Asset Sale - Worked Examples

Scenario 1

An Asset is purchased on 1 Feb 2010 for $5000, set up with book depreciation of 33% SL. The company’s balance date is 31 March, so it is depreciated for each year and year-ends are performed. The asset is finally sold for $3000 on 30 Jun 2011.

The following schedule shows each event that affects the asset, and the impact that the event has on the Asset Values, as shown on the Details tab, and the General Ledger Accounting that is initiated by that event.

|

|

Add Asset |

Depreciate |

Year-End Roll |

Depreciate |

Year-End Roll |

Depreciate |

|

ASSET VALUES |

|

|

|

|

|

|

|

Opening value |

5,000.00 |

5,000.00 |

4,733.29 |

4,733.29 |

3,083.29 |

3,083.29 |

|

Current Year Depreciation |

0.00 |

266.71 |

0.00 |

1,650.00 |

0.00 |

275.75 |

|

Depreciation Value |

5,000.00 |

4,733.29 |

4,733.29 |

3,083.29 |

3,083.29 |

2,807.54 |

|

Last Dep Date |

01/02/2010 |

31/03/2010 |

31/03/2010 |

31/03/2011 |

31/03/2011 |

31/05/2011 |

|

GL ACCOUNTING |

|

|

|

|

|

|

|

Depreciation Expense |

|

266.71 |

|

1,650.00 |

|

275.75 |

|

Depreciation Recovered |

|

|

|

|

|

|

|

Accumulated Depreciation |

|

-266.71 |

|

-1,650.00 |

|

-275.75 |

|

Asset Cost |

5,000.00 |

|

|

|

|

|

|

Debtors or Bank |

|

|

|

|

|

|

|

Depreciation Calculation |

|

$5000 |

|

$5000 |

|

$5000 |

The asset is sold on 30/06/2011 for $3000.00

|

|

Sale 30/06/2011 |

|

|

|

|

|

ASSET VALUES |

|

|

|

|

|

|

Opening value |

3,083.29 |

|

|

|

|

|

Current Year Depreciation |

411.37 |

|

|

|

|

|

Depreciation Value |

2,671.92 |

|

|

|

|

|

Last Dep Date |

30/06/2011 |

|

|

|

|

|

GL ACCOUNTING |

Sale Journal A |

Sale Journal B |

Sale Journal C |

Sale Journal D |

Account Totals |

|

Depreciation Expense |

135.62 |

|

|

|

2,328.08 |

|

Depreciation Recovered |

|

|

-328.00 |

|

-328.00 |

|

Accumulated Depreciation |

-135.62 |

2,000.00 |

328.00 |

|

0.00 |

|

Asset Cost |

|

-2,000.00 |

|

-3,000.00 |

0.00 |

|

Debtors or Bank |

|

|

|

3,000.00 |

3,000.00 |

|

Depreciation Calculation |

$5000 |

|

|

|

|

Sales Journals

A - Additional Depreciation from 31/05/09 to 30/06/09 (the sale date).

B - Offset Cost and Accumulated Depreciation with Cost less Proceeds ($5000 - $3000). The expectation is that the Sale proceeds will be accounted for separately (see Journal D).

C - Take whatever the system considers to be Accum Depn (Cost - NBV : $5,000 - $2,671), then subtract the amount that has already been debited to Accumulated Depreciation ($2000). This is either depreciation recovered or additional depreciation.

D - Journal to handle proceeds (not automatic from Fixed Assets).

Exceptions

In this example the asset was sold for more than its Book Value and less than its original Cost.

If it was sold for less than its book value, the system would account for the difference between NBV and the sale value as additional depreciation. The Depreciation Recovered account would not be affected.

If the asset is sold for more than its original cost, the entries would be as above except that Depreciation Recovered is only credited up to the total of Accumulated Depreciation; the remaining credit (the difference between sale proceeds and original cost) is credited to the Capital Reserve account, as it represents a capital gain. This is dealt with in Scenario 2 below.

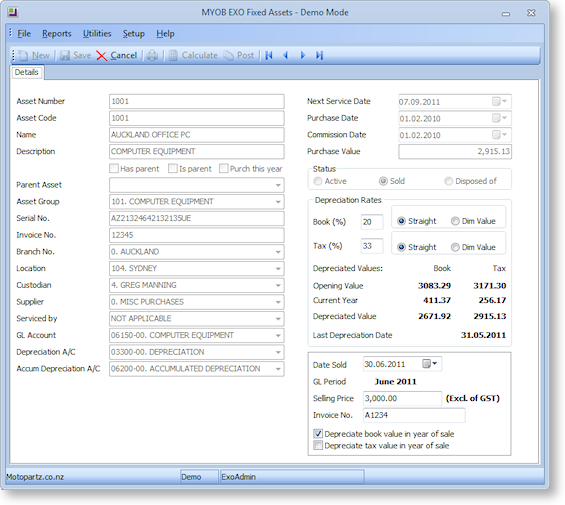

After the sale the asset looks like this:

Scenario 2

This is exactly the same as Scenario 1, except that the asset is sold for $6,000, giving rise to capital gains.

Note that all columns are the same as the previous example, except for the GL journal entries that account for the sale.

|

|

Add Asset |

Depreciate |

Year-End Roll |

Depreciate |

Year-End Roll |

Depreciate |

|

ASSET VALUES |

|

|

|

|

|

|

|

Opening value |

5,000.00 |

5,000.00 |

4,733.29 |

4,733.29 |

3,083.29 |

3,083.29 |

|

Current Year Depreciation |

0.00 |

266.71 |

0.00 |

1,650.00 |

0.00 |

275.75 |

|

Depreciation Value |

5,000.00 |

4,733.29 |

4,733.29 |

3,083.29 |

3,083.29 |

2,807.54 |

|

Last Dep Date |

01/02/2010 |

31/03/2010 |

31/03/2010 |

31/03/2011 |

31/03/2011 |

31/05/2011 |

|

GL ACCOUNTING |

|

|

|

|

|

|

|

Depreciation Expense |

|

266.71 |

|

1,650.00 |

|

275.75 |

|

Depreciation Recovered |

|

|

|

|

|

|

|

Accumulated Depreciation |

|

-266.71 |

|

-1,650.00 |

|

-275.75 |

|

Asset Cost |

5,000.00 |

|

|

|

|

|

|

Capital Gains |

|

|

|

|

|

|

|

Debtors or Bank |

|

|

|

|

|

|

|

Depreciation Calculation |

|

$5000 |

|

$5000 |

|

$5000 |

The asset is sold on 30/06/2011 for $6000.00

|

|

Sale 30/06/2011 |

|

|

|

|

|

ASSET VALUES |

|

|

|

|

|

|

Opening value |

3,083.29 |

|

|

|

|

|

Current Year Depreciation |

411.37 |

|

|

|

|

|

Depreciation Value |

2,671.92 |

|

|

|

|

|

Last Dep Date |

30/06/2011 |

|

|

|

|

|

GL ACCOUNTING |

Sale Journal A |

Sale Journal B |

Sale Journal C |

Sale Journal D |

Account Totals |

|

Depreciation Expense |

135.62 |

|

|

|

2,328.08 |

|

Depreciation Recovered |

|

|

-2,328.00 |

|

-2,328.00 |

|

Accumulated Depreciation |

-135.62 |

-1,000.00 |

3,328.00 |

|

0.00 |

|

Asset Cost |

|

1,000.00 |

|

-6,000.00 |

0.00 |

|

Capital Gains |

|

|

-1,000.00 |

|

-1,000.00 |

|

Debtors or Bank |

|

|

|

6,000.00 |

6,000.00 |

|

Depreciation Calculation |

$5000 |

|

|

|

|

Sales Journals

A - Additional Depreciation from 31/05/09 to 30/06/09 (the sale date).

B - Offset Cost and Accumulated Depreciation with Cost less Proceeds (-$1,000 = $5000 - $6000). The expectation is that the Sale proceeds will be accounted for separately (see Journal D).

C - Take whatever the system considers to be Accumulated Depreciation (Cost - NBV : $5,000 - $2,671), then subtract the amount that has already been debited to Accumulated Depreciation ( $1000).

$3,328.08 = (5,000.00 - 2,671.92) -1,000

This amount is debited to Accumulated Depreciation in order to clear out its balance for this asset.

An amount equivalent to the total depreciation written-off over time ($2,328.08) is credited to depreciation recovered. The remaining amount ($1000) is equivalent to the sale proceeds ($6000) less the original cost ($5000), is credited to Capital Gains.

D - Journal to handle proceeds (not automatic from Fixed Assets).