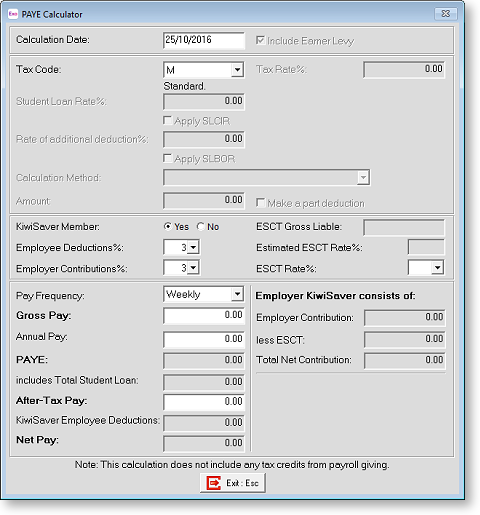

PAYE Calculator

![]()

Exo Payroll includes a PAYE Calculator utility for calculating the Tax, Net Pay and Student Loan for any amount. Open the PAYE Calculator from the Utilities menu or by clicking on the PAYE Calculator button on the toolbar.

Calculation Date This will default to today's date and therefore the calculator will use the current tax tables. If you want to use a previous tax rate, enter a date for that period and the system will recalculate the PAYE for that period.

Include Earner Levy Tick this box to prevent Exo Payroll from deducting earner levy from the pay. This is commonly done for withholding payments.

Student Loan

Tax Code Select the required Tax Code from this list. The Tax Code you select affects which of the following properties are available.

Tax Rate Enter a percentage Tax Rate, e.g. 20.00 for 20%.

Student Loan Rate This field lets you override the student loan rate - by default, student loan is calculated at 12% of the gross taxable earnings when the Calculation Date is after 01/04/2013 and at 10% before this date.

Ignore Student Loan Threshold Tick this box to ignore the student loan threshold when overriding the Student Loan Rate.

Apply SLCIR Tick this box to include additional student loan deductions that are required by the Commissioner of Inland Revenue. Enter the rate of additional deduction, as specified by Inland Revenue.

NOTE: An Ignore Threshold checkbox is available for SLCIR when the STC tax code is selected. Ticking this box means that the student loan threshold will not be used when calculating repayments.

Apply SLBOR Tick this box to include additional student loan deductions that are made voluntarily by the employee. Select the calculation method, then enter the desired amount/rate. Tick the Make a part deduction box to make a partial SLBOR deduction in cases where there is not enough Net Pay to cover the full deduction amount.

KiwiSaver

KiwiSaver Member Select an option to specify whether or not KiwiSaver contributions are made for the employee.

Employee Deductions Select the percentage rate of employee KiwiSaver deductions. Choose from 2, 3, 4, 6, 8 or 10.

Employer Contributions Select the percentage rate of employer KiwiSaver contributions. Choose any number from 0 - 12.

ESCT Rate The gross amount liable for Employer Superannuation Contribution Tax (ESCT) is displayed; the estimated ESCT rate is determined based on this amount. You can override this rate by specifying a new rate here.

Totals

Select the required Pay Frequency from the list, then enter an amount into any of the pay fields:

- Gross Pay - the gross earnings for the selected pay frequency.

- Annual Pay - the employee's annual earnings.

- After-Tax Pay - the pay amount after PAYE has been deducted, but before any KiwiSaver deductions are made.

When an amount is entered into one of these fields, all other fields are updated.

PAYE Exo Payroll calculates the appropriate PAYE and earner premium. The amount displayed here includes any student loan payments.

incls Total Student Loan The student loan repayment amount that is included in the PAYE amount appears here for Tax Codes that include a student loan.

KiwiSaver Employee Deductions The total amount deducted for the employee's contribution to KiwiSaver.

Net Pay How much money the employee will receive after tax.

Employer KiwiSaver consists of These fields show a breakdown of the employer's contribution to KiwiSaver, showing the contribution amount and the amount of ESCT on it.

Total SL consists of These fields show a breakdown of the Student Loan amount, showing how much of it is the regular Student Loan repayment, and how much is additional repayments under the SLCIR and/or SLBOR tax codes.