Payroll Giving Donees

Any donee organisations that employees want to donate to for the payroll giving scheme must be set up in the Exo Payroll system before donations can be made.

Payroll giving donations can only be made to donee organisations that have Inland Revenue-approved donee status. To check if an organisation is an approved donee, visit the following IRD web page:

http://www.ird.govt.nz/donee-organisations/donee-organisations-index.html

You can allow employees to nominate the organisations they want to donate to, or you can provide a list of organisations you have chosen. In either case, all organisations must be set up as Payroll Giving Donees in the Exo Payroll system. You can set up as many donee organisations as you want.

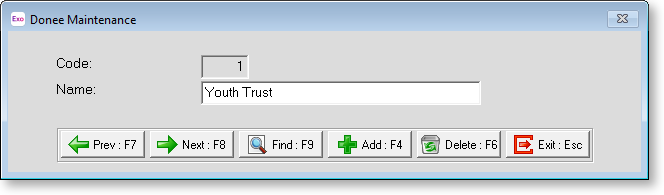

To set up Payroll Giving Donees for your Payroll company, select Payroll Giving Donees from the Maintenance menu.

NOTE: This option is only available if you have enabled the Use Payroll Giving option on the Special Options Setup window.

Press F9 or click Find for a list of all donee organisations. Press F4 or click Add to add a new organisation:

Code Enter a unique code to identify the organisation.

Name Enter a name for the organisation.