Depreciation - Worked Example

The following example illustrates how the relevant field values are used in the depreciation calculation and how they are updated as the asset is depreciated.

An asset is added to Asset Register with a Purchase Value of $1000, and Commission Date of 01-01-2010. The following fields are set and do not change through the life of the asset:

-

Acquisition value (START_VALUE) = $1000

-

Commission date (COM_DATE) = 01/01/2010

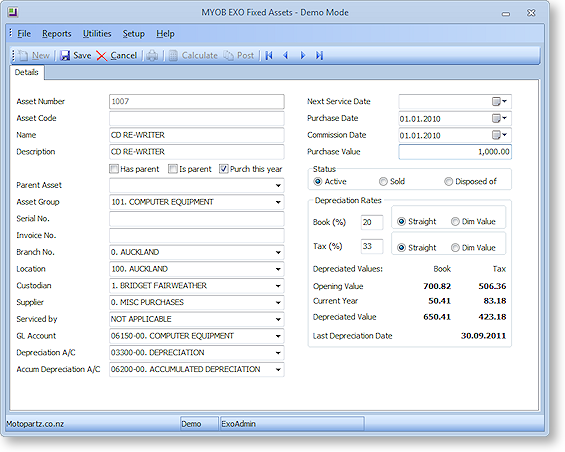

Most of the key fields used in the depreciation calculation can be seen on the Asset Details screen. The following screenshot is of our sample asset, taken at the end of all depreciation processing:

|

Property |

Field |

Contents |

Notes |

|

Commission Date |

COM_DATE |

01/01/2010 |

Date that EXO Business will start to depreciate from. |

|

Purchase Value |

START_VALUE |

1,000.00 |

Acquisition value. Basis of straight-line depreciation. |

|

Opening Val (Book) |

YR1_BOOKVAL or START_VALUE, if you haven’t done Year End Rollover. |

700.82 |

Opening Net Book Value (NBV) for current year. |

|

Current Year (Book) |

Opening Val – Dep Value. Not from a field. |

50.41 |

Current year’s movement (mainly depreciation). |

|

Dep Value (Book) |

DEPVALUE |

650.41 |

Current Net Book Value. |

|

Last Dep Date |

DEP_DATE |

30/09/2011 |

Date that the asset is depreciated-to. i.e. Current NBV is current to this date. |

Notes

-

Also needed, but not seen on this screen is CURRENT_YR_DEP_START_BOOK. This holds the commission date if the asset has not yet gone through a year-end roll, otherwise it holds the date of the last year-end rollover.

-

All field values are held in the ASSET_REG table.

-

The term Net Book Value (NBV) is defined as the Asset’s Cost (Acquisition Value) less Accumulated Depreciation.

-

The example is only dealing with Book/Accounting Depreciation.

-

In this example we depreciate every quarter, and year-end is 30th June.

The following table shows how the relevant fields are modified after each depreciation run and year-end roll. To understand how the system calculates these values, refer to the Depreciation Algorithms topic, which includes an example showing how the "Depreciate to 31/03/2011" line (highlighted) is calculated.

|

Event |

DEPVALUE |

DEP_DATE |

YR1_BOOKVAL |

YR2_BOOKVAL |

CURRENT_YR |

Depreciation |

|

After the asset addition |

1000.00 |

|

|

|

01/01/2010 |

|

|

Depreciate to 31/03/2010 |

950.68 |

31/03/2010 |

|

|

01/01/2010 |

49.32 |

|

Depreciate to 30/06/2010 |

900.82 |

30/06/2010 |

|

|

01/01/2010 |

49.86 |

|

Year-End Rollover 30/06/2010 |

900.82 |

30/06/2010 |

900.82 |

|

30/06/2010 |

|

|

Depreciate to 30/09/2010 |

850.41 |

30/09/2010 |

900.82 |

|

30/06/2010 |

50.41 |

|

Depreciate to 30/12/2010 |

800.00 |

30/12/2010 |

900.82 |

|

30/06/2010 |

50.41 |

|

Depreciate to 31/03/2011 |

750.68 |

31/03/2011 |

900.82 |

|

30/06/2010 |

49.32 |

|

Depreciate to 30/06/2011 |

700.82 |

30/06/2011 |

900.82 |

|

30/06/2010 |

49.86 |

|

Year-End Rollover 30/06/2011 |

700.82 |

30/06/2011 |

700.82 |

900.82 |

30/06/2011 |

|

|

Depreciate to 30/09/2011 |

650.41 |

30/09/2011 |

700.82 |

900.82 |

30/06/2011 |

50.41 |

Depreciation charged to GL values are charged to the General Ledger as follows:

-

DR: Depreciation Expense (P&L)

-

CR: Accumulated Depreciation (BS)