Step Three - Current Timesheet

This is where you edit In and Out times for an employee, wherever the actual times vary from the defaults set in the Standard Times screen.

The intent being that a copy of the Standard Times templates is used on a week-to-week basis, with only minimal changes needing to be made if there is a variance on the employee's normal times.

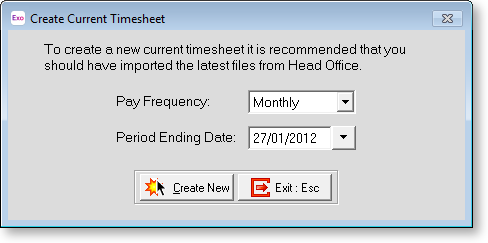

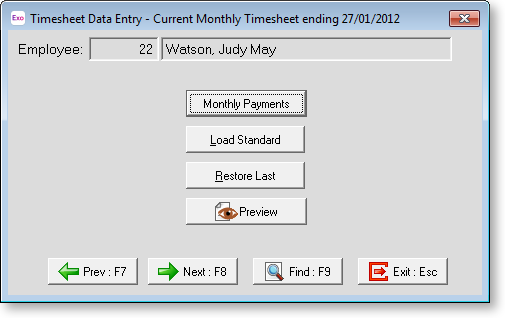

Select Step Three from the Setup Cycle - the Create Current Timesheet window appears.

Pay Frequency This is indicates the span of dates within the pay period, for accounting and taxation purposes. Select from:

-

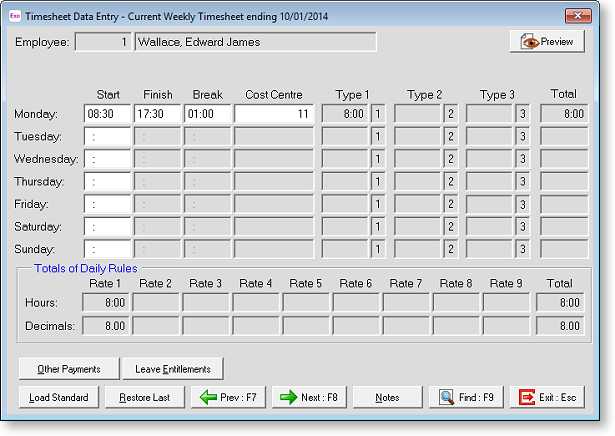

Weekly - A weekly Timesheet has a single Sheet to enter times against:

-

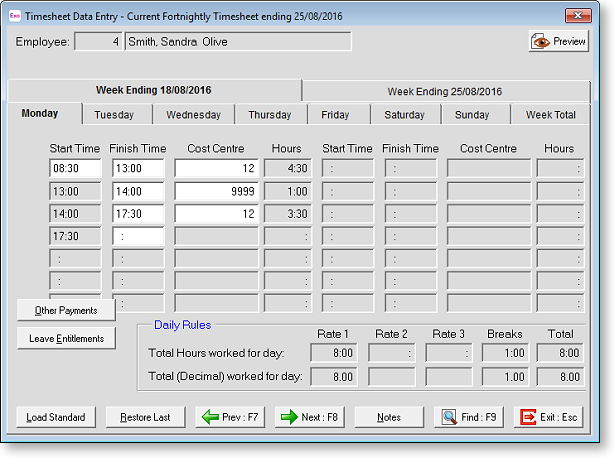

Fortnightly - A fortnightly Timesheet has two sheets to enter times against – times are still grouped into weeks for applying Weekly Rules:

-

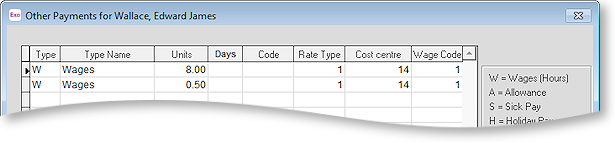

Monthly - For a monthly Timesheet, there is not enough room to break down time into four and sometimes five weeks in the monthly pay period. Therefore when activating the Monthly Payments option, the Other Payments screen is used to load data into the Timesheet:

Create New

If a Current Timesheet for the selected Pay Frequency does not currently exist, a Create New button is available. Click this button to commence a new pay period. The Timesheet will automatically bring the preset data from the Standard Times into this pay period.

Edit

If a Current Timesheet for the selected Pay Frequency already exists, an Edit button is available. Click this button to proceed, you will then see the Select Employee screen. Highlight the employee you want to enter times for, then click the Select button or press ENTER.

The Current Timesheet screen then appears. This is where you can maintain pay period times for this employee – the equivalent of Exo Payroll's Current Pay.

Load Standard

This will completely clear the Current Timesheet and reset the times for this employee to exactly match those stored in the Standard Times screen.

Restore Last

This will completely clear the Current Timesheet and reset the times for this employee to exactly match those stored in Current Times screen, as of the last posting.

Notes

Here you can modify the employee's Standard Note (if there is one) or enter a new note, for this employee. The end result being that the note will be posted to the Employee Notes screen in Payroll.

Transaction Entry

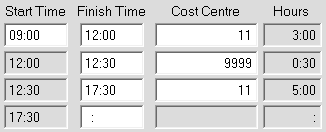

Start Time Enter the time that the employee is expected to clock in on this day.

Finish Time Enter the time that the employee is expected to clock out on this day.

Cost Centre Enter the cost centre that the employee's time is charged to on this day.

Hours Data entry differs depending on what you want to achieve.

Example 1

Clocking start and finish times, clocking meal breaks:

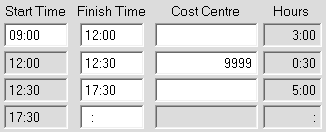

Example 2

Entering hours only

If you are keying from source documents such as time cards you may already know the hours to pay. Note that the break line is not needed in this case because the hours to pay are a known quantity.

Example 3

No Costing:

Note that in both of the above cases the cost centre field is optional – in other words, only for costing fragments of time to specific jobs. If no cost centre is entered, the payroll will assume the appropriate cost centres, when the wages reach Head Office. Note that the break code is still needed.

Example 4

Time and Attendance Mode

This method requires you to know the start time and the number of hours worked for the day, in order to process times for a day. Key in the start time, and the job cost centre if applicable, then key in the hours worked…

Note that the Finish Time will be automatically calculated by the system.

Example 5:

Note that in all of the above cases you are entering values for the day in terms of time (base 60). If you want to enter times in decimal form (base 10) use Other Payments button (transaction type = W).

Note that the daily rules (in Timesheet Setup) do not apply to the Other Payments screen. Therefore overtime has to be clearly stated on a separate line.

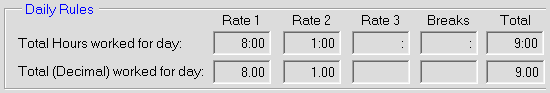

Daily Rules

A Daily Rules section appears on the Current Timesheet window if "Daily Limits" was selected for the Rates calculated using property on the Timesheet Setup window.

The premise of a daily rule is that an employee must work at least X hours per day, before getting overtime. How much of that extra time is liable for time ½ or double time is also specified in the daily rule.

Total Hours Worked for Day This will display the split of ordinary pay vs overtime vs breaks, as a governed by the daily maximums in the Setup screen, in units of time (base 60).

Total (Decimal) Worked for Day This will display the split of ordinary pay vs overtime vs breaks, as a governed by the daily maximums in the Setup screen, in decimal units (base 10).

Preview

This will display the breakdown of units to pay in a report form.

Weekly Rules

A Weekly Rules section appears on the Current Timesheet window if "Weekly Limits" was selected for the Rates calculated using property on the Timesheet Setup window.

The premise of a weekly rule is that, regardless of how many hours an employee has worked on any given day(s), they must physically have worked at least X hours per week, before payment overtime is payable.

How much of those hours are liable for time ½ or double time is also specified in the weekly rule.

The right-most page tab on the Data Entry screen holds the weekly breakdown of pay, if you are using Weekly Rules rather than daily rules.

From the Current Times screen click on the Exit button, this will return you to the Timesheet Cycle.

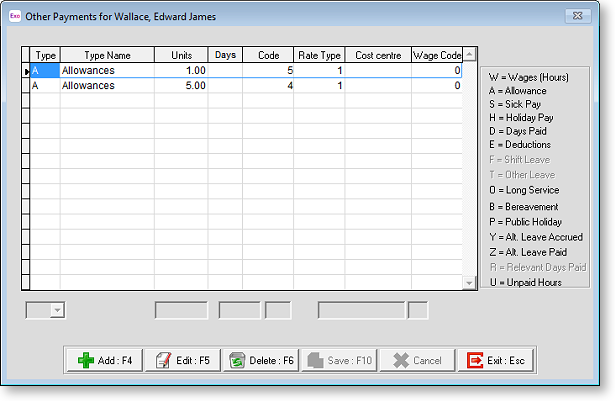

Other Payments

From the Timesheet Entry screen, click on the Other Payments button to enter non-wage transactions that this employee would normally receive every pay period.

NOTE: The Other Payments screen is not available for Time and Attendance employees. This is because the Time and Attendance system only accepts data in the form of a times file, and times files only consist of start and finish times.

Click the Add button to add a transaction. In the transaction type field, click or press the spacebar on the list box to see your choices.

- W - Wages (Hours )

- A - Allowances

- S - Sick Pay

- H - Holiday Pay

- D - Days Paid

- E - Deductions

- F - Shift Leave

- T - Other Leave

- O - Long Service Leave

- B - Bereavement

- P - Public Holiday

- Y - Alternative Leave Accrued

- Z - Alternative Leave Paid

- R - Relevant Days Paid

- U - Unpaid Leave

Click the Edit button to edit a saved transaction.

Click the Delete button to remove the selected record from the system.

Hours

Hours transactions require the Hours to Pay, Rate Type (e.g. Ord, T1/2). Normally you would not need to enter this into the Allowance and Other Payments screen, they are usually entered in the standard times screen.

Allowances

Allowance transactions require the Allowance Code and number of units to pay.

Sick

Where sick leave is being measured in hours, Sick pay transactions require the number of hours to pay (to be valued at the employee's relevant hourly rate) and the number of Hours of Sick Leave Entitlement to Reduce for those hours.

Where sick leave is being measured in days, Sick pay transactions require the number of hours to pay (to be valued at the employee's relevant hourly rate) and the number of Days of Sick Leave Entitlement to Reduce for those hours.

Holiday Pay

Where holiday pay is being measured in hours, Holiday Pay transactions require the number of hours to pay.

Where holiday pay is being measured in days, Holiday Pay transactions require the number of days to pay.

Days Paid

Days Paid is necessary for users who do not have Pay Period Valuation turned on in their company holiday pay setup. This field requires the number of days paid for holiday pay purposes. It is used in conjunction with the Normal/Days and Permanent Part-time holiday pay methods.

Deductions

Deduction transactions require the Deduction Code and depending on the deduction setup, may require the Amount or the Rate.

Shift Leave

Where holiday pay is being measured in hours, Shift leave transactions require the number of hours to pay.

Where holiday pay is being measured in days, Shift leave transactions require the number of days to pay.

Other Leave

Where holiday pay is being measured in hours, Other leave transactions require the number of hours to pay.

Where holiday pay is being measured in days, Other leave transactions require the number of days to pay.

Long Service Leave

Long Service Leave requires the Units to pay and a cost centre.

Long service leave may be paid in days or hours.

Bereavement Leave

Bereavement Leave transactions require the number of hours to pay (to be valued at the employee's relevant hourly rate) and the number of Days of leave taken for those hours.

Public Holiday

This is for payment on a statutory holiday on which the employee did not work. Public Holiday transactions require the number of hours to pay (to be valued at the employee's relevant hourly rate) and the number of Days not worked for those hours.

Alternative Leave Accrued

Where alternative leave is being measured in days, this is for granting an employee an extra holiday for coming into work on a statutory holiday or rostered day off. It will add to the alternative leave entitlement field in the payroll's Open Employee screen (Sick & Other Leave tab). It requires the number of number of Days of Alternative Leave to Accrue.

Where alternative leave is being measured in hours, this is for granting an employee an extra holiday for coming into work on a statutory holiday or rostered day off. It will add to the alternative leave entitlement field in the payroll's Open Employee screen (Sick & Other Leave tab). It requires the number of Hours of Alternative Leave to Accrue.

In addition to accruing an alternative day, the employee should be paid for the number of hours that they did work on the statutory holiday. This extra payment is transacted as hours and paid at penal rates i.e. time and a half.

Alternative Leave Paid

Where alternative leave is being measured in days, this is for paying an employee for an extra holiday earned during a prior pay period, during which the employee worked on a statutory holiday or a rostered day off. This will reduce from the alternative leave entitlement field in the payroll's Open Employee screen (Sick & Other Leave tab). It requires the number of hours to pay (to be valued at the employee's relevant hourly rate) and the number of days of Alternative Leave to reduce for those hours.

Where alternative leave is being measured in hours, this is for paying an employee for an extra holiday earned during a prior pay period, during which the employee worked on a statutory holiday or a rostered day off. This will reduce from the alternative leave entitlement field in the payroll's Open Employee screen (Sick & Other Leave tab). It requires the number of hours to pay (to be valued at the employee's relevant hourly rate) and the number of Hours of Alternative Leave to Reduce for those hours.

Relevant Days Paid

The number of Days Paid for the relevant rate calculation (for sick leave, bereavement leave, alternative leave, etc) should represent the number of physical days that the employee has worked on in this pay period. Any portion of a day worked should be counted as 1 day. For example, if an employee has worked 5 full days and 1 half day you would enter 6.

Edit

Click the Edit button to edit a saved transaction

Delete

Click the Delete button to remove the selected record from the system.

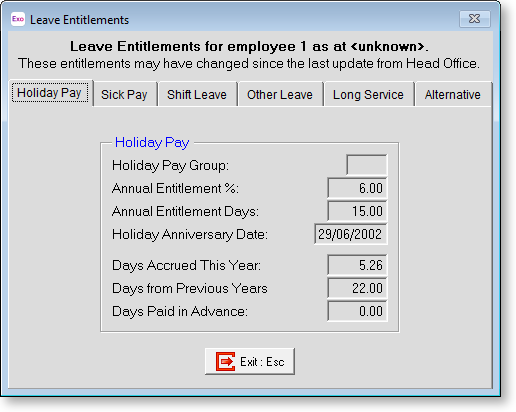

Leave Entitlements

This screen holds the current balance for all leave types relating to the current employee. It is primarily used during the processing of the Current Times for checking that the employee has enough leave entitlement to cover their upcoming absence.