Selling or Disposing of an Asset

When a fixed asset is at the end of its useful economic life, you may decide to dispose of it either by selling it, trading it in on a new model or throwing it away.

To sell or dispose of an asset:

-

Double-click on the asset on the main Search screen to show the Details tab for that asset.

-

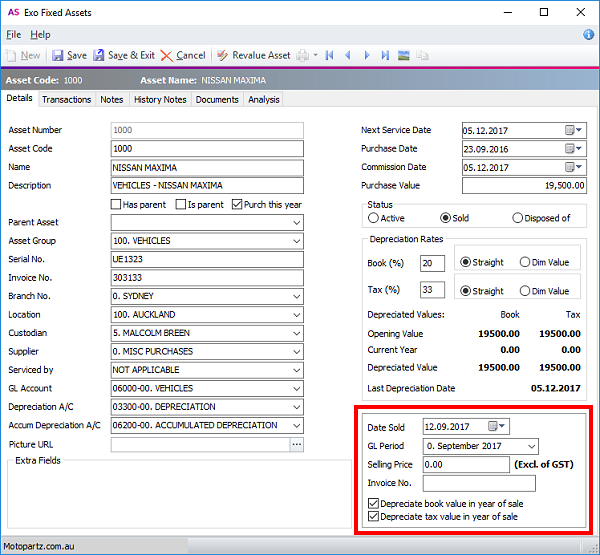

Select "Sold" or "Disposed of" for the Status field. Extra fields appear at the bottom right of the tab:

Enter values for each field:

Field

Description

Date Sold

The date the asset was sold or disposed of.

GL Period

The General Ledger period that sale/disposal transactions should be posted to.

Selling Price

The selling price of the asset (excluding GST). This field only applies when the asset is being sold.

Invoice number

The invoice number of the asset.

Depreciate book value in year of sale

Select this option if you want book/accounting depreciation in the year of sale.

Depreciate tax value in year of sale

Select this option if you want tax depreciation in the year of sale.

-

Click Save.