InterCompany Creditors Invoices

The InterCompany option in the core Exo Business module is used to process creditor invoices that need to be charged out to more than one company.

Note: This menu option must be added manually using the Exo Business Configurator. The Inter-Company Creditor Invoice Authority profile setting must be enabled for all users who will need to access this function.

Example

If A Ltd and B Ltd share an office that is cleaned by the same company, and that company only issues one invoice for $2000 +GST, then it could be processed in the following way:

In A Ltd, we enter the creditor’s invoice using Inter-Company Creditor Invoices. Assume that 75% of the cost relates to A Ltd.

The effect in A Ltd is:

|

DR |

Cleaning Costs |

$1,500 |

|

|

DR |

InterCompany Clearing account with B Ltd |

$500 |

|

|

DR |

GST |

$150 |

|

|

CR |

Creditor’s Control |

|

$2,150 |

The effect in B Ltd is:

|

DR |

Cleaning Costs |

$500 |

|

|

CR |

InterCompany Clearing account with A Ltd |

|

$500 |

The Process

The process is illustrated using the above example.

-

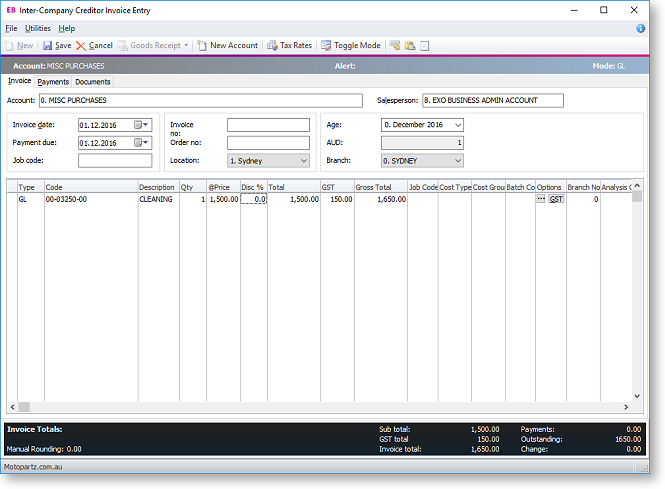

Start the core Exo Business module for the company that will be processing the creditor’s invoice (in this case A Ltd). Select the InterCompany Creditors Invoices menu option.

-

As in normal Creditors invoice entry, identify the creditor and enter other header details. For lines that will be charged to GL accounts within the same company (in this case A Ltd), enter these as normal.

-

For lines that need to be charged to another company, use the short-code CTRL+<N>, where <N> is a number from 1 to 9 that identifies the company from the InterCompany Companies.

-

Enter or search for the GL account that the line should be charged to. Double-click or click Select & Close.

-

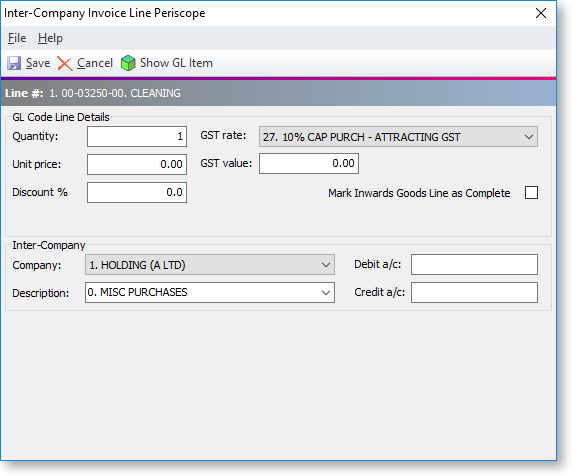

The system will place the Source InterCompany Clearing account into the Code column of the main grid of the invoice, and present the line periscope:

Enter the amount to be charged to B Ltd in Unit price. Other detail on this window can be checked and amended if necessary.

-

Click OK on periscope and the system will return to the main grid.

-

Save the creditor’s invoice, and click Yes when prompted for confirmation.

Results

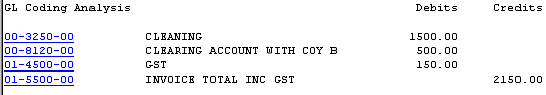

In A Ltd, Post Creditors to GL will show this GL entry.

In B Ltd, the user will find a suspended GL Batch.

-

Go to Transactions > General Ledger > GL Transactions.

-

Click New.

-

Click Open Suspended, and the system will list suspended batches, select the appropriate one, by double-clicking, or press Load.

-

The system will display the GL batch that was generated from the Intercompany Creditors Invoice Entry, for the portion that relates to B Ltd.

Note that the Debit and Credit accounts and other details are as per the periscope in Intercompany Creditors Invoice Entry.

-

Click Post to GL to post the entry in B Ltd.

The expectation is that the two related InterCompany Clearing Accounts would have equal and opposite transactions/balances. It’s an intercompany asset in one company and an intercompany liability in the other. However there will be exchange rate differences where the target and source companies are held in different currencies.

Special Case – Currency Handling

The system handles Creditor Invoices that are posted to group companies that are held in different companies. It uses the Currency table from the company that is processing the creditor’s invoice to determine the appropriate exchange rate.

For example, consider an invoice from a US Supplier for USD 1,000.

The Currency table lists:

|

NEW ZEALAND |

1 |

|

UNITED STATES |

0.76 |

|

SINGAPORE |

0.9952 |

Use InterCompany Creditor’s Invoice entry in A Ltd (held in NZD), to charge to C Ltd (held in SGD).

In A Ltd we get:

|

DR |

InterCo Clearing account with C Ltd |

NZD 1,315.79 [ = USD1,000 / 0.76] |

|

|

CR |

Creditor’s Control |

|

NZD 1,315.79 |

In C Ltd we get:

|

DR |

Expense account |

SGD 1,309.47 [=NZD 1,315.79 * 0.9952] |

|

|

CR |

InterCo Clearing account with A Ltd |

|

SGD 1,309.47 |