Time and Material Billing: Adjustments, Remainders, and Write-Offs

You may need to modify a pro forma invoice if you send this invoice to the customer for acceptance and if the customer requests some adjustments.

On the Pro Forma Invoices (PM307000) form, you can edit the lines of a pro forma invoice if it is assigned the On Hold status. If a pro forma invoice has the Closed status but you have not released the created accounts receivable document yet, you can delete the AR document to be able to edit the pro forma invoice.

The following sections describe how you can review and modify the pro forma invoice lines before you prepare the accounts receivable invoice for this pro forma invoice.

Increasing the Billed Amounts

On the Time and Material tab of the Pro Forma Invoices (PM307000) form, you can increase the billed amounts by doing any of the following:

- Increasing the Amount to Invoice of the pro forma invoice line to bill the customer in a greater amount.

- Adding a new line to the pro forma invoice based on an unbilled transaction. To do this, you click Upload Unbilled Transactions on the table toolbar. In the Upload Unbilled Transactions dialog box, which opens, you select the lines with the project transactions that have not been billed yet, and click Upload & Close. The system creates new lines for these project transactions.

- Manually adding to a pro forma invoice an adjustment line that does not originate from the project transactions.

Postponing the Billed Amounts

To postpone the full amount of any pro forma invoice line, delete this line from the pro forma invoice on the Time and Material tab of the Pro Forma Invoices (PM307000) form. This line will appear in the next pro forma invoice prepared for the project.

To postpone a partial amount of the pro forma invoice line, decrease the Amount to Invoice and select Hold Remainder in the Status column. The unbilled remainder (that is, the difference between the original amount and the edited amount) will be postponed until the next billing for the project. For an unbilled remainder to be billed, the corresponding AR invoice that contains the line from which this remainder originates must be released.

You cannot postpone the partial amount of the pro forma invoice lines that have no link to a project transaction.

Writing Off the Billed Amounts

To write off the full amount of the pro forma invoice line, you select Write Off in the Status column for the line on the Time and Material tab of the Pro Forma Invoices (PM307000) form. This line will no longer appear in pro forma invoices prepared for the project.

To write off a partial amount of the pro forma invoice line, decrease the Amount to Invoice and select Write Off Remainder in the Status column. The unbilled remainder (that is, the difference between the original amount and edited amount) will be written off and will no longer appear in pro forma invoices prepared for the project.

You cannot fully or partially write off the amount of the pro forma invoice lines that have no link to a project transaction.

Decreasing the Billed Amounts

On the Time and Material tab of the Pro Forma Invoices (PM307000) form, you can click a pro forma invoice line and click View Transaction Details on the table toolbar. The system opens the Transaction Details dialog box, which shows the list of project transactions that correspond to this line. The Billed Quantity and Billed Amount values for each project transaction in the list were calculated by using the formula of the billing rule. These values are totaled to populate the Billed Quantity and Billed Amount of the pro forma invoice line.

To reduce the billed quantity and amount of the pro forma invoice lines, you delete the particular transaction from the list. The deleted project transaction is unlinked from the pro forma invoice line and will appear in the next pro forma invoice prepared for the project.

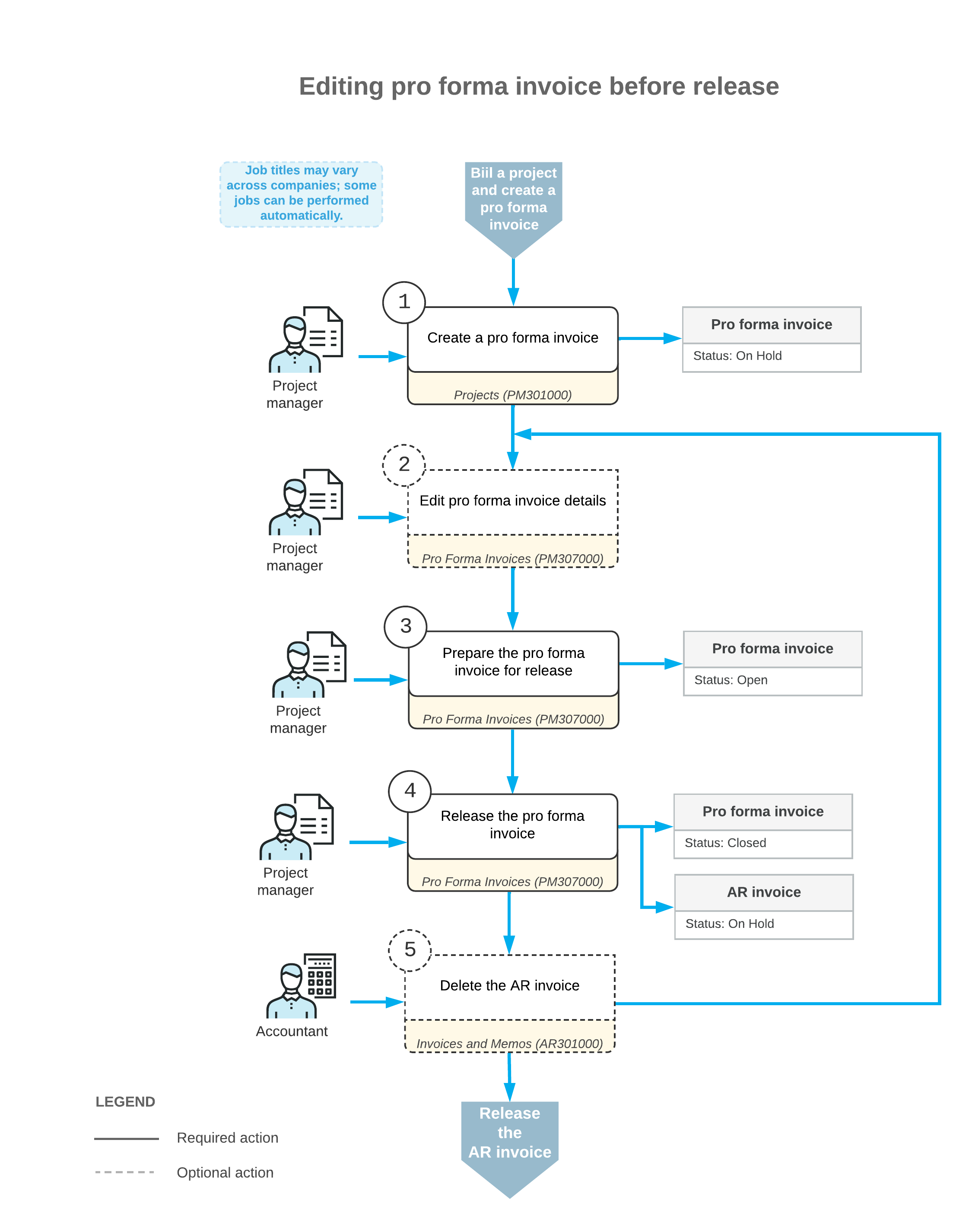

Workflow of Changing Pro Forma Invoices

The following diagram illustrates the workflow of making changes to a pro forma invoice.