Making a Debtor Adjustment

Use Debtor Adjustments to write off or adjustment the outstanding balance on a debtor account. They do not affect the source transactions that make up that balance. You can only make debtor adjustments on unallocated transactions.

You can make these debtor adjustments:

|

Adjustment Type |

Description |

|

Small Balance |

Makes automatically-created minor rounding adjustments. |

|

Write Off |

Writes off an amount of the outstanding balance. |

|

Correction |

A correction. |

|

Opening Balance |

Adjusts a new account with an inherited opening balance. |

|

Journal |

A Journal transaction. |

|

Retention |

For retention payments, typically in Job Costing, if a client has withheld payment, pending achievement of a milestone. This retention is held in the Debtors Retention account and shown as an asset on a balance sheet. |

To make a debtor adjustment:

-

On the Transactions tab, highlight the unallocated transaction to adjust.

-

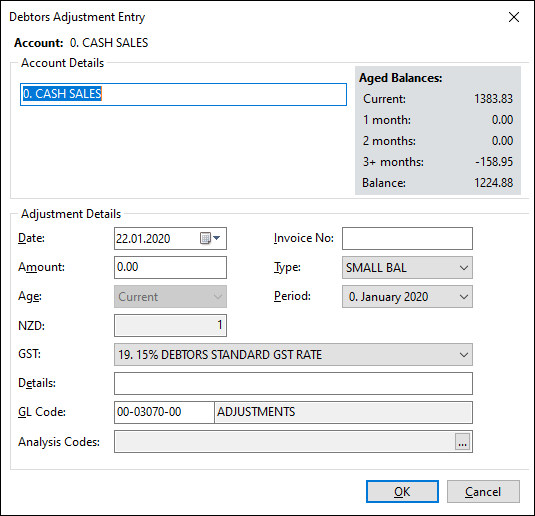

Right-click and select Journal. The Debtors Adjustment Entry window displays.

-

Enter details of the adjustment:

Fields

Description

Date

The date of the adjustment.

Amount

The amount of the adjustment, not the amount of the revised total.

Invoice No

The invoice number against which you are making this adjustment.

Type

The adjustment type.

Age

The age of the current period. This field is display only.

Period

The current period. This field is display only.

GST

The GST code to use with this adjustment.

Details

A description of the adjustment.

GL Code

The GL adjustments account.

Analysis Codes

Enter one or more Analysis Codes.

-

Click OK.

Note: If the payment is in a foreign currency, a message confirming the conversion of the foreign currency to the local currency displays when you click OK.

You can review any adjustments by viewing the Debtors Adjustment Listing report under Reports > Debtors Reports > Debtors Adjustment Report.