount as the number of hours to pay.

If you wanted to pay half a day, then enter half the hours per standard day value as the hours to pay.

To pay the employee their relevant daily pay for 1 day of sick leave, bereavement leave, public holiday or alternative leave you would enter 8 hours (the hours per standard day amount).

The hours per standard day value now appears on the leave payment screen for sick, bereavement and public holidays so you can see how many hours to enter when paying leave to get the average day amount.

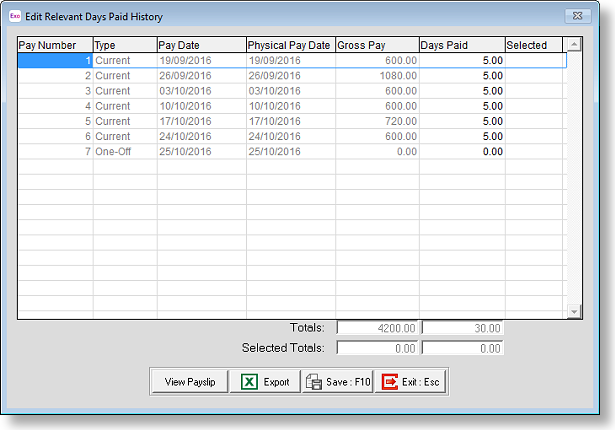

Editing Relevant Days Paid History

On upgrade to the new version, Exo Payroll will populate the physical days worked history with the values from the regular days paid history.

In the case of employees using the permanent part time / pro-rata holiday accrual, the days paid for holiday pay should already represent the physical days worked amount.

You should not need to edit the data for these employees.

For employees that are using an averaging calculation for their relevant rate and are set to a full time holiday accrual you may need to edit the physical days worked history.

To edit the history use the Edit Days button next to the relevant rate selection.

The button will only appear when the "Average Daily Pay" method is selected.

When you click onto the Edit Days button you will see a screen like the one below.

In this screen you can edit the days paid values by clicking onto the days paid field and typing in the new value.

The Relevant Rate calculation uses the past 52 weeks of pays.

The date range is determined by looking at the most recently updated pay and counting back 364 days.

All pays in this period will be factored into the calculation.

Any pays that have not been updated are excluded.

There is no benefit in editing the days paid for pays that fall outside of this range.