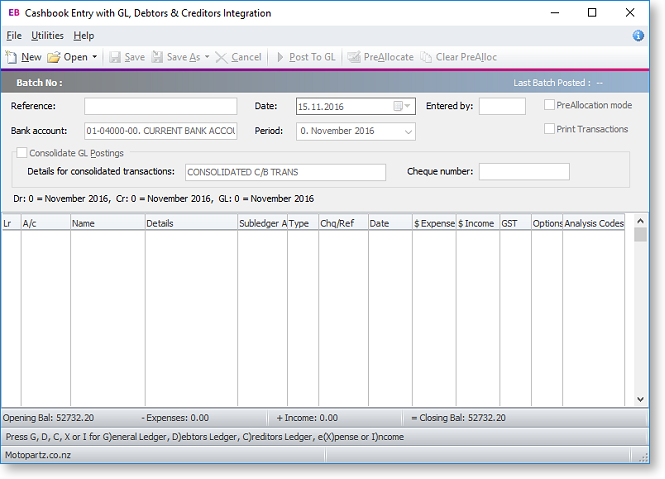

Integrated Cashbook

Transactions > General Ledger > Integrated Cashbook Entry

(Understanding this Path above)

The Integrated Cashbook is used to enter information directly from a bank statement. It is used for Foreign Exchange accounts, bank fees, and interest and for cash transactions that have not been processed by Debtors or Creditors.

To make a new entry:

-

From the main window, click New to enter a new transaction. Complete the necessary fields using the table below as reference.

Item

Description

Reference

Enter some reference test to identify this entry.

Bank Account

The GL account for the bank statement

Date

The date the statement is prepared.

GL Period

The period the GL transactions are to be posted to.

Entered by

The initials of the staff member preparing the statement.

PreAllocation Mode

Check this option to enable the Pre-allocation mode.

Print Transactions

Check this option to enable the printing of transactions.

Consolidate GL Postings

Check this option if all Debtor entries are to be consolidated as one.

Grid column headings

Lr

The name of the ledger.

To select the type, click the cursor in the field and press:

-

G (General Ledger)

-

D (Debtors Ledger)

-

C (Creditors Ledger)

-

X (Expense)

-

I (Income)

A/c

The account number or part of the account name. Double-click on the account name to drill down to the relevant GL, Debtor or Creditor account.

Name/Details

The account name or the transaction details.

Subledger Account

The subaccount name.

Type

The type of transaction.

To select the type, click the cursor in the field and press:

-

C (Cash)

-

Q (Cheque)

-

V (Visa)

-

M (Mastercard)

-

A (Amex)

-

D (Diners)

-

E (Eftpos)

-

I (Direct Credit)

-

T (Direct Debit)

Chq/Ref

The cheque number or reference number.

Date

The date of the transaction.

Enter the date in the format dd.mm.yy

$ Expense

The amount of the transaction if it is an expense.

$ Income

The amount of the transaction if it is an income.

GST

The GST rate number.

Options

An edit button is available in this column for Expense and Income lines. Clicking this button opens a Cashbook Periscope window, where a different GST rate and/or value can be entered.

Analysis Codes

Click in this column to select Analysis Codes for the line.

-

-

Click Post to GL to process the cashbook transaction. Alternatively, click Save to save as a recurring or suspended transaction.

Notes

-

The Integrated Cashbook is also accessible from the Bank Reconciliation module.

-

Pre-allocation mode is supported.

-

System settings are also available to consolidate posting.

-

Only D, C, X and I transactions (Debtors, Creditors, eXpense and Income) have a tax component.