Adding an Asset

Newly acquired fixed assets are normally recorded in the General Ledger first. Typically, a creditor’s invoice for the purchase of a fixed asset is charged to a GL Fixed Asset cost account, then the asset is added to the Fixed Assets register.

There are two ways of adding a new asset to Fixed Assets:

- Double-click on an asset in the General Ledger Assets window (or select the asset and click Add).

- Click New on the main Fixed Assets window.

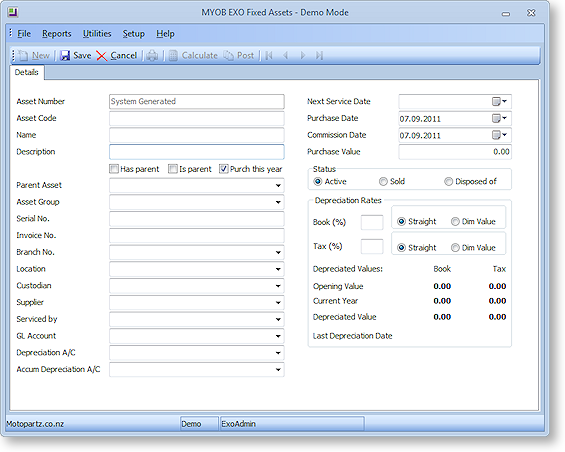

In either case, the main Fixed Assets window shows the Details tab for the new asset:

Enter values for all fields, then click Save to add the asset.

Note: Adding an asset to Fixed Assets does not produce General Ledger accounting entries. The update to the General Ledger Asset Cost accounts is done independently. It is important to reconcile the GL Asset Cost accounts (and accumulated depreciation) to relevant totals from Fixed Assets.

Asset Details

The following details must be completed for all assets. These details can be edited after the asset is created.

|

Field |

Description |

|

Asset Number |

A unique identifier for the asset. This number is generated by the system and cannot be changed. |

|

Asset Code |

A code to help you identify the asset. If you already have an existing system, you can transfer the number to this system. |

|

Name |

The name assigned to the asset. |

|

Description |

Description of the asset as listed in the General Ledger and the invoice. |

|

Has parent |

Select this option if the asset is a part of a larger asset. |

|

Is parent |

Select this option if the asset is the main asset and has other subsidiary assets. |

|

Purch this year |

Select this option if the asset was purchased this year. |

|

Parent Asset |

If the Has parent option is selected, specify the asset's parent asset. |

|

Asset Group |

Select the Asset Group that the asset belongs to. This determines default values for General Ledger accounts and depreciation rates/methods. |

|

Serial No. |

The serial number of the asset (if applicable). |

|

Invoice No. |

The Creditor Invoice number. |

|

Branch No. |

The branch that the asset is located in. |

|

Location |

The Asset Location that the asset belongs in. |

|

Custodian |

The name of the staff member responsible for the asset. |

|

Supplier |

The name of the supplier who sold the asset to you. |

|

Serviced by |

The name of the person who will service the asset (if applicable). |

|

GL Account |

The Balance Sheet Asset Cost account number. |

|

Depreciation A/C |

The Profit & Loss Depreciation expense account. |

|

Accum Depreciation A/C |

The Balance Sheet Accumulated Depreciation account. |

|

Next Service Date |

The date you want the service to take place (if applicable). |

|

Purchase Date |

The date the asset was purchased. |

|

Commission Date |

The date you want to start depreciating the asset. |

|

Purchase Value |

The price paid for the asset (excluding GST). |

|

Status |

Select whether the asset is Active (i.e. with you and being depreciated), has been Sold or has been Disposed of. |

|

Depreciation Rates |

|

|

Book [%] |

The book/accounting depreciation rate. |

|

Tax [%] |

The tax depreciation rate. |

|

Straight |

Select this option if the Straight Line depreciation method is to be used for this asset. |

|

Dim Value |

Select this option if the Diminishing Value depreciation method to be used for this asset. |

|

Depreciated Values (all read-only) |

|

|

Opening Value |

The opening Net Book Value for the current year. |

|

Current Year |

The amount that the asset has depreciated by this year. |

|

Depreciated Value |

The current Net Book Value of the asset (equal to Opening Val - Current Year). |

|

Last Depreciation Date |

The date when depreciation was last calculated on the asset. |