Enter P11 Journal - UK

You enter a P11 Journal for each employee when starting up a new system part way through a financial year. The information on this record will be used for reporting to the HMRC.

Each employee in Greentree can have one P11 Journal. You can only add it before running a pay in Greentree Desktop. Once you enter a journal and pays exist, you shouldn't change the values. You can edit them to enable for NI adjustments. The information contained in the P11 Journal is used on the FPS records sent to the HMRC and on P45 Part 1 and P60 reports for the employee.

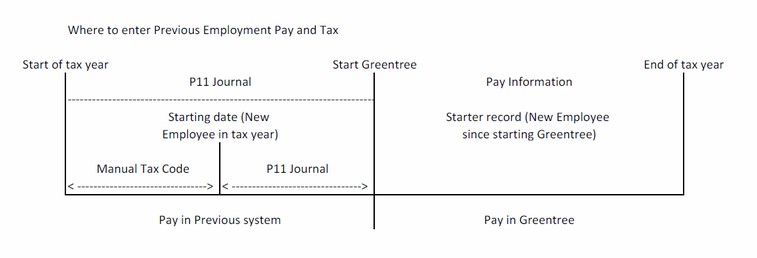

The taxable pay and the tax should only contain values from the current employment. They should not include any previous pay from a previous employment. You should add previous pay from previous employment to the Manual Tax code record.

This diagram shows where previous employment pay and tax should be entered into Greentree Desktop.

You must fill in the National Insurance amounts with the values from the previous system. You can add or import up to four different categories.

Options Reference

Each option and field on the form is described below. Mandatory options and fields are highlighted in red.

Code

Enter or select the employee's code from the dropdown.

Surname

Enter or select the employee last name from the dropdown.

First Name

Enter or select the employee first name from the dropdown.

Taxable Pay

Enter the employee's taxable pay for the financial year to date. This should only include pay that was in the current employment. Any pay from a previous employment should be included on the Manual Tax Code.

Tax

Enter the employee's tax paid pay for the financial year to date. This should only include tax that was in the current employment. Any tax from a previous employment should be included on the Manual Tax Code.

Statutory sick pay (SSP)

Enter the amount of SSP paid to the employee in the financial year to date.

Statutory maternity pay (SMP)

Enter the amount of SMP paid to the employee in the financial year to date.

Statutory paternity pay (OSPP)

Enter the amount of SSPP paid to the employee in the financial year to date.

Statutory paternity pay (ASPP)

Enter the amount of ASPP paid to the employee in the financial year to date.

Statutory adoption pay (SAP)

Enter the amount of SAP paid to the employee in the financial year to date.

Student loan deduction (SLD)

Enter the amount of SLD paid by the employee in the financial year to date.

Category

Enter the NI category for the employee. You can enter up to four categories.

1a >= LEL

Enter the employee's YTD figure for earnings greater than or equal to LEL for the category.

1b > LEL and <+ PT

Enter the employee's YTD figure for earnings greater than LEL and less than or equal to PT for the category.

1c >PA and <=UAP

Enter the employee's YTD figure for earnings greater than PT and less than or equal to UAP for the category.

1d >UAP and <= UEL

Enter the employee's YTD figure for earnings greater than UAP and less than or equal to UEL for the category.

1e Total NIC

Enter the total of the employee and Employer National Insurance contributions for the financial year to date.

1f Employee NIC

Enter the employee's Employee National Insurance contributions for the financial year to date.

Gross earnings for NIC

Enter the employee's gross earnings that the employee's National Insurance had been calculated on for the financial year to date.