Two-Step Transfers: General Information

If your organization uses multiple warehouses to store items, you may need to transfer stock items between warehouses. To record stock movements between warehouses in MYOB Acumatica, you use a two-step transfer—that is, you first issue the required quantity of items from a source warehouse, and you then receive the items in the destination warehouse.

Learning Objectives

In this chapter, you will do the following:

- Record the movement of stock items between warehouses by using a two-step transfer

- Find information about items in transit

Applicable Scenarios

You may need to use two-step transfers when you need to track movements of items between warehouses. A two-step transfer can reflect a movement between warehouses in different towns (which may take up to multiple days) or a movement between warehouses that are close to each other (which may take up to several hours).

Two-Step Transfer Process

For a two-step transfer, you create both of the following documents:

- Transfer of the 2-Step type: You create this document by using the Transfers (IN304000) form. When this document is released, the on-hand quantity of the items in the source warehouse is decreased.

- Transfer receipt: When the transferred items are received, you create an inventory receipt for this transfer on the Receipts (IN301000) form by selecting the reference number of the transfer in the Transfer Nbr. box. When you select this number, the relevant settings of the transfer, including the detail lines, will be inserted in the transfer receipt. When the receipt is released, the on-hand quantity of the items in the destination warehouse is increased.

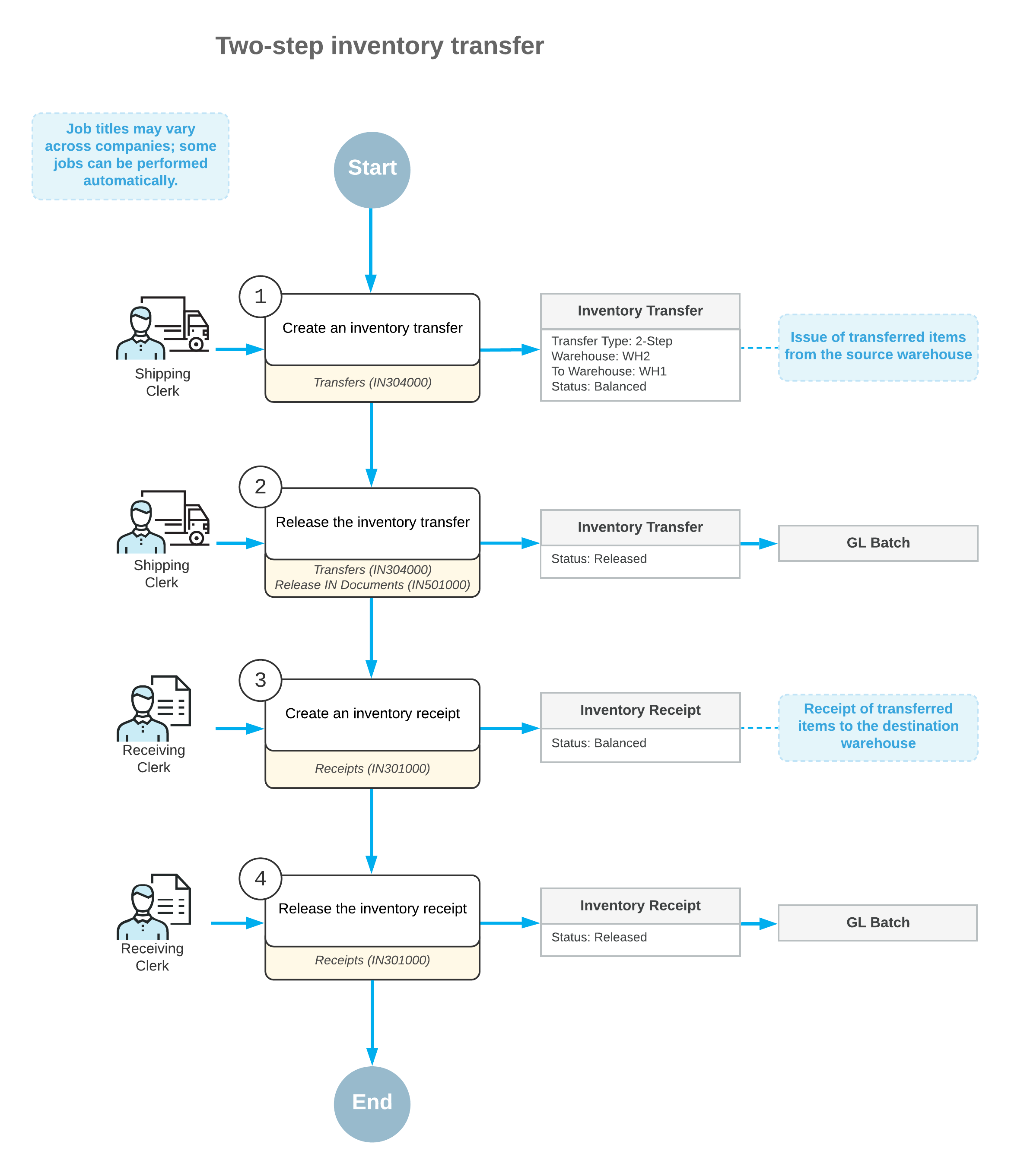

Workflow of a Two-Step Inventory Transfer

For a transfer of items between warehouses, the typical processing involves the actions and generated documents and transactions shown in the following diagram.

Costs of Transferred Items

Moving stock items between warehouses usually requires some time. Items that have been issued from a source warehouse and have not been delivered to a destination warehouse are regarded as being in transit. The costs of items in transit are recorded temporarily to the In-Transit account, which is specified in the In-Transit Account box on the Inventory Preferences (IN101000) form (Account Settings section of the General tab). When the items are received at the destination warehouse, their costs are transferred to the appropriate inventory account. For details, see Two-Step Transfers: Generated Transactions.

The costs the transferred items will have in the destination warehouse depend on the valuation methods assigned to the items on the Stock Items (IN202500) form. For items with the Average and Standard valuation methods specified in the Valuation Method box, the cost of an item in the destination warehouse will be the same as the cost of the item at the source warehouse. For an item with the FIFO or Specific valuation method, a transfer receipt creates a new cost layer with the transferred quantity of the item and with the number and date of this transfer receipt.