Payment Times Reporting

The Payment Times Reporting Scheme (PTRS) is a method of reporting to the Australian Government Department of Industry, Science, Energy, and Resources (DISER) based on the time taken for a large business to make a payment to their small business suppliers.

Note: For more information, see "Payment Times Reporting Scheme" on the DISER website.

Only Large Businesses need to perform this reporting, and only on bills they have received from the Small Businesses they deal with. A Large Business is defined as a business that:

- earns over $100m in revenue for the last financial year, or;

- is part of a group that has earned over $100m for the last financial year, and this company earns more than $10m, and;

- is registered to operate in Australia.

A Small Business is defined as a business that:

- has annual revenue <$10mil, and;

- is registered to operate in Australia, and;

- is registered on the DISER tool for small businesses.

The Payment Times Reporting Scheme commenced on 1 January 2021. It requires businesses to submit a report on their payment terms and practices. Reports are due each six months of an income year, within three months of the end of the reporting period. The first reporting period is therefore 1 January 2021 - 30 June 2021, with the first report due by 30 September 2021.

PTRS reports are uploaded to the Payment Times Reporting Portal website. You will need a myGovID to log in to the portal. The PTRS report consists of two files:

- The PTR Template, which is a CSV file containing data on all of your payment information. MYOB Exo Business produces this file.

- The Responsible Member Declaration Template, which is a Word document containing signatures and associated declarations. The template for this document can be downloaded from the Payment Times Reporting Portal website—look for the Download PTR Responsible Member Declaration Template link on the home page.

See the page "How to report" for information on how to log in and complete the PTRS report.

Enabling Payment Times Reporting

If you qualify as a Large Business, you must activate the PTRS features in Exo Business Configurator at Company > Company Settings. Tick the Required to Report under PTRS box if you are a Large Business who is required to report payment times.

Setting up Creditors for Payment Times Reporting

Once PTRS features have been enabled, you can set PTRS options on Creditor accounts. A PTRS Small Business option is available on the Details 2 tab of the Creditor Account Details window. Tick this box if the Creditor qualifies as a Small Business under PTRS.

You can tick this box manually if the Creditor qualifies as a Small Business, or it can be set automatically by the Payment Times Reporting tool - see "Generating the Payment Times Report" below.

Note: To be included in PTRS reports, Creditor accounts must have an ABN recorded. Before generating PTRS reports, review your Creditor accounts and ensure that they have ABNs.

Entering Creditor Invoices

An Invoice Received field is available on the Creditor Invoice Entry window, so you can record when you received the invoice for PTRS reporting. This field defaults to the invoice date, but you can edit it if necessary. (The field is always available, even if PTRS features have not been enabled.)

Note: It is your responsibility to ensure that all invoice dates are entered correctly.

Generating the Payment Times Report

The Payment Times Reporting utility lets you enter the necessary details and generate a PTRS report file, which can then be uploaded to the Payment Times Reporting Portal website.

The utility also lets you verify and update which Creditor accounts count as Small Businesses for PTRS.

The basic workflow for using the utility is:

- Open the Payment Times Reporting utility and click Export to generate a CSV file containing the ABNs entered for all Creditor accounts in your system.

- Upload this file to the Small Business Identification tool on the Payment Times Reporting Portal website.

- The Small Business Identification tool will return a CSV file containing only those ABNs from your export file belonging to businesses that count as Small Businesses under PTRS. Return to the Payment Times Reporting utility and click Import to import this file into Exo Business. This will automatically tick the PTRS Small Business setting of all Creditor accounts whose ABNs are included in the import file.

- Enter all required details into the tabs of the Payment Times Reporting utility, then click Calculate to generate the PTRS report CSV file.

- Upload this file to the Payment Times Reporting Portal.

Details on the Payment Times Reporting utility are divided across four tabs:

- Company Details

- Payment Details

- Arrangements

- Reporting

Most of the details you enter will stay the same from reporting period to reporting period, so a Save button is available to save the contents of each tab for future use.

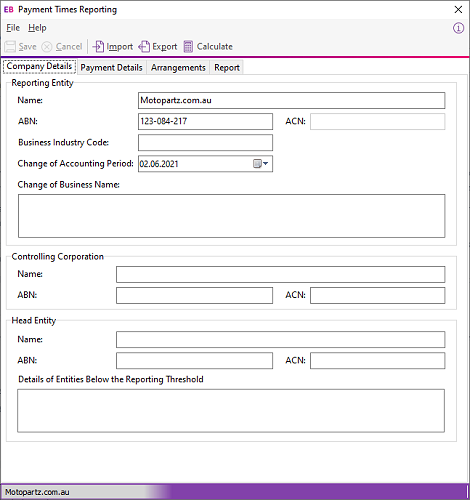

Company Details

This tab contains details of your company (defaults are taken from the Company Details screen in Exo Business Configurator), and details of the corporation or group that it belongs to, if any.

Note: The Business Industry Code is the Australian and New Zealand Standard Industrial Classification (ANZSIC) code for your company. To find your ANZSIC code, see the Business industry code tool on the ATO website.

Payment Details

This tab contains information on the standard, shortest and longest paying periods offered for inclusion in your contracts with your Small Business Creditors.

Note: If any of these values change from one reporting period to the next, you must include information on the change(s) in the relevant Details of Change field.

Arrangements

This tab contains descriptions of the invoicing arrangements you have with your Small Business suppliers. The PTRS report takes into account any supply chain finance agreements, i.e. discounts for prompt payment of invoices, you have with any of your suppliers. Fields are available here to describe your supply chain arrangements (if any).

Report

This tab contains the details of the people submitting the PTRS report and the dates that the report covers.

The report start and end dates, the Submitter details and the Approver details are all required before the report can be generated.

Note: Saving the report saves all details on this tab except for the report start and end dates - these must always be entered manually before generating the report.