Revaluing Balances

The Revaluation Utility should be used with foreign currency subsidiaries. It is used to revalue the balance sheet account balances that have come from the foreign currency subsidiary. If the Group Consolidation Entity is populated with transactions from source companies each month, these monthly movements will have been converted at the rates at the end of each month. The revaluation utility resets the balance sheet balances (sum of all transactions) to the rate entered by the user.

Note: GL Accounts can be excluded from revaluation, e.g. Goodwill on Consolidation. To do this go to Account > General Ledger in the EXO Business core module and tick the Excluded from Revaluation option on the Details tab. In particular, ensure that Retained Earnings is excluded from revaluation.

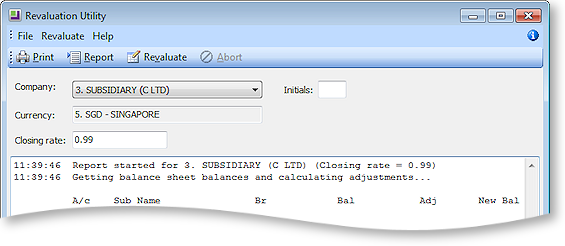

To perform a revaluation, select Utilities > Revaluation Utility. The following window appears:

Select the Company from the drop-down list (only foreign current companies are displayed.) The Closing Rate is retrieved from the Setup Conversion Rates window, but this can be changed.

Click Report to report the revaluation calculation.

Click Revaluate to perform the calculation and post the adjustment journal.

The system retrieves all Balance Sheet transactions for the selected company (excluding those where the Excluded from Revaluation flag has been set). It totals the foreign currency amount, then recalculates the local currency value based on the entered exchange rate. The difference between the new local currency value and the current balance is calculated and this difference is posted to the account. The net difference in this journal is posted to the P&L FOREX account.

Example

AMOUNT : NZD 3764.00

FCAMOUNT : SGD 3087.00

Exchange rate of 0.85 was entered.

DIFFERENCE = 3087 / 0.85 – 3764 = -132.24

In the current period, post a journal:

CR ACCNO, SUBACCNO, BRANCHNO with the difference of 132.24

DR P&L FOREX account

Note: If the difference is positive, debit ACCNO, SUBACCNO and BRANCHNO.