Tax Rate Hierarchy Setup

Once the tax rates have been linked to the tax return key points, and the default rates setup, optional tax rate overrides by debtor/ creditor account and stock item can be set up. These settings will override the default tax rates specified at Configuration Assistant > Business Essentials > General Settings.

Existing Transactions

Databases with existing transactions will need to be checked before using the automatic tax return features if they have not been configured previously. For new transactions entered going forward, this should not be an issue as long as the settings are correct.

Historical information should be marked so that this information will not be picked up when the Include previous option is selected on a new tax return, (i.e. when the intention is to include transactions added to a prior period that has already had a Tax Return created, in whatever format was used previously). This historical information could be captured by creating a "dummy" tax return to mark all the transactions in the historic data’s date range.

Tax Rate on Debtors/ Creditors

The automatic tax rate used on a transaction can be determined by a rate set on a Debtor or Creditor account. This is useful, for example, if the tax rate charged to a foreign Debtor is different to local accounts, or if the tax rate paid to a foreign creditor is different. Setting the tax rate on an account will set the tax rate on a transaction line to this account’s default rate.

The Debtor/Creditor default rate is the "highest" overriding level in the automatic hierarchy (with the exception of manually overriding the rate during transaction entry).

To override the tax rate on an account:

-

Select the Debtor or Creditor from the Account > Debtor or Account > Creditor screen.

-

Select a rate for the Override Tax Rate field on the Details 2 tab. Leaving this field set to "-1. AUTO SELECT RATE" will disable any overriding of the tax rate by the account, so the next level down the hierarchy will be used (which is the tax rate on the stock item).

Tax Rate on Stock Items

The automatic tax rate used on a transaction can also be determined at a stock item level, e.g. to accommodate various tax rates are applied specifically by stock item. A tax rate set on a stock item will be not be used if a tax rate is also set on the Debtor/Creditor account, or if one is manually set during transaction entry, as they have higher priority.

To set the tax rate on a specific stock item:

-

Select the stock item from the Stock > Account screen.

-

Select rates for the Sales Tax and Purch Tax fields on the Details 2 tab. Leaving these fields set to "-1. AUTO SELECT RATE" will disable any automatic overriding of the tax rate by the stock item, so the next level down the tax rate hierarchy will be used (which is the default tax rate of the system).

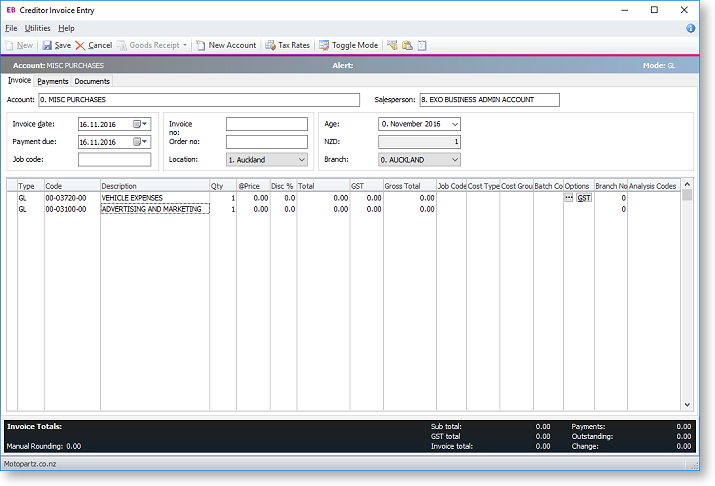

Manually Overriding Transactions

When entering lines on an invoice, the tax rate hierarchy is used to automatically select the tax rate on the line. This automatic selection may then be optionally overridden by the user, if they are set up with permission to do so.

On invoices where a rate other than the automatic rate is needed, the periscope button can be used on that line manually enter the rates and value. (Use with caution when using a payment-based tax system). The button next to the periscope allows price options to be changed between tax inclusive and tax exclusive.

To compare the tax calculated by the default tax rate hierarchy with the rate manually overridden, click the Tax Rates button on the toolbar.

Note: The ability to override the rates on invoices is controlled by the user profile setting Allow override of tax amount for invoice lines.

Overriding the tax value on Debtors transactions is not recommended. If the client manually overrides the Tax value field, this will result in a discrepancy between the Gross on the invoice and the Gross on the Tax Return. Instead of changing the tax value, clients should change the tax rate.

Changing the Tax Rate

In some circumstances clients may want to change the tax, e.g. from 15% to 0%, because the tax on a transaction is for a "Zero Rated" supply such as exported goods.

In this case, clients should change the Tax rate using the drop down of available rates to a rate that is set to 0%, and let the system recalculate the tax amount to $0.00. Do not simply override the Tax value to $0.00.

This way MYOB Exo Business will correctly calculate the Gross to be shown on the Tax Return.

Changing the Tax Value (Creditors Invoices)

In some rare circumstances, clients may want to change the Tax value on a Creditors transaction, e.g. when entering a Creditors Invoice, the tax as calculated by Exo Business may differ slightly to that as charged by the Supplier.

In this circumstance it is acceptable to override the Tax value to agree with the supplier’s documentation.