Setting Cost Types

A Cost Type is the (optional) lowest level of categorisation of a job. Cost Types are used to describe a product or activity, which can be added to other Cost Type products or activities, to make up a Cost Group. A Cost Type activity or product can be made up of one or more items in the stock module.

For example, appropriate Cost Types for the Motorpartz demo database, under the Cost Group "Labour", may be "Labour Standard", "Labour 1.5 Time", and "Labour Double Time". Appropriate Cost Types for Motorpartz under the Cost Group "Cleaning" may be "Tyre Cleaning", "Engine Cleaning" and "Interior Cleaning".

To set up Cost Types:

-

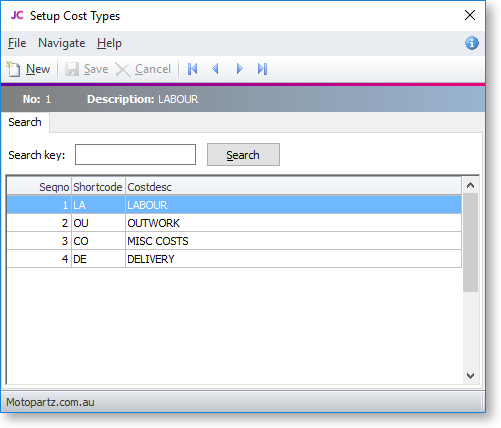

Select Setup > Setup Cost Types from the Job Costing menu. The Setup Cost Type screen is displayed.

-

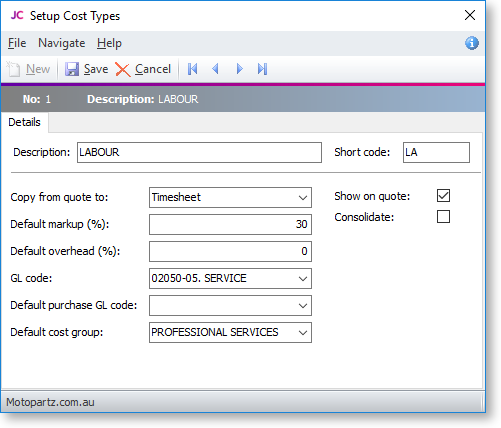

Click New. Type in the first of the required Cost Types.

Field

Description

Description

A descriptive name for this Cost Type. Descriptions could be taken from the Job Costing Analysis.

Short code

A short code to match the Cost Type description. This can be up to 3 characters long.

Copy from quote to

If information for this Cost Type needs to be copied from the quote to the timesheet or costs tab, select the required tab here. Leave as "None" if this functionality is not required. If selected, the information entered on the quote will not need to be re-entered in the chosen tab.

The information in the selected tab can be changed after copying from the quote.

Show on quote

Select this option to display the Cost Type on the quote.

Consolidate

Select if all Cost Types are to be consolidated into one invoice line e.g. multiple entries of normal labour are totalled as one entry line. Leave unchecked if each type's costs are to be shown separately.

Default markup (%)

The percentage of the standard markup. Enter as a number e.g. 12.45 will be calculated as 12.45%.

Default overhead (%)

The value of the standard overhead percentage. Enter this as a number e.g. 12.45 will be calculated as 12.45%

GL code

A General Ledger code for the Sales Account related to this item.

Default purchases GL code

A General ledger code for the Purchases Account related to this item.

Default cost group

The Cost Group this item belongs to.

-

Click Save to save data or Cancel to lose all entries made.

To add another Cost Type, click New and repeat this process.