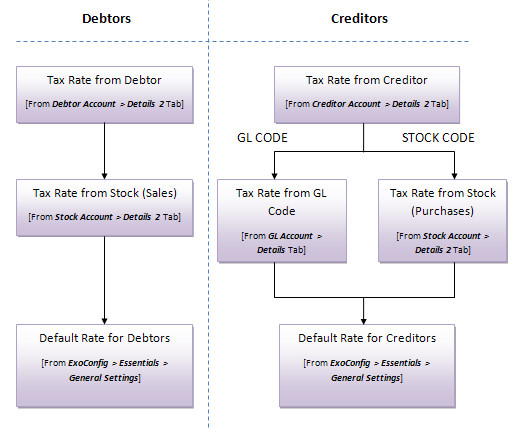

Automatic Tax Rate Hierarchy

When a transaction is entered, the tax rate used is automatically determined by a hierarchical structure. The user can then accept this setting, or optionally manually override it.

The following diagram depicts the hierarchy for automatically selecting a transaction’s tax rate:

For example, when performing a Debtor's Invoice function, the tax rate is automatically selected by using the hierarchy as follows:

-

Account - the tax rate of the Debtor account is used if explicitly specified on the Debtor account.

-

Stock - if no tax rate has been set at the Debtor account level, then the rate applicable to the stock item is selected, if explicitly set on the stock item.

-

Default Rate - if no tax rate has been set on the account or the stock item, then the default Debtors rate from the MYOB Exo Configurator is used.

In the case of a Creditor’s Invoice that uses General Ledger (GL) codes instead of stock items, if the Creditor’s account default rate is not set, the rate from the GL account is used, and if a rate is not set on the GL account, the default creditor tax rate in the Configurator is used.

Once the tax rate is chosen, the user can also manually override this rate and specifically set the tax rate number and tax rate, using the periscope function.

Overriding Function

The following options are available on many transaction entry windows (if enabled for the user), to allow manual overriding of the automatically selected transaction tax rate and amounts:

-

Line periscope – to view line detail, and also to explicitly set the tax rate and amount.

-

Tax Toggle – to change amount to inclusive or exclusive of tax.

-

Tax Rates button – to compare calculated tax against default hierarchical tax rate.