Foreign Currency

Use multiple currencies to store Debtors, Creditors, and Balance Sheet accounts in a currency other than the default currency.

Note: Don't enable this function if you don't regularly do transactions in foreign currency.

Setup

Enabling Foreign Currency Features

To enable foreign currency transactions, select the option Operate in multiple currencies in Exo Business Configuration Assistant under Business Essentials > General Settings. The Currency property is enabled when you create accounts.

Setting Up Local Currencies

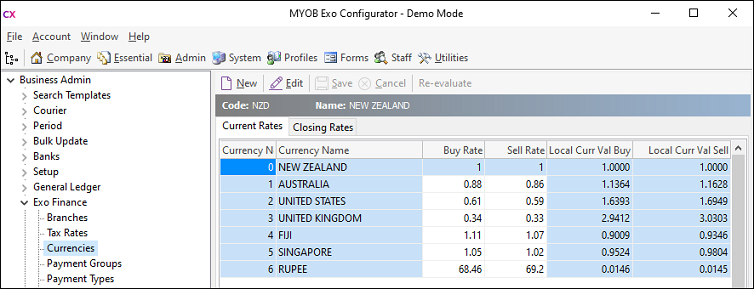

You can maintain exchange rates in Exo Business Configurator under Administration > Finance > Currencies.

Note: You can also edit currencies from within the main Exo Business application by adding the Setup Currencies menu item.

The local currency (0) exists in all Exo Business databases when they are created. If the local currency does not reflect the region the user is in, change it before entering transactions. The local currency rate must always have buy and sell rates of 1.

Click New to create a currency rate.

You can edit the exchange rate for all currencies, except the local currency, on the Current Rates tab. The Buy Rate for each currency is the exchange rate used when purchasing from Creditors. The Sell Rate is the exchange rate used when selling to Debtors.

The Local Curr Val Buy and Local Curr Val Sell values show the inverse values of the Buy Rate and Sell Rate. You should update currency exchange rates frequently. When editing rates, you are warned if you change rates by more than a predefined limit (set by the % Change Alert property on the Details tab).

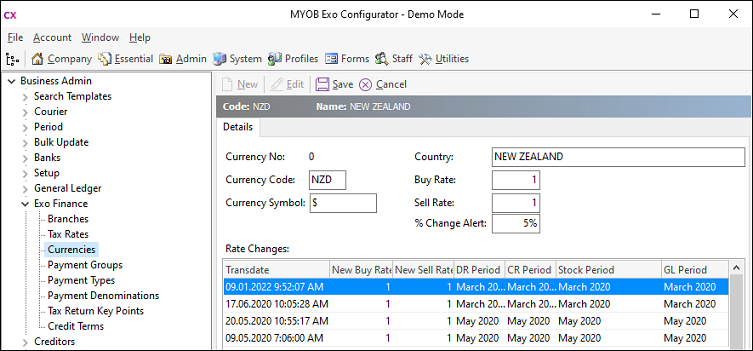

To edit all properties of an existing currency rate, double click on it or select it and click Edit. The Details tab displays:

The Details tab also contains a history of all rate changes for the currency.

Currency Closing Rates

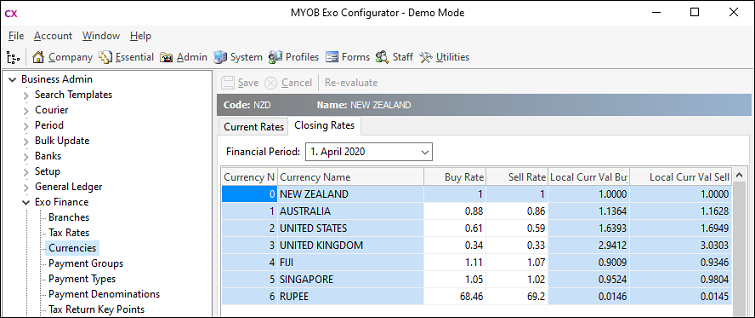

The Closing Rates tab on the Currencies screen displays the closing currency rates for each financial period:

These rates are used for all future valuations relating to the period ending balance— for example, in period end reports such as Control account reconciliation reports and Aged balance reports. You can set or change closing rates for the prior period (age 1). For all other periods, the rates are read-only. You can also re-evaluate unrealised foreign exchange gains and losses for the prior period.

Setting Up Control Accounts

To support variances within the GL to balance the changes in the Debtor and Creditor control accounts, create a Forex Gain/Loss account in the profit and loss section of the GL.

Note: Once a Debtor/Creditor or GL bank account has had any transactions posted to it, you cannot change the currency.

After you have created the GL accounts, nominate the Forex Gain/Loss accounts as control accounts for each ledger.

Setting Up Customers/Suppliers

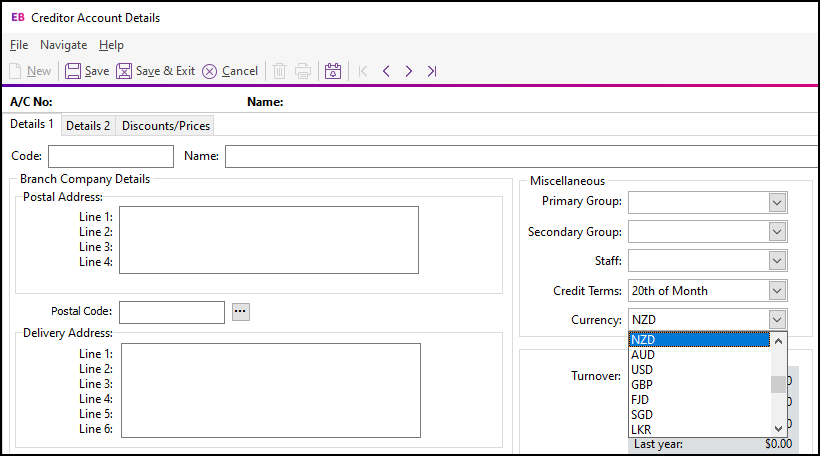

Any transaction that takes place is in the customer's/supplier's currency. Your view of the account is also in the customer's/supplier's currency. Select the currency from the Currency list when you create a Debtor or Creditor account:

Sales reports and all Stock movements are always converted to local currency immediately, at the rate for the transaction.

Note: You cannot change the currency after you have saved the account.

Operation

The Foreign Currency option may be required in different situations.

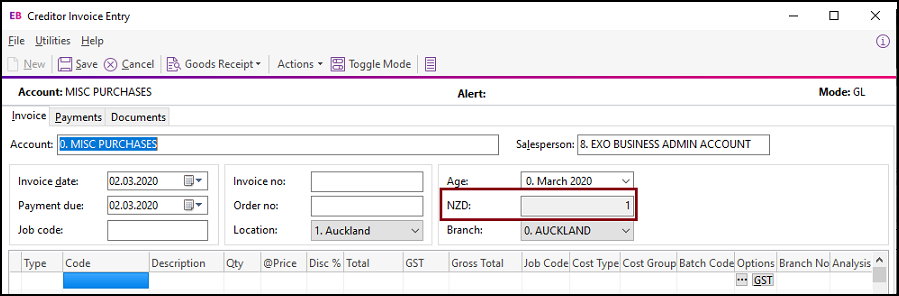

During Sale/Purchase

The rate displayed here is the default rate selected from the currency table, set up in Exo Business Configurator. You can overwrite the rate here.

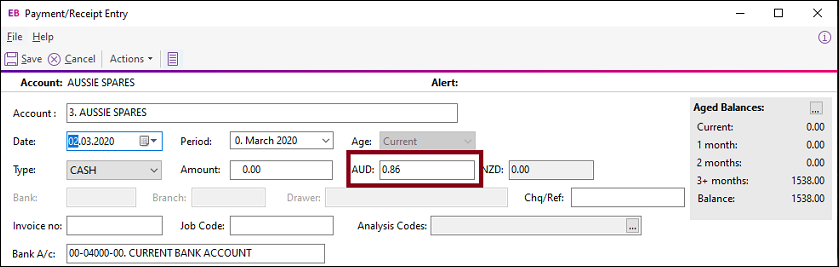

During Payment Entry

The rate displayed here is the default rate selected from the currency table, as set up in Exo Business Configurator. You can change the rate.

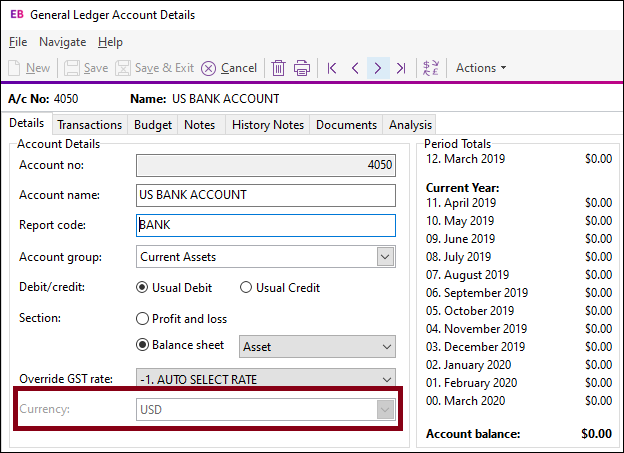

While Designating a Foreign Currency GL Account

The Currency is set when the account is created. You cannot change it after saving the account.

The amounts displayed in the Period Totals section are in the local

currency. However, if this is a foreign currency account and you clicked

the Show amounts in foreign currency

button (  ), these amounts are converted from the

local currency to the foreign currency.

), these amounts are converted from the

local currency to the foreign currency.

To change the default setting from the default currency, select the foreign currency previously set up in Exo Business Configurator. Changing this currency does not affect the currency that the account is reported in.

The foreign currency numbers are stored in the GLTRANS table and used to calculate the unrealised change in the foreign currency.

Note: You cannot change the currency after you have entered a transaction.

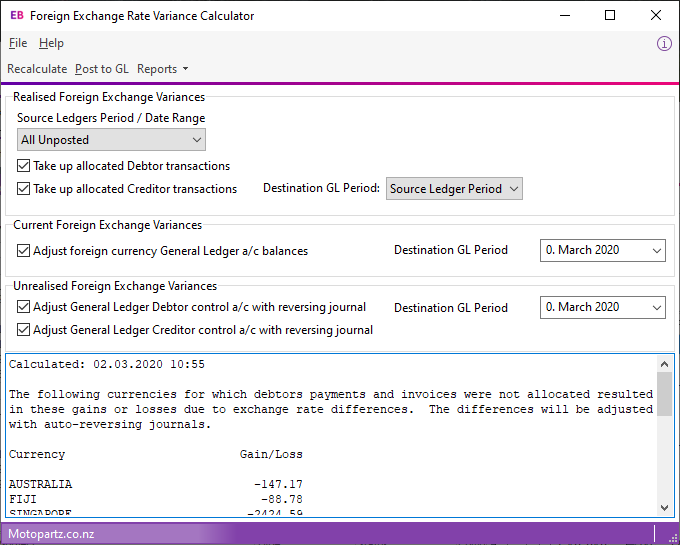

Foreign Currency Reconciliation

Use the Foreign Exchange Rate Variance Calculator window to perform a reconciliation, which calculates variances based on the rates you specify.

Before running the reconciliation, set up these GL Control Accounts in Exo Business Configurator under Business Essentials> GL Control Accounts:

- Debtors Forex Variance

- Creditors Forex Variance

- Current Forex Variance

Utilities > Foreign Exchange Rate Variance Calculator

Click the Reports > Detailed Report option to generate a detailed report that shows the allocation of payments to invoices in each ledger, with the adjustment made to take up the difference.

The Unallocated Payments Report highlights unallocated payments. You can correct problems before recalculation and posting.

Print the summary screen by selecting Reports > Summary Report in the Foreign Exchange Rate Variance Calculator window. You can activate the journal posting in the GL by clicking the Post to GL button.

|

Field |

Description |

|

Source Ledgers Period / Date Range |

Specify the period or dated range from which to extract data:

Note: This control applies to realised variances only. The entire sub-ledger is re-valued for current and unrealised variances at the end of the specified period. |

|

Take up allocated Debtor transactions Take up allocated Creditor transactions |

Provides realised transactions as per the details report. You can post transactions to the source ledger period, or a select a custom period. You can select a Destination GL Period for realised foreign exchange variances. |

|

Adjust foreign currency General Ledger a/c balances Adjust General Ledger Debtor control a/c with reversing journal Adjust General Ledger Creditor control a/c with reversing journal |

Gives the difference in the exchange rates on the actual transactions and the rates in the Setup Currencies screen. You can select a Destination GL Period for unrealised foreign exchange variances and for current foreign foreign exchange variances. Note: You can only post unrealised foreign exchange variances into the current period or prior periods. If Exo Intercompany is installed, you can only post them to the current period. |

Note: You can use the Integrated Cashbook (under Transactions > General Ledger > Integrated Cashbook Entry) to enter payments into Debtor and Creditor accounts, as long as the Debtor or Creditor is the same currency as the bank account, or using the local currency. Exo Business converts the transaction using the exchange rate.

Note: Realised gains or losses only post to the GL after allocating the invoice(s) and corresponding payment(s).

Foreign Exchange Re-evaluations

You can reevaluate unrealised foreign exchange gains and losses:

- In the Setup Currencies window. Click the Re-evaluate button while on the Current Rates tab to reevaluate the current period (age 0). This button is enabled on the Closing Rates tab when you select the prior period (age 1).

- During the End of Period process. For example, when ending June and rolling into July, the End of Period utility now revalues the unrealised gains/losses for June and sets the closing rates for June. This also applies to the End of Year process.

- Using the Foreign Exchange Variance Calculator.

Note: The Re-evaluate button on the Setup Currencies window is disabled when Exo Intercompany is installed.

When posting foreign exchange variances to the current period (age 0), the previous revaluation is reversed before a new auto-reversing journal takes place.

When posting to the previous period (age 1), the existing valuations in age 1 are reversed and new ones are entered for the period. These then auto-reverse themselves out in the next period. IExisting foreign exchange auto-reversals in age 0 are reversed out as well.

When re-evaluating unrealised gains and losses from the Setup Currencies window, the Profit account (Retained Earnings) also updates if the period being re-evaluated is a part of previous year.